26.03.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

26.03.2012

Policy Points

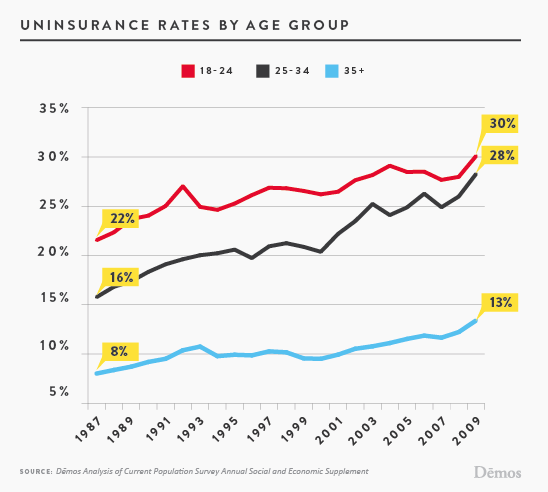

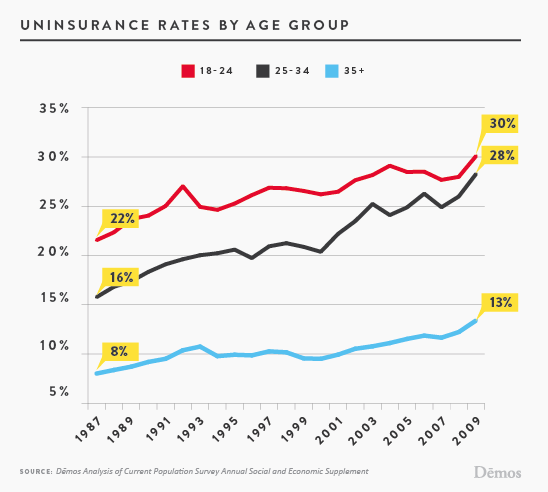

Policy Shop points out that the federal healthcare reform helped 2.5 million young adults receive coverage at a minimal cost. That said, some 30 percent of young adults still lack coverage.

26.03.2012

Policy Points

Writing for Project Syndicate, Robert Skidelsky mulls the economics of the “fair trade” movement.

But, despite its shaky economics, the fair-trade movement should not be despised. While cynics say that its only achievement is to make consumers feel better about their purchases – rather like buying indulgences in the old Catholic Church – this is to sell fair trade short. In fact, the movement represents a spark of protest against mindless consumerism, grass-roots resistance against an impersonal logic, and an expression of communal activism.

…

That justification will not convince economists, who prefer a dryer sort of reasoning. But it is not out of place to remind ourselves that economists and bureaucrats need not always have things their own way.

23.03.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

23.03.2012

Policy Points

Simon Johnson explains “the limits of American exceptionalism.”

The ability of the United States to borrow reflects its collective strength. After a difficult struggle to establish viable public finances during and immediately after the War of Independence, the United States finally found its fiscal footing. The bicentennial of the real turning point is this year — it was the War of 1812 that finally created a political consensus for fiscal prudence, including agreement on the need to pay, with taxes, for what the government spends. The United States earned the hard way and long deserved its reputation for fiscal prudence.

…

Its ability to borrow today creates what can be an advantage. When the economy turns down sharply — for example, because some big banks blew themselves up — it is much better to avoid being forced into fiscal austerity. Ask the Europeans.

…

But our willingness to borrow has also become a weakness. We need to bring the deficit and our national debt under control. In large part we should restore revenues to where they were in the mid-1990s, before the rash move to lower tax rates in the mistaken belief that there was a budget surplus to distribute.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed