Policy Points

06.11.2014

Our Projects, Policy Points

In the summer of 2014, South by North Strategies developed a seven‐hour introductory course on labor market information for practitioners in local workforce development, economic development, and research organizations. The course was developed on behalf of the North Carolina Workforce Development Training Center, a unit within the North Carolina Department of Commerce.

The day-long course includes modules on “Labor Market Information in Context,” “Labor Market Information in Detail,” “Accessing Labor Market Information,” and “Talking about Labor Market Information,” as well as a practical group exercise. Sessions have been delivered in the North Carolina cities of Raleigh, Hickory, and Boone.

The course is based on material contained in South by North Strategies’ book “Running The Numbers: A Practical Guide to Regional Economic and Social Analysis” (Armonk, NY: M.E. Sharpe, 2014).

06.11.2014

Our Projects, Policy Points

In October 2014, South by North Strategies, Ltd. facilitated two 90-minute professional development sessions on ways of using and communicating regional labor market information. The sessions were delivered as part of the 2014 North Carolina Workforce Development Partnership Conference, an annual gathering of approximately 900 workforce development professional organized by the North Carolina Workforce Development Training Center.

The sessions took place on October 16, 2014 in Greensboro and were based on material covered in the book “Running The Numbers: A Practical Guide to Regional Economic and Social Analysis” (Armonk, NY: M.E. Sharpe, 2014).

06.11.2014

Our Projects, Policy Points

In October 2014, John Quinterno of South by North Strategies, Ltd. presented on key economic changes that have occurred to North Carolina’s rural communities as a result of “The Great Recession.” The remarks were delivered to the approximately 400 participants in the 2014 North Carolina Rural Assembly, an event held in Raleigh and organized by the North Carolina Rural Economic Development Center, a statewide nonprofit organization.

Among other topics, Quinterno discussed how the the recession spared no community in North Carolina, how the recession occurred alongside the increased “metropolitinization” of the state’s economy, how different types of non-metro communities have fared, and how the recession has exacerbated certain workforce challenges in rural communities. A copy of the presentation is available online and also is embedded below.

Other presenters discussed demographic changes in rural North Carolina, the outlook for the rural economy, and promising community development models and practices. All of those presentations also are available online.

06.11.2014

Policy Points

For the benefit week ending on October 18, 2014, North Carolinians filed some 5,005 initial claims for state unemployment insurance benefits and 43,406 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 5,043 initial claims were filed over the previous four weeks, along with an average of 43,613 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,238, and the four-week average of continuing claims equaled 70,675.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.92 million versus 3.85 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 6.5 years ago.

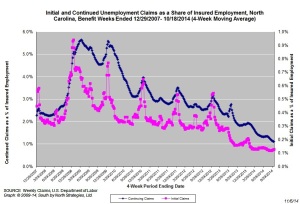

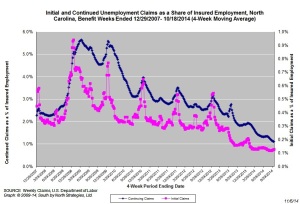

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is near the lowest level recorded since early 2008, while the four-week average of continuing claims is at the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (5,043) was 19.2 percent lower than the figure recorded one year ago (6,238), while the average number of continuing claims was 38.3 percent lower (43,613 versus 70,675). Given the modest rate of job growth that has occurred in North Carolina over the past year, such large declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

31.10.2014

Policy Points

For the benefit week ending on October 11, 2014, North Carolinians filed some 5,121 initial claims for state unemployment insurance benefits and 43,577 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 4,945 initial claims were filed over the previous four weeks, along with an average of 43,895 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,170, and the four-week average of continuing claims equaled 71,342.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.91 million versus 3.84 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 6.5 years ago.

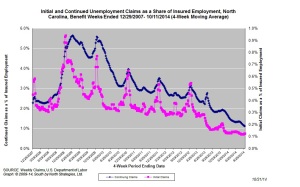

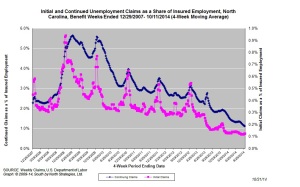

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is near the lowest level recorded since early 2008, while the four-week average of continuing claims is at the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (4,945) was 19.9 percent lower than the figure recorded one year ago (6,170), while the average number of continuing claims was 38.5 percent lower (43,895 versus 71,342). Given the modest rate of job growth that has occurred in North Carolina over the past year, such large declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed