Remember Two Things

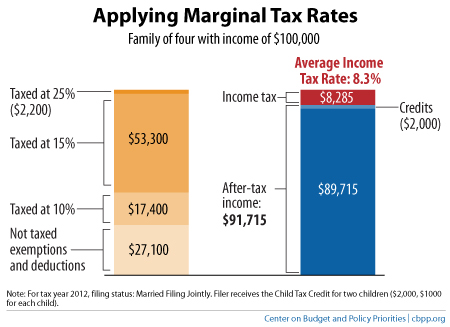

Off the Charts has a nifty graph that illustrates the differences between a person’s marginal income tax rate, which is the rate applied to the last dollar of income received, and average tax rate, which is the share of income paid in taxes.

Remember that average tax rates normally are much lower than marginal ones thanks to various exemptions, deductions, and credits.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed