NC’s Labor Market: A Recap

On Friday, the Employment Security Commission of North Carolina will release the employment report for September, the 21st month of the recession. As the downturn nears the two-year mark, where does the state’s labor market stand?

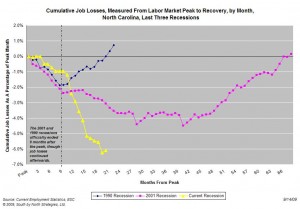

As of August, the recession had led North Carolina’s non-farm employers to eliminate, on net , 253,400 payroll positions. Consequently, payroll employment is now 6 percent smaller than it was in December 2007 (graph, left).

As of August, the recession had led North Carolina’s non-farm employers to eliminate, on net , 253,400 payroll positions. Consequently, payroll employment is now 6 percent smaller than it was in December 2007 (graph, left).

In terms of job losses, the current recession was a slow starter. Significant net losses did not start until fall 2009, with heavy losses occurring every month between 11/08 and 3/09. In fact, that period accounts for 64 percent of all the job losses that have occurred during the recession. Although the pace of job losses has moderated since April, the overall trend remains a downward one.

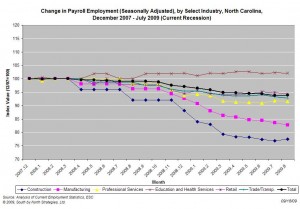

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

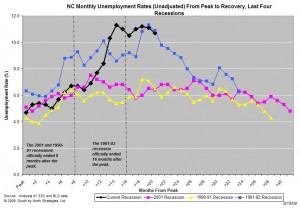

Job loss has led to a rapid increase in unemployment. Since the start of the recession, the state unemployment rate has more than doubled, rising to 10.8 percent from 4.7 percent. The unemployment rate now is at a level last seen during the recession of the early 1980s (graph, below). Due to limitations in the ways in which unemployment is calculated, the number of individuals who are effectively jobless likely is higher. Consider: North Carolina’s labor force now is 0.2 percent smaller than it was at the start of the recession. Similarly, the share of the prime-age population engaged in economically productive activities has fallen.

In geographic terms, unemployment has been widespread. In August, 63 counties had double-digit unemployment rates, and 34 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 6.8 percent)

In geographic terms, unemployment has been widespread. In August, 63 counties had double-digit unemployment rates, and 34 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 6.8 percent)

Little in the state employment data suggest that a recovery is imminent. Economic demand remains weak at the state and national levels despite the important boost provided by the federal recovery package. Even when demand does return — a date that may be a few years away, firms will have many alternatives to hiring permanent employees.

Based on current trends, North Carolina’s labor market likely will remain weak into the foreseeable future. For individuals, a weak market will result in family economic hardships, while firms will struggle to secure business. Meanwhile, the state will grapple with the resulting budget shortfalls.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed