NC Unemployment Claims: Week Of 11/23/13

For the benefit week ending on November 23, 2013, North Carolinians filed some 4,682 initial claims for state unemployment insurance benefits and 69,510 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

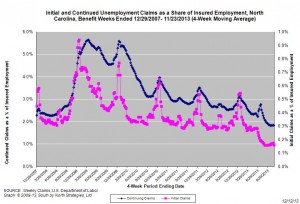

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,223 initial claims were filed over the previous four weeks, along with an average of 70,826 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 14,047, and the four-week average of continuing claims equaled 100,824.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is again at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to near the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,223) was 55.6 percent lower than the figure recorded one year ago (14,047), while the average number of continuing claims was 29.8 percent lower (70,826 versus 100,824). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed