09.03.2012

News Releases, Policy Points

CHAPEL HILL (March 9, 2012) – The national employment situation improved in February, as employers added 227,000 more payroll positions than they eliminated. Furthermore, the unemployment rate held steady at 8.3 percent. While the growth in payroll employment and the maintenance of the unemployment rate are positive developments, the national job market remains far from robust.

“February marked the third straight month in which the national economy gained at least 200,000 more jobs than it lost,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “While 2012 has started well, the extent to which such progress is sustainable is unclear. After all, 2011 started with similar levels of growth, only to see them tail off as the year progressed.”

In February, the nation’s employers added 227,000 more payroll positions than they cut. Gains occurred entirely in the private sector (+233,000), while government payrolls fell by 6,000 positions due mainly to cuts at the federal level (-7,000). Additionally, the payroll employment numbers for December and January underwent upward revisions; with the updates, the economy gained 507,000 jobs over those two months rather than the 446,000 positions previously reported.

Almost every major private-sector industry group netted jobs in February. Professional and business services added the most positions (+82,000 due chiefly to gains in the administrative and waste services sub-sector, which includes temporary help services), followed by education and health services (+71,000), leisure and hospitality services (+44,000 due primarily to growth in the accommodation and food service sub-sector), and manufacturing (+31,000 due entirely to growth in durable goods manufacturing). Meanwhile, the construction industry shed 13,000 positions; the other services sector lost 6,000 jobs; and information shed 1,000 positions.

“Over the past three months, the economy has gained an average of approximately 245,000 jobs,” noted Quinterno. “The current pace of job growth is nevertheless modest relative to the size of the overall jobs gap. The overall economy still faces a shortfall of roughly 10 million jobs—a gap that would take some 5 years to close at the current rate of growth.”

Soft employment conditions were evident in the February household survey. Last month, 12.8 million Americans (8.3 percent of the labor force) were jobless and seeking work. While the number of unemployed Americans and the unemployment rate held steady last month, the share of the population participating in the labor force (63.9 percent) rose slightly, as did the share of the adult population with a job (58.6 percent); regardless, both indicators remain at depressed levels.

Last month, unemployment rates among adult male and female workers were the same (7.7 percent for each group). Unemployment rates were higher among Black (14.1 percent) and Hispanic workers (10.7 percent) than among White ones (7.3 percent). The unemployment rate among teenagers was 23.8 percent. Moreover, 7 percent of all veterans were unemployed in February; the rate among recent veterans (served after September 2001) was 7.6 percent.

Jobs remained difficult to find in February. Last month, the underemployment rate equaled 14.9 percent. Among unemployed workers, 42.6 percent had been jobless for at least six months with the average spell of unemployment lasting for 40 weeks.

“The February employment report offers much proof that the labor market is not rebounding as rapidly as it should following a recession as severe as the recent one,” observed Quinterno. “The February employment report provides little evidence that that joblessness is about to start declining sharply.”

“While the comparatively good growth in payroll employment in recent months is important, the basic fact remains that the economy still is not generating enough jobs for the millions of Americans who need work and has not done so for almost four years.”

09.03.2012

Policy Points

A new report from the Economic Policy Institute points out that the wages paid to entry-level workers, including those with college degrees, fell over the course of the last decade. From the report …

Entry-level wages fell among both women and men college graduates from 2000 to 2007, declining by 2.5 percent among men and 1.6 percent among women, and tumbled further in the recessionary years after 2007. This means that young college graduates who finished their education in the last five years or so are earning significantly less than their older brothers and sisters who graduated in the late 1990s. The poor wage growth in the last decade contrasts markedly with the strong period of rising wages for entry-level men college graduates from 1995 to 2000, during which time they increased 20.3 percent. In contrast, from 1979 to 1995, the entry-level hourly wage for men college graduates fell more than $1. Thus, the period of falling wages since 2000 does not stand as the exception to the rule for young college-educated men; rather, it is the wage boom of the late 1990s that seems exceptional. In 2011, the hourly wage of entry-level college-educated men was slightly more than $1 higher than in 1979, a rise of only 5.2 percent over 32 years.

08.03.2012

Policy Points

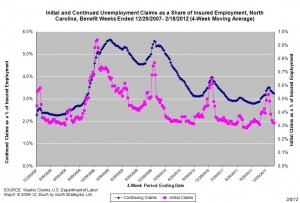

For the benefit week ending on February 18, 2012, some 11,436 North Carolinians filed initial claims for state unemployment insurance benefits, and 118,923 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,002 initial claims were filed over the previous four weeks, along with an average of 121,240 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 13,266, and the four-week average of continuing claims equaled 133,634.

In recent weeks covered employment has increased and now slightly exceeds the level recorded a year ago (3.74 million versus 3.71 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were four years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed