22.05.2012

Policy Points

Gretchen Morgenson of The New York Times explains the fuzzy math behind claims that financial rescue programs like TARP have made money for the taxpayers. One problem is the failure to account for the true value of the subsidies provided to financial institutions.

An even larger problem with the Treasury analysis, Mr. [Edward] Kane [of Boston College] said, is its failure to calculate the value of the subsidy that taxpayers provided to rescue recipients. “You would not pass Economics 101,” he said, “if you didn’t understand the opportunity costs involved in providing the subsidy.”

—

The programs provided enormous amounts of money at below-market terms for extended periods, he said. Had those guarantees been priced at their true market value — what a private investor would have charged to lend during those dire days — taxpayers should have received far higher returns.

—

Timothy G. Massad, assistant Treasury secretary for financial stability, said: “We believe the fact that we took strong, forceful action resulted in us preventing significant economic costs, including the risk of a second Great Depression….”

—

Charles W. Calomiris, is a professor at Columbia Business School ….. He worked with Mr. Kane on the critique of the Treasury’s analysis and said in an interview last week: “Pretending that when providing these subsidies all you have to do is get your money back and not get an adequate return accounting for risk — that is not a good accounting for cost.”

21.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

21.05.2012

Policy Points

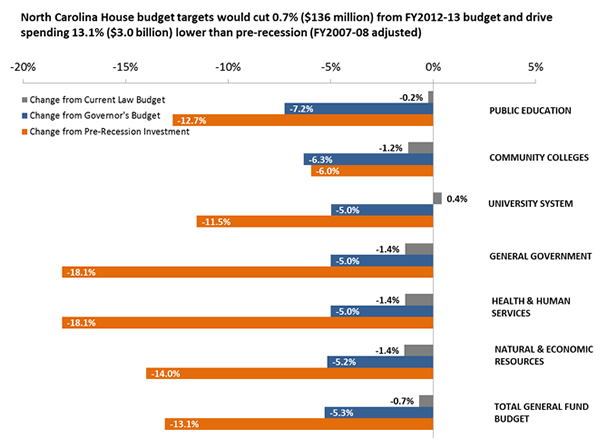

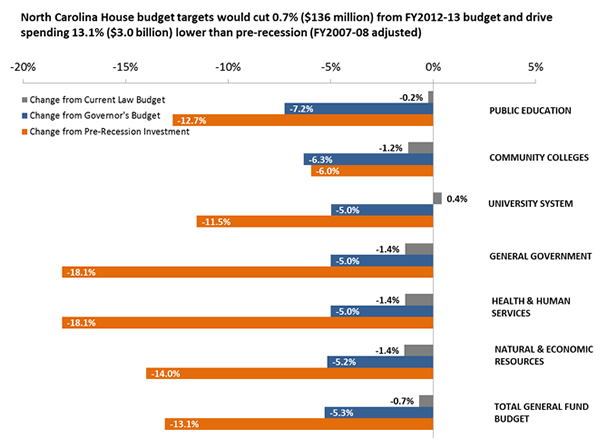

An infographic prepared by the North Carolina Budget & Tax Center depicts the extent to which real General Fund spending has fallen since fiscal year 2007-2008 and how much farther it would fall under one proposed budget for fiscal year 2012-2013.

21.05.2012

Policy Points

Catherine Rampell of The New York Times discusses the ludicrous debate over the future of the American Community Survey and the Economic Census, two of the US Census Bureau’s most important and useful products. Bottom line: never let facts get in the way of preconceived notions.

“Knowing what’s happening in our economy is so desperately important to keeping our economy functioning smoothly,” said Maurine Haver, the chief executive and founder of Haver Analytics, a data analysis company. “The reason the Great Recession did not become another Great Depression is because of the more current economic data we have today that we didn’t have in the 1930s.”

…

She added that having good data about the state of the economy was one of America’s primary competitive advantages. “The Chinese are probably watching all this with glee,” she said, noting that the Chinese government has also opted not to publish economic data on occasion, generally when the news wasn’t good.

…

Other private companies and industry groups — including the United States Chamber of Commerce, the National Retail Federation and the National Association of Home Builders— are up in arms.

…

Target recently released a video explaining how it used these census data to determine where to locate new stores. Economic development organizations and other business groups say they use the numbers to figure out where potential workers are.

18.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed