Comparing Tax Plans For North Carolina

A new research brief prepared by Americans for Responsible Taxes and Citizens for Tax Justice looks at how North Carolina’s personal taxpayers would fare under the expiration of the Bush-era tax changes and under each of the two major congressional proposals.

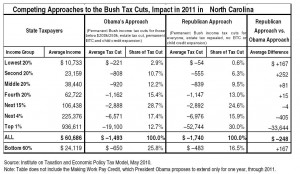

The table (below) summarizes the changes by income group.

Key findings include the following:

Key findings include the following:

- Under the Republican approach, the bottom 60 percent of North Carolina taxpayers would pay $167 more in 2011, on average, than they would under President Obama’s approach.

- Under the Republican approach, the richest one percent of North Carolina taxpayers would pay $33,644 less in 2011, on average, than they would under President Obama’s approach.

- Under the Republican approach, the richest one percent of North Carolina taxpayers would receive 30.0 percent of the total tax cuts going to the state in 2011.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed