15.05.2012

Policy Points

In conjunction with its upcoming annual conference, scheduled to be held in late June in Chattanooga, Tennessee, Southern Growth Policies Board is soliciting opinions about the workforce challenges facing the American South.

Southerners interested in sharing their thoughts about the topic should complete a brief survey that is available here.

14.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

14.05.2012

Policy Points

Naked Capitalism joins the debate about the social consequences of escalating student loan debt, as described in a recent article in The New York Times.

One of the distressing threads in the article was elected officials and even students arguing that it was completely reasonable to expect students to carry most of the freight of their education. I wonder if any of the ones over, say, 35 giving that view would be anywhere near as comfortable as they are now if that had been required of them. You can see the open, casual rendering of one of the obligations of society, that of educating the young.

…

I’ve never understood when (once in a while) someone (clearly young) shows up in comments and rails against Social Security and Medicare because of the burden it imposes on him. Now I get it. The student debt issue is deepening social fractures. If young people are asked to stand on their own, and given only unpalatable choices (forego a college degree, the entrance ticket to middle class life, or accept debt slavery at a tender age), no wonder they adopt a “devil take the hindmost” attitude. I hope some of these people who so cavalierly argue for loading up the next generation with debt realize that the young may not want to take care of them either, and they are far more at risk. The outcome of cutting social safety nets to the elderly ultimately means that old people will die faster.

14.05.2012

Policy Points

A lengthy report in The New York Times explores the impact that rising college costs is having on the lives of young adults. The report mirrors many of the themes raised in “The Great Cost Shift,” a report prepared by South by North Strategies for Demos, a public policy organization in New York City. From the story in The New York Times …

The roots of the borrowing binge date to the 1980s, when tuition for four-year colleges began to rise faster than family incomes. In the 1990s, for-profit colleges boomed by spending heavily on marketing and recruiting. Despite some ethical lapses and fraud, enrollment more than doubled in the last decade and Wall Street swooned over the stocks. Roughly 11 percent of college students now attend for-profit colleges, and they receive about a quarter of federal student loans and grants.

…

In the last decade, even as enrollment at state colleges and universities has grown, some states have cut spending for higher education and many others have not allocated enough money to keep pace with the growing student body. That trend has accelerated as state budgets have shrunk because of the recent financial crisis and the unpopularity of tax increases.

…

Nationally, state and local spending per college student, adjusted for inflation, reached a 25-year low this year, jeopardizing the long-held conviction that state-subsidized higher education is an affordable steppingstone for the lower and middle classes. All the while, the cost of tuition and fees has continued to increase faster than the rate of inflation, faster even than medical spending. If the trends continue through 2016, the average cost of a public college will have more than doubled in just 15 years, according to the Department of Education.

11.05.2012

Policy Points

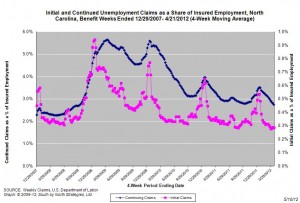

For the benefit week ending on April 21, 2012, some 9,504 North Carolinians filed initial claims for state unemployment insurance benefits and 100,017 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and fewer continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,720 initial claims were filed over the previous four weeks, along with an average of 103,232 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,596, and the four-week average of continuing claims equaled 114,339.

In recent weeks covered employment has increased and now exceeds the level recorded a year ago (3.76 million versus 3.71 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were over four years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed