23.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

23.05.2012

Policy Points

Sadly, The Economist opted to use a different cover image and altogether different cover story from the one below for this week’s US edition. Felix Salmon explains why this difference matters.

23.05.2012

Policy Points

Writing at Policy Shop, David Callahan explains just how few jobs are created by technology companies like Facebook.

Technology companies deliver amazing products and services, and Facebook is a prime example of how breakthroughs in the tech sector can change how we live. But don’t look to the tech sector to create the middle class jobs of tomorrow. Facebook illustrates this reality. Even as the company has become spectacularly successful, and vastly enriched individuals associated with it, it has generated relatively few jobs.

…

Facebook added just over 1,000 jobs in 2011, bringing its total work force to 3,200 employees. Indirectly, through the apps and other subsidiary components supported by Facebook, the company is estimated to have created between 53,000 and 129,000 jobs in the United States.

…

Even if Facebook doubles or triples its labor force with the new investment capital it raises from the IPO, it will employ vastly fewer people than any other U.S. corporation of a similar value in the range of $100 billion. For example, PepsiCo has 285,000 employees with a market value of $103 billion, according to Fortune. Abbott Laboratories employs 91,000 people with a market value of $95.6 billion. Walt Disney has 156,000 employees with a market value of $77 billion. Bank of America, with a market value of $102 billion has 284,000 employees. GM, with a third the market cap of Facebook, has 209,000 employees.

22.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

22.05.2012

Policy Points

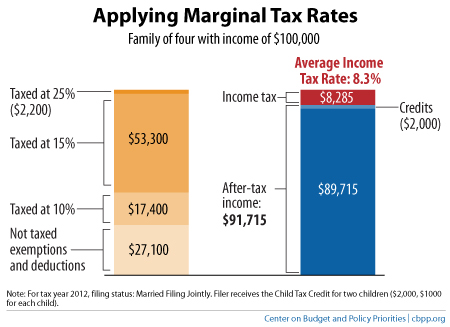

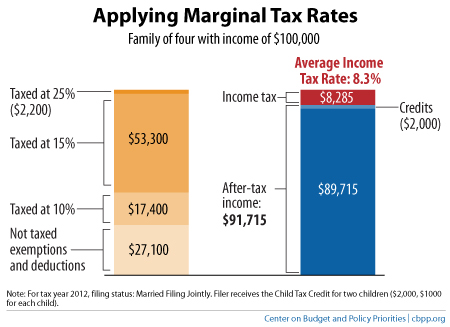

Off the Charts has a nifty graph that illustrates the differences between a person’s marginal income tax rate, which is the rate applied to the last dollar of income received, and average tax rate, which is the share of income paid in taxes.

Remember that average tax rates normally are much lower than marginal ones thanks to various exemptions, deductions, and credits.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed