Changing Incomes & Top Marginal Tax Rates

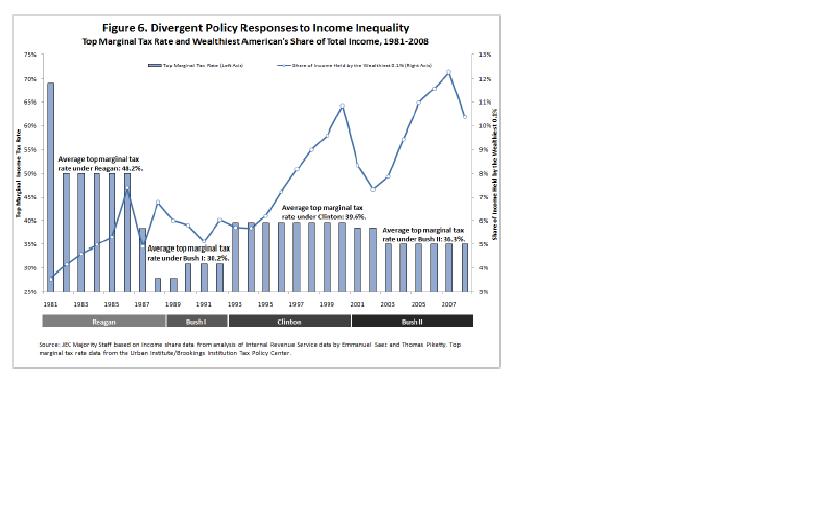

The following graph, taken from an analysis prepared by the majority staff of Congress’ Joint Economic Committee, compares changes in the top marginal federal income tax rate to the the share of the nation’s income held by the top 1 percent of households.

Not only are current rates low by historical standards, but they also appear to have little impact on the share of income held by the richest households; rather, their fortunes are influenced much more by economic conditions and market returns.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed