Understanding the GDP-ARRA Link

Many analyses of the impact of the American Recovery and Reinvestment Act (ARRA) on the nation’s Gross Domestic Product (GDP) have confused GDP levels and GDP growth rates. Typically, the mistake is to say that two-thirds of ARRA funds are yet to be spent and when they are, they will boost GDP growth. That is not so. While the remaining ARRA funds will influence GDP levels, the package already has had its maximum impact on GDP growth. And as elements of ARRA and other forms of government aid are withdrawn in 2010, GDP growth rates will slow and likely turn negative in late 2010 and early 2011.

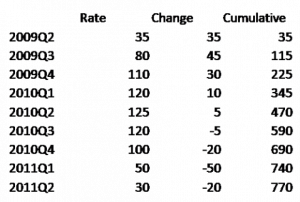

At his blog, economist Paul Krugman uses the following stylized example (right) to illustrate that pattern. In the chart, “rate” measure total ARRA spending in a quarter; “change” reflects the change in ARRA spending over the preceding quarter, and “cumulative” measures total ARRA spending to date.

Using this example, ARRA will exert its maximum impact on GDP levels in the third quarter of 2010, yet it had its maximum effect on GDP growth in the third quarter of 2009. As time passes and ARRA provisions expire, GDP growth rates will slow and then turn negative in late 2010 and remain negative into early 2011. (This example tracks forecasts by analysts at Deutsche Bank).

It is this trend that is causing some analysts to doubt the sustainability of the current recovery and to warn about a possible “double dip” recession in late 2010 or early 2011.

Yet this pattern does not mean that ARRA was ineffective. As economist Menzie Chinn writes at Econbrowser:

In other words, even as the stimulus subtracts from growth starting in the second half of 2010, the level of GDP is still higher than what would be the case in the absence of the stimulus package. Critics of the stimulus package often neglect to highlight that point.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed