05.01.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

05.01.2012

Policy Points

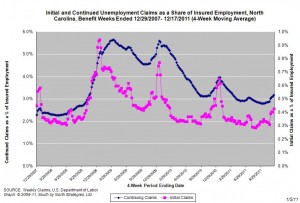

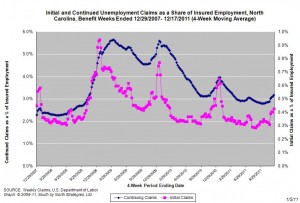

For the benefit week ending on December 17, 2011, some 13,249 North Carolinians filed initial claims for state unemployment insurance benefits, and 116,251 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 15,954 initial claims were filed over the previous four weeks, along with an average of 118,310 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 18,738 and the four-week average of continuing claims equaled 129,498.

In recent weeks covered employment has increased slightly and has returned to the 3.73 million level recorded a year ago. Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost three years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

05.01.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the broad service sector gained momentum in December, bolstered by improvement in the non-retail services subsector, according to the latest survey by the Federal Reserve Bank of Richmond. However, total retail sales slowed and big-ticket sales weakened compared to November’s survey. Shopper traffic flattened at retail establishments. Retail inventories increased more slowly than a month ago. At non-retail services firms, revenues rose sharply in December. Survey participants were upbeat about business prospects for the first half of 2012.

…

Hiring picked up notably at non-retail services firms, while retailers reduced their payrolls further this month. Average wage increases prevailed in the service sector.

…

Price change in the overall service sector increased at a slightly faster pace in December than in November. Looking ahead six months, survey respondents expected prices in the broad service sector to increase at nearly the same rate as their outlook a month ago.

04.01.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

04.01.2012

Policy Points

The Huffington Post reports on Washington’s failures to deal with the nation’s economic problems in 2011.

Those meager provisions likely prevented the economy from falling back into recession, but in the year since Obama cut that deal with congressional Republicans, economic growth has averaged a pathetic 1.2 percent. The unemployment rate has fallen from a horrific 9.8 percent to a merely terrible 8.6 percent. But much of that progress is illusory — millions of out-of-work Americans have simply given up all hope of finding a job, a situation that isn’t captured by the unemployment statistics.

—

Today there are nearly 1 million homes scheduled for a foreclosure auction, down from about 1.5 million at this time last year, but again, there’s less to the improvement than meets the eye. Widespread legal challenges to fraudulent foreclosures have forced banks to slow down the eviction process.

…

The same Wall Street firms that sent the economy into a tailspin remain broadly unaccountable. The robo-signing of foreclosure documents, in which banks process foreclosures at lightening speed without proper review, is still taking place. Most of the major new bank regulations required by 2010’s Wall Street reform legislation have been delayed. The new Consumer Financial Protection Bureau, perhaps the signature achievement of last year’s bill, has no director. The Federal Reserve Board of Governors is short two members.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed