30.03.2012

Policy Points

James Kwak points out that health insurance has a value as insurance, meaning security against illness and financial loss, even if someone who is insured is fortunate enough never to become ill and draw on a policy.

…Health insurance, like any kind of insurance, can be framed after the fact as redistribution. You pay health insurance premiums, you stay healthy, and therefore you “lose”—your money goes to pay for other people’s losses. But this is true of any kind of insurance….

…

The other way to think of insurance is, well, as insurance. We want and value insurance in the current period, before we know if we’ll be “winners” or “losers” in the future period. The insurance itself has value to us. In fact, whenever you buy insurance, you are hoping that you will end up as a loser.

…

The framing of the health care individual mandate as a transfer from the healthy to the sick is the exact same as the framing of tax-funded social insurance programs as a transfer from the rich to the poor. At the time you enter the system, you probably don’t know which category you will fall into. You might have some knowledge of the probabilities, but you could turn out to be very wrong: there are plenty of people who are healthy in their twenties but get very sick later. In either case, the framing as redistribution and the focus on winners and losers is a way of making something that all people value—protection from risk, backed by the federal government’s balance sheet—seem like a from of zero-sum redistribution brokered by that evil, meddling federal government.

29.03.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

29.03.2012

Policy Points

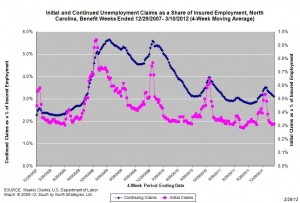

For the benefit week ending on March 10, 2012, some 11,551 North Carolinians filed initial claims for state unemployment insurance benefits and 113,250 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 11,739 initial claims were filed over the previous four weeks, along with an average of 116,323 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 13,058, and the four-week average of continuing claims equaled 126,768.

In recent weeks covered employment has increased and now slightly exceeds the level recorded a year ago (3.74 million versus 3.71 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were four years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

29.03.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the service sector strengthened in March, according to the latest survey by the Federal Reserve Bank of Richmond. Retail sales accelerated and revenues at non-retail services firms also rose sharply. Retail shopper traffic surged and big-ticket sales expanded, while merchants’ inventories flattened. Looking ahead six months, survey respondents were decidedly optimistic about demand for their goods and services.

…

On the labor front, retail hiring and average wages slowed, while employment and average wages at non-retail firms picked up.

…

Price growth in the broad service sector edged up in March, and survey participants generally expected further acceleration during the next six months.

28.03.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed