Policy Points

03.05.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

03.05.2012

Policy Points

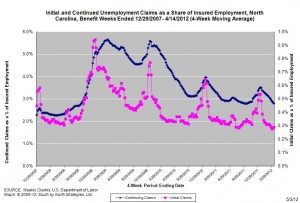

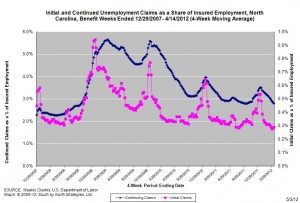

For the benefit week ending on April 14, 2012, some 11,074 North Carolinians filed initial claims for state unemployment insurance benefits and 103,149 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and fewer continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,806 initial claims were filed over the previous four weeks, along with an average of 105,331 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,282, and the four-week average of continuing claims equaled 115,863.

In recent weeks covered employment has increased and now exceeds the level recorded a year ago (3.75 million versus 3.71 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were over four years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

02.05.2012

Policy Points

Writing at Economix, Nancy Folbre argues that policymakers are trying to pass the buck regarding the unemployment crisis.

Many such voters are also drawn to a particular austerity strategy my fellow Economix blogger Casey B. Mulligan laid out last week: cutting taxes for high earners and cutting subsidies for low earners. This strategy makes perfect sense if you believe that most people who are struggling to pay their bills aren’t trying hard enough.

…

This argument appeals for several reasons. It absolves believers of any responsibility for other people’s hardships. It lends credence to the assertion that the labor market would work just fine if it weren’t jammed up by a social safety net. It lays the blame for persistent unemployment squarely on President Obama, who has urged extensions of unemployment benefits and other forms of public assistance.

…

And this argument holds a partial truth: some people probably do shirk, letting access to unemployment benefits, food stamps or disability insurance reduce their job search efforts.

…

But the number who fall into this category is small, and so are the overall effects, especially compared with the loss of output, effort, motivation, and well-being that results when people who need a job can’t find one.

02.05.2012

Policy Points

The North Carolina Budget and Tax Center reports on the role of the state’s personal income tax in funding public services and investments in an equitable manner.

North Carolina’s reliance on the personal income tax as its primary source of state revenues provides multiple important benefits to state residents. It ensures that state revenues are better able to keep pace with growth in the state’s economy and demand for public investments, and it better aligns North Carolinians’ state and local tax contributions with families’ ability to pay.

…

Reforms to the personal income tax are certainly needed, but they should be done in a way that supports the consensus principles of comprehensive revenue modernization and, in so doing, ensure that North Carolina is positioned to invest in economic opportunity for all.

01.05.2012

Policy Points

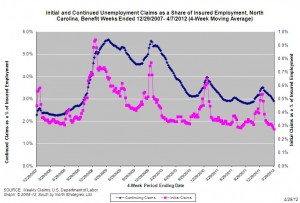

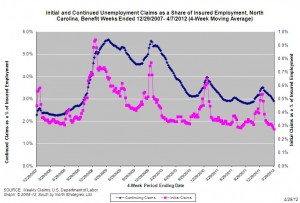

For the benefit week ending on April 7, 2012, some 12,112 North Carolinians filed initial claims for state unemployment insurance benefits and 105,601 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,511 initial claims were filed over the previous four weeks, along with an average of 106,736 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,698, and the four-week average of continuing claims equaled 118,693.

In recent weeks covered employment has increased and now exceeds the level recorded a year ago (3.75 million versus 3.71 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were over four years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed