09.05.2012

Policy Points

Jonathan Chait of New York magazine offers a succinct summary of Rep. Paual Ryan’s proposals for the federal budget.

The basic elements of Ryan’s plan are this: The tax code would be collapsed into two rates, with the top rate dropping to 25 percent, but eliminating unspecified tax deductions would keep tax revenues at the current level, as set by the Bush tax cuts. Medicare would remain untouched for those 55 years old and older, but those under would be given vouchers at a capped rate. Given that the Medicare savings would not begin to take effect for more than a decade, that taxes would stay level (at best), and that military spending would increase, Ryan would achieve his short-term deficit reduction by focusing overwhelmingly on programs targeted to the poor (which account for about a fifth of the federal budget, but absorb 62 percent of Ryan’s cuts over the next decade). The budget repeals Obamacare, thereby uninsuring some 30 million Americans about to become insured. It would then take insurance away from another 14 to 27 million people, by cutting Medicaid and children’s health-insurance funding.

…

This is not a moderate plan. As Robert Greenstein, a liberal budget analyst, summed up the proposal, “It would likely produce the largest redistribution of income from the bottom to the top in modern U.S. history.” And yet, Ryan has managed to sell it as something admirable, and something else entirely: a deficit-reduction plan….

09.05.2012

Policy Points

A recent article in Bloomsberg Businessweek explores the extent to which the recovery is squeezing America’s middle class and what it means for the future.

Ninety-five percent of the net job losses during the recession were in middle-skill occupations such as office workers, bank tellers, and machine operators, according to research by economists Nir Jaimovich of Duke University and Henry Siu of the University of British Columbia. That’s what we all assume happens in recessions: The middle class is hit hardest, then eventually climbs back. Only, that comeback isn’t happening. Job growth since the end of the recession has been clustered in high-skill fields inaccessible to workers without advanced degrees or in low-paying industries, the economists found.

…

In March the U.S. had 2 million more managers and professionals working than five years earlier. Lower-paying service-sector jobs were up 1.5 million. It’s the middle-income jobs that have been slow to return. Over the same period, there were 3.2 million fewer Americans working in sales and office jobs and 1.2 million fewer employed in transportation and production—a broad category that includes factory and assembly-line workers, printers, welders, tailors, and poultry and meat plant workers. Another worrisome measurement: Median annual household income in March was $2,900 lower after inflation than at the start of the recovery in June 2009, according to Sentier Research, an economic consulting firm.

08.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

08.05.2012

Policy Points

Writing in The New York Review of Books, Paul Krugman lays out n agenda for “how to end this depression.”

The truth is that recovery would be almost ridiculously easy to achieve: all we need is to reverse the austerity policies of the past couple of years and temporarily boost spending. Never mind all the talk of how we have a long-run problem that can’t have a short-run solution—this may sound sophisticated, but it isn’t. With a boost in spending, we could be back to more or less full employment faster than anyone imagines.

…

But don’t we have to worry about long-run budget deficits? Keynes wrote that “the boom, not the slump, is the time for austerity.” Now, as I argue in my forthcoming book—and show later in the data discussed in this article—is the time for the government to spend more until the private sector is ready to carry the economy forward again. At that point, the US would be in a far better position to deal with deficits, entitlements, and the costs of financing them.

…

Meanwhile, the strong measures that would all go a long way toward lifting us out of this depression should include, among other policies, increased federal aid to state and local governments, which would restore the jobs of many public employees; a more aggressive approach by the Federal Reserve to quantitative easing (that is, purchasing bonds in an attempt to reduce long-term interest rates); and less timid efforts by the Obama administration to reduce homeowner debt.

08.05.2012

Policy Points

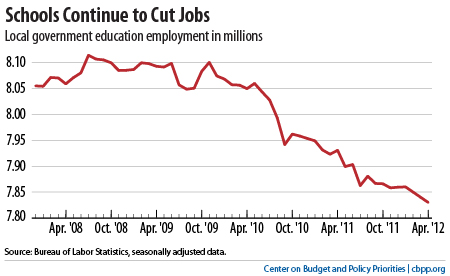

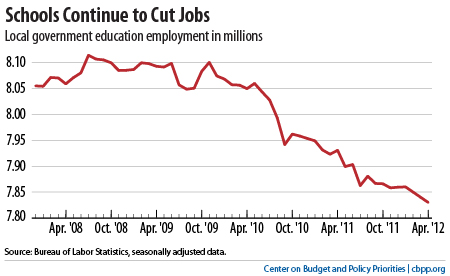

Off the Charts graphs the ongoing decline of local government education employment.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed