No Rebound For NC Job Market In 2011

(February 10, 2012) North Carolina’s labor market experienced minimal payroll employment growth during 2011. Between December 2010 and December 2011, the state gained 19,600 more payroll jobs than it lost (+0.5 percent). Though the private sector netted 29,400 positions, a net drop of 9,800 government jobs erased one-third of the private-sector gain. With such weak growth, little progress was made against unemployment. Both the number of unemployed individuals and the share of the labor force that was unemployed rose in 2011. And, 2011 marked the fourth consecutive year of negative (2008 and 2009) or minimal (2010 and 2011) job growth in North Carolina.

Private-Sector Job Growth, Public-Sector Contraction

During 2011, business establishments in North Carolina added 19,600 more payroll jobs than they cut. The private sector drove that growth by netting 29,400 positions, while the public sector lost 9,800 more positions than it added. Net declines in state government (-6,500 jobs, -3.4 percent) and local government (-4,500, -1 percent) employment drove the public-sector contraction. Compared to December 2007, state government payrolls were 5.5 percent smaller (-10,900 jobs) in December 2011, while local governments collectively had 6,100 fewer positions (-1.4 percent). If public sector payrolls had held steady in 2011, all else equal, North Carolina would have ended the year with 0.3 percent more jobs than it did.

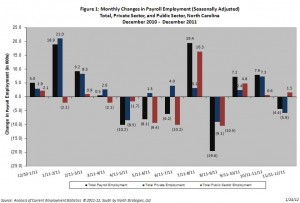

Fig. 1 shows, the monthly pattern of job growth in 2011. When the monthly totals are grouped into calendar quarters, distinct patterns emerge. In Q1 (Jan.-Mar.), private payrolls grew, and public payrolls held relatively steady, resulting in a net gain of 33,100 jobs. In Q2 (Apr.-Jun.), private growth turned negative, and sizable governmental losses occurred, leading to a net loss of 17,800 jobs. Private and public payrolls contracted by 6,400 positions in Q3 (Jul.-Sept.) with employment in both sectors rebounding by a combined 10,700 positions in Q4 (Oct.-Dec.). The net result was an annual gain of 19,600 jobs.

Fig. 1 shows, the monthly pattern of job growth in 2011. When the monthly totals are grouped into calendar quarters, distinct patterns emerge. In Q1 (Jan.-Mar.), private payrolls grew, and public payrolls held relatively steady, resulting in a net gain of 33,100 jobs. In Q2 (Apr.-Jun.), private growth turned negative, and sizable governmental losses occurred, leading to a net loss of 17,800 jobs. Private and public payrolls contracted by 6,400 positions in Q3 (Jul.-Sept.) with employment in both sectors rebounding by a combined 10,700 positions in Q4 (Oct.-Dec.). The net result was an annual gain of 19,600 jobs.

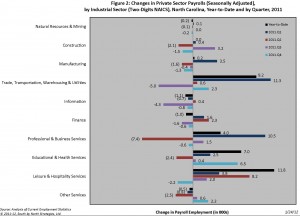

The private-sector gains logged during 2011 did not occur uniformly across industries (fig. 2). The leisure and hospitality services sector grew the most in absolute and relative terms (+11,800 jobs, +3 percent), due overwhelmingly to net growth in the accommodation and food service sub-sector (+10,600 jobs, +3.1 percent). Put differently, 36.1 percent of all the private-sector jobs that North Carolina netted in 2011 were at lodging establishments, restaurants, bars, limited-service eating establishments, food service contractors, catering firms, and mobile food vendors.

The next fastest growing private industry sector, again in both absolute and relative terms, was trade, transportation, warehousing, and utilities, which netted 9,200 positions (+1.3 percent), thanks to the addition of 9,000 jobs in retail trade (+2.1 percent). Education and health services added 7,000 more positions than it lost (+1.3 percent) with the gains split almost equally between the educational services and health care and social services sub-sectors. Professional and business services added 4,000 jobs (+0.8 percent); declines in professional, scientific, and technical services were offset by gains in the corporate management sub-sector and the administrative and waste management sub-sector, which is the sector that encompasses temporary help services.

The next fastest growing private industry sector, again in both absolute and relative terms, was trade, transportation, warehousing, and utilities, which netted 9,200 positions (+1.3 percent), thanks to the addition of 9,000 jobs in retail trade (+2.1 percent). Education and health services added 7,000 more positions than it lost (+1.3 percent) with the gains split almost equally between the educational services and health care and social services sub-sectors. Professional and business services added 4,000 jobs (+0.8 percent); declines in professional, scientific, and technical services were offset by gains in the corporate management sub-sector and the administrative and waste management sub-sector, which is the sector that encompasses temporary help services.

In terms of contracting industries, information lost the most jobs in absolute and relative terms (-1,100 jobs, -1.6 percent), followed by finance (-1,000 jobs, -0.5 percent). The losses in finance stemmed from cuts in the real estate and rental leasing sub-sector (-2,000 jobs, -4.1 percent). Construction and manufacturing payrolls both were flat over the year. In manufacturing, the loss of 5,100 jobs in non-durable manufacturing erased most of a gain of 5,300 jobs in durable manufacturing.

Note that the industrial growth trends seen during 2011 are inconsistent with the notion that unemployment is the product of mismatches between workforce skills and job requirements. Some 78.9 percent of net private-sector growth occurred in accommodation and food services, retail trade, and administrative and waste management (including temporary help services); these are industries that generally employ significant numbers of workers with modest skill levels. Employment in industries that typically employ relatively more skilled workers (e.g., professional, scientific, and technical services; information; and manufacturing), in contrast, contracted.

Large Job Gap Remains

The weak job growth recorded during 2011 did little to replace the jobs lost earlier in the business cycle. Since the onset of the “Great Recession,” North Carolina has lost, on net, 295,300 positions, or 7.1 percent of its payroll employment base. The maximum job loss recorded during the business cycle occurred in February 2010, when the state had 323,000 fewer jobs (-7.7 percent) than it did 26 months before. Since that time, North Carolina has netted 27,700 positions (+0.7 percent), for an average monthly gain of nearly 1,300 jobs. While the state’s economy added more jobs in 2011 than in 2010 (+19,600 versus +5,400), the growth was too weak to materially alter the employment situation. Even if the annual level of job growth were to triple, it still would take roughly five years to close the current jobs gap, holding all else equal.

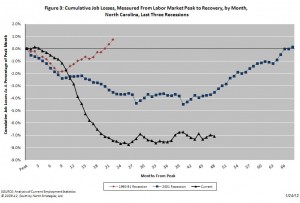

As fig. 3 shows, the job losses recorded during the Great Recession have proven more severe than the ones experienced during the 2001 and 1990-1991 recessions. At the height of the 2001 recession, the state shed 4.5 percent of its jobs base, while the comparable drop during the 1990-1991 recession was 1.9 percent. In both of those recessions, the job gap began to steadily close after the peak job losses were realized. That has not happened during the current cycle. In fact, since December 2009, payroll employment in the state has grown by just 25,000 positions, which has succeeded in lowering the job gap by only 0.6 percentage points.

As fig. 3 shows, the job losses recorded during the Great Recession have proven more severe than the ones experienced during the 2001 and 1990-1991 recessions. At the height of the 2001 recession, the state shed 4.5 percent of its jobs base, while the comparable drop during the 1990-1991 recession was 1.9 percent. In both of those recessions, the job gap began to steadily close after the peak job losses were realized. That has not happened during the current cycle. In fact, since December 2009, payroll employment in the state has grown by just 25,000 positions, which has succeeded in lowering the job gap by only 0.6 percentage points.

To further understand the magnitude of the job gap facing North Carolina, consider that the state ended 2011 with 11,700 fewer payroll jobs (-0.3 percent) than it had in December 1999. While the image of North Carolina as a state growing rapidly in terms of population and jobs was very much an accurate one in the late 1990s, it no longer holds. In fact, North Carolina has not recorded any net job growth over the past 12 years despite adding residents.

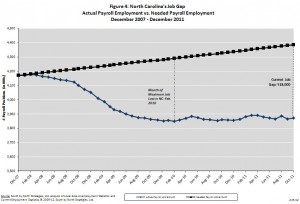

Remember, too, that the job shortfall currently facing North Carolina is actually larger than the one caused by the destruction of jobs during the recession. Since December 2007, the number of working-age Tar Heels has increased by 362,100 (+5.2 percent) persons. This means that payroll employment in the state should have been growing at an average monthly rate of 0.11 percent per month just to keep pace with workforce growth. If one considers the jobs that should have been created over the last four years but were not, the gap facing the state is 518,000 positions (fig. 4). To close that gap by December 2015, holding all else equal, North Carolina would need to net 14,389 jobs per month for each of the next 36 months. At no point since 1990 has North Carolina sustained such a level of growth over so long a period.

Remember, too, that the job shortfall currently facing North Carolina is actually larger than the one caused by the destruction of jobs during the recession. Since December 2007, the number of working-age Tar Heels has increased by 362,100 (+5.2 percent) persons. This means that payroll employment in the state should have been growing at an average monthly rate of 0.11 percent per month just to keep pace with workforce growth. If one considers the jobs that should have been created over the last four years but were not, the gap facing the state is 518,000 positions (fig. 4). To close that gap by December 2015, holding all else equal, North Carolina would need to net 14,389 jobs per month for each of the next 36 months. At no point since 1990 has North Carolina sustained such a level of growth over so long a period.

Joblessness Remains Widespread

Weak job growth in 2011 did little to reduce the problems of unemployment and joblessness in North Carolina. The monthly number of unemployed Tar Heels (seasonally adjusted) averaged 449,679. Furthermore, the average number of unemployed persons rose over the year. On a quarterly basis, there was an average of 16,216 more unemployed persons (+3.7 percent) during 2011.Q4 than one year earlier.

In December 2011, the statewide unemployment rate equaled 9.9 percent, compared to 9.8 percent in December 2010. Throughout 2011, the monthly unemployment rate fluctuated between 9.7 and 10.5 percent. For the year, the average monthly rate was 10 percent, which represented an improvement over the 2010 average rate of 10.5 percent.

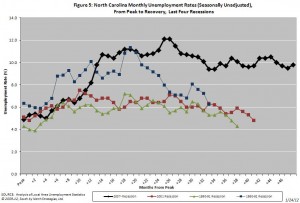

When judged in terms of the statewide unemployment rate (seasonally unadjusted), the recent recession has proven to be the longest and most severe of any post-1980 downturn (fig. 5). Between 1980 and 2008, the highest unemployment rate recorded in North Carolina was 11.3 percent in March 1983. During the same 28-year period, the unemployment rate exceeded 10 percent on just four occasions, all in the early 1980s. Since February 2009, however, the seasonally-unadjusted unemployment rate has exceeded 10 percent in 24 of 34 months and has fallen no lower than 9.4 percent. And, the unemployment rate exceeded 11 percent in seven of those months and reached a high of 12.1 percent in early 2010.

When judged in terms of the statewide unemployment rate (seasonally unadjusted), the recent recession has proven to be the longest and most severe of any post-1980 downturn (fig. 5). Between 1980 and 2008, the highest unemployment rate recorded in North Carolina was 11.3 percent in March 1983. During the same 28-year period, the unemployment rate exceeded 10 percent on just four occasions, all in the early 1980s. Since February 2009, however, the seasonally-unadjusted unemployment rate has exceeded 10 percent in 24 of 34 months and has fallen no lower than 9.4 percent. And, the unemployment rate exceeded 11 percent in seven of those months and reached a high of 12.1 percent in early 2010.

In every other post-1980 recession, the state unemployment rate had returned to its pre-recessionary level by 42 months following the onset of the downturn. Despite the passage of 48 months since the onset of the last recession, North Carolina’s seasonally unadjusted unemployment rate of 9.8 percent remains twice as high as the December 2007 level of 4.9 percent.

More Problems Than Simple Unemployment

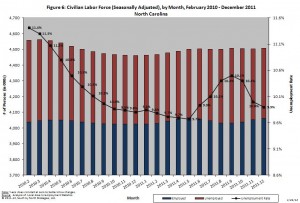

The size of the state’s civilian labor force (seasonally adjusted) increased during 2011. Between December 2010 and December 2011, the number of North Carolinians in the state’s labor force rose by 45,822 persons (+1 percent), climbing to 4.51 million from 4.46 million. Over the year, the number of employed individuals increased by 36,668 (+0.9 percent), which brought total employment to 4.06 million. The number of unemployed individuals rose by 9,154 individuals (+2.1 percent). Note that almost all of the labor force and employment growth occurred in the first half of the year. From December 2010 to June 2011, the labor force added 41,446 persons (+0.9 percent), but from June 2011 to December 2011, only 4,376 people joined the labor force (+0.01 percent).

Labor force growth resulted from the entry of new individuals to the workforce and the re-entry of experienced workers. Unfortunately, the slight uptick in the size of the labor force that occurred in 2011 was insufficient to reverse the overall contraction in the size of the labor force that has occurred since 2007. In December 2011, North Carolina’s civilian labor force had 52,859 fewer members (-1.2 percent) than it did in December 2007, when the national recession began, and 49,746 fewer individuals (-1.1 percent) than was the case in February 2010, the month when the state’s labor market bottomed out (fig. 6). While part of that decline may be attributable to changes in the structure of the workforce (e.g., more people of retirement age), part is likely tied to the decision of frustrated job seekers to abandon their searches. This suggests that joblessness is more widespread than reflected in the official unemployment rate.

Labor force growth resulted from the entry of new individuals to the workforce and the re-entry of experienced workers. Unfortunately, the slight uptick in the size of the labor force that occurred in 2011 was insufficient to reverse the overall contraction in the size of the labor force that has occurred since 2007. In December 2011, North Carolina’s civilian labor force had 52,859 fewer members (-1.2 percent) than it did in December 2007, when the national recession began, and 49,746 fewer individuals (-1.1 percent) than was the case in February 2010, the month when the state’s labor market bottomed out (fig. 6). While part of that decline may be attributable to changes in the structure of the workforce (e.g., more people of retirement age), part is likely tied to the decision of frustrated job seekers to abandon their searches. This suggests that joblessness is more widespread than reflected in the official unemployment rate.

Estimates of the underemployment rate, a broader measure of labor under-utilization prepared by the US Bureau of Labor Statistics, indicate that 17.9 percent of North Carolina’s adjusted labor force was underemployed, on average, in 2011. That measure includes not only individuals who meet the formal definition of unemployment, but also those working part-time despite preferring full-time work and those marginally attached to the workforce. Over the year, the statewide underemployment rate rose by 0.5 percentage points, rising to 17.9 percent from a level of 17.4 percent in 2010.

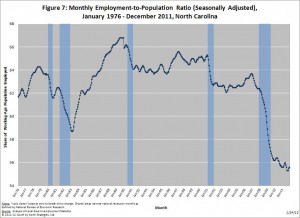

Regardless of the exact measure used, a sizable amount of labor in North Carolina is currently sitting idle. Nearly 10 of every 100 members of the state’s labor force are unemployed (seasonally adjusted), while almost 18 of every 100 are underemployed. Moreover, the share of adult North Carolinians with a job has fallen sharply since late 2007. In December 2011, only 55.6 percent of working-age North Carolinians (seasonally adjusted) had jobs, a level no different from the one posted one year prior. This rate actually fell to a low of 55.3 percent near the end of 2011.Q3. At no other time since 1976 has the employment-to-population been as low as it has been in recent months (fig. 7). The current ratio also is well below the historical average rate of 63.6 recorded between January 1976 and December 2007.

Regardless of the exact measure used, a sizable amount of labor in North Carolina is currently sitting idle. Nearly 10 of every 100 members of the state’s labor force are unemployed (seasonally adjusted), while almost 18 of every 100 are underemployed. Moreover, the share of adult North Carolinians with a job has fallen sharply since late 2007. In December 2011, only 55.6 percent of working-age North Carolinians (seasonally adjusted) had jobs, a level no different from the one posted one year prior. This rate actually fell to a low of 55.3 percent near the end of 2011.Q3. At no other time since 1976 has the employment-to-population been as low as it has been in recent months (fig. 7). The current ratio also is well below the historical average rate of 63.6 recorded between January 1976 and December 2007.

Similarly, the December 2011 labor force participation rate of 61.7 percent was tied for the second-lowest rate recorded since 1976. Prior to the Great Recession, the participation rate never had fallen below 65.1 percent and averaged 67.1 percent While some of that change is likely due to shifts in the age structure of the workforce, the recession has played a driving role. Over time, the degree to which the participation rate rebounds will influence the number of jobs needed to bring down unemployment. The higher the share, the more job growth that will be needed.

Geographic Patterns in Joblessness

During 2011, labor market conditions remained weak across North Carolina. In December 2011, 59 counties had unemployment rates of at least 10 percent, while 27 counties had unemployment rates at or above 12 percent. Compared to a year earlier, unemployment rates were higher in 68 counties, lower in 27 counties, and unchanged in five counties. (All local figures are seasonally unadjusted.)

Labor markets in non-metropolitan communities remained particularly weak. In December 2011, the unemployment rate in non-metropolitan North Carolina was 10.9 percent, no different from the rate recorded in December 2010. The metropolitan unemployment rate, meanwhile, rose over the course of the year, climbing to 9.4 percent from 9.2 percent. Meanwhile, 9.1 percent of the combined labor force residing in the “Big Three” metro areas of Charlotte, the Research Triangle, and the Piedmont Triad was unemployed; a year ago the figure was 9 percent.

Between the onset of the recession and December 2011, the size of North Carolina’s non-metro labor force declined by 46,460 individuals (-3.5 percent), while the metropolitan labor force gained 19,429 members (+0.6 percent). Within metro North Carolina, growth in the “Big Three” metros accounted for 84 percent of the total gain.

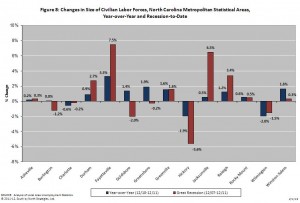

As fig. 8 shows, the labor market performances of North Carolina’s metro areas varied over the year. Ten of the state’s 14 areas posted increases in their labor forces with the greatest gains occurring in the Fayetteville (+3.3 percent) and Greensboro (+1.9 percent) metros. In contrast, Wilmington’s labor force contracted by 2 percent, while the labor force shrank by 1.9 percent in the Hickory-Morganton-Lenoir metro. Since the start of the recession, the greatest rates of labor force growth have occurred in the military communities of Fayetteville (+7.5 percent) and Jacksonville (+6.5 percent), followed by Raleigh-Cary (+3.4 percent) and Durham-Chapel Hill (+2.7 percent).

As fig. 8 shows, the labor market performances of North Carolina’s metro areas varied over the year. Ten of the state’s 14 areas posted increases in their labor forces with the greatest gains occurring in the Fayetteville (+3.3 percent) and Greensboro (+1.9 percent) metros. In contrast, Wilmington’s labor force contracted by 2 percent, while the labor force shrank by 1.9 percent in the Hickory-Morganton-Lenoir metro. Since the start of the recession, the greatest rates of labor force growth have occurred in the military communities of Fayetteville (+7.5 percent) and Jacksonville (+6.5 percent), followed by Raleigh-Cary (+3.4 percent) and Durham-Chapel Hill (+2.7 percent).

At 7.5 percent, Durham had the lowest metro unemployment rate in December 2011. Next came Asheville (7.9 percent), followed by Raleigh-Cary (8 percent). The highest rates were in Rocky Mount (12.9 percent), Hickory (11.9 percent), and Charlotte-Gastonia-Rock Hill, NC-SC (10.3 percent).

When looking at local unemployment numbers, it is important to place them in perspective. The 7.5 percent unemployment rate found in the Durham metro, for instance, is low relative to the performance of other North Carolina metros, yet it is high by any objective standard. Consider how in December 2007 just 3.8 percent of Durham’s labor force was unemployed. Four years later, the area’s unemployment rate was 1.9 times greater, while the number of unemployed residents was 99.2 percent larger. Despite faring better than other metros in the state, Durham’s labor market hardly can be deemed robust.

Economic Hardships Continue to Mount

The lack of jobs continues to be the most serious problem facing working North Carolinians. During 2011, job openings remained scarce. While state-level information is not available, data from the US Bureau of Labor Statistics suggests that, in the South region, there were 3.4 unemployed workers for every job opening posted in December 2011. The regional job-seekers ratio rate improved over the year, dropping from 5:1, though the current level remains high by historical standards. In December 2007, for instance, there were 1.5 unemployed workers per job opening in the South, and in January 2001, there were 1.1 unemployed workers per job opening in the South.

Given the scarcity of job openings, it is not surprising that individuals who have lost jobs are experiencing extended periods of unemployment. In December 2011, 42.9 percent of all unemployed Americans had been jobless for at least six months, with the average spell of unemployment lasting 40.1 weeks. Unfortunately, the longer workers are unemployed, the less likely they are to secure new positions due to competition, skills deterioration, and stereotyping. If such trends continue, many of North Carolina’s long-term unemployed workers likely will never return to work.

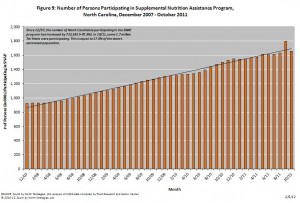

Perhaps the most troubling indicator of the economic hardships facing North Carolina’s households is the surge in the size of the state’s Food Stamp caseload. Between December 2010 and October 2011, the most recent month with data, the number of Tar Heels participating in the program grew by 7 percent, or 108,073 persons. (Note the 2011 data are influenced by the provision of emergency assistance following some natural disasters.) Much of the growth is attributable to job losses among individuals with modest incomes — job losses that pushed their household incomes below the program eligibility level (gross monthly income of 130 percent of the poverty level, or $2,422 for a four-person household). Moreover, since December 2007, the number of Tar Heels participating in the program has grown by 732,543 persons, or 79.2 percent (fig. 9). And, the number of program participants has increased by 25.7 percent since February 2010, the month in which the state’s labor market bottomed out. As a result, 17.6 percent of the state’s residents were connected to the food assistance program in October 2011.

Perhaps the most troubling indicator of the economic hardships facing North Carolina’s households is the surge in the size of the state’s Food Stamp caseload. Between December 2010 and October 2011, the most recent month with data, the number of Tar Heels participating in the program grew by 7 percent, or 108,073 persons. (Note the 2011 data are influenced by the provision of emergency assistance following some natural disasters.) Much of the growth is attributable to job losses among individuals with modest incomes — job losses that pushed their household incomes below the program eligibility level (gross monthly income of 130 percent of the poverty level, or $2,422 for a four-person household). Moreover, since December 2007, the number of Tar Heels participating in the program has grown by 732,543 persons, or 79.2 percent (fig. 9). And, the number of program participants has increased by 25.7 percent since February 2010, the month in which the state’s labor market bottomed out. As a result, 17.6 percent of the state’s residents were connected to the food assistance program in October 2011.

Future Prospects

2011 proved to be another lost year for North Carolina’s labor market. Since job losses peaked in February 2010, North Carolina has netted just 27,700 payroll jobs (+0.7 percent). That rate of growth is insufficient to keep pace with the natural increase in the size of the state’s working-age population, to say nothing of replacing the jobs lost during the recession. While the private sector performed better than it has in recent years, payroll reductions in the public sector erased a third of the private-sector gain. Even if that had not occurred, the degree of expansion in the private sector still would have been insufficient to close the large job gap that opened earlier in the business cycle in any meaningful or perceptible way.

Unfortunately, there exists little evidence suggesting an imminent change from the status quo. While the worst of the public-sector job cuts linked to closing of an estimated $2.4 billion general fund budget gap for the biennium ending on June 30, 2013, likely is past, the state revenue situation remains tentative and highly dependent on improvements in employment conditions. More cuts therefore are possible in the upcoming short legislative session.

Additionally, fiscal contraction in the form of federal spending reductions and the expiration of stimulative policies like emergency unemployment compensation and the temporary cut in payroll taxes is likely to weigh on growth. And unfavorable international developments remain a concern. Though national economic conditions seemed to improve in late 2011, those strides were modest relative to the magnitude of the problems facing the labor market and are insufficient to return the labor market to health anytime soon.

If recent trends hold, North Carolina’s labor market will not grow robustly in 2012. Even if job growth in the private sector accelerates, it is unlikely to pick up enough to put much of a dent in the problems of unemployment and underemployment. Economic hardships therefore should remain pronounced across much of the state. For the long-term unemployed in particular, their odds of returning will continue to fall, yet the tattered state of the nation’s safety net means that little help will be available for such individuals and their families.

Absent significant changes in economic conditions and public policies, weak job growth, high levels of joblessness, and pervasive economic hardships appear to be in store for North Carolina, with 2012 apt to mark the fifth consecutive year of negative or minimal job growth.

###

Individuals with a printed copy of this analysis may access it online at http://www.sbnstrategies.com/?p=9798 or by scanning the QR code below.

All material within this analysis Copyright © 2012 South by North Strategies, Ltd. All rights reserved.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed