Policy Points

18.09.2014

Policy Points

For the benefit week ending on August 30, 2014, North Carolinians filed some 4,491 initial claims for state unemployment insurance benefits and 47,504 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 4,663 initial claims were filed over the previous four weeks, along with an average of 49,975 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,065, and the four-week average of continuing claims equaled 79,689.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.9 million versus 3.8 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than six years ago.

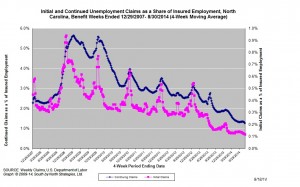

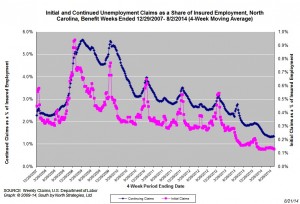

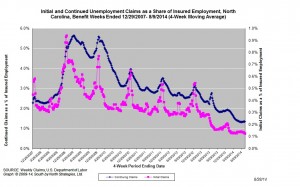

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008, while the four-week average of continuing claims is at the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (4,663) was 23.1 percent lower than the figure recorded one year ago (6,065), while the average number of continuing claims was 37.3 percent lower (49,975 versus 79,689). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

11.09.2014

Policy Points

For the benefit week ending on August 16, 2014, North Carolinians filed some 4,873 initial claims for state unemployment insurance benefits and 49,439 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 4,823 initial claims were filed over the previous four weeks, along with an average of 51,287 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,470, and the four-week average of continuing claims equaled 83,110.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.9 million versus 3.8 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than six years ago.

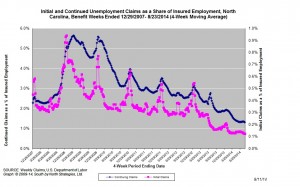

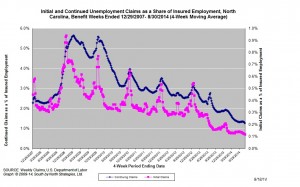

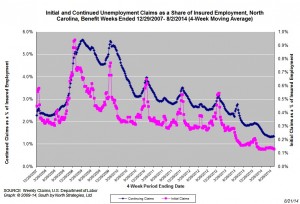

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008, while the four-week average of continuing claims is at the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (4,823) was 25.5 percent lower than the figure recorded one year ago (6,470), while the average number of continuing claims was 38.3 percent lower (51,287 versus 83,110). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

04.09.2014

Policy Points

For the benefit week ending on August 16, 2014, North Carolinians filed some 4,656 initial claims for state unemployment insurance benefits and 50,891 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 4,877 initial claims were filed over the previous four weeks, along with an average of 52,130 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,699, and the four-week average of continuing claims equaled 87,059.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.9 million versus 3.8 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than six years ago.

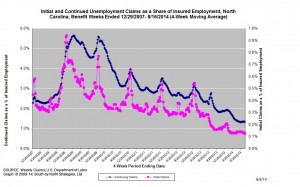

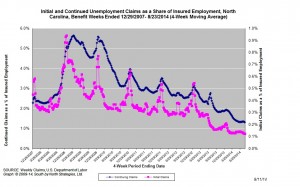

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008, while the four-week average of continuing claims is near the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (4,877) was 27.2 percent lower than the figure recorded one year ago (6,699), while the average number of continuing claims was 40.1 percent lower (52,130 versus 87,059). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

28.08.2014

Policy Points

For the benefit week ending on August 9, 2014, North Carolinians filed some 4,632 initial claims for state unemployment insurance benefits and 52,067 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 4,902 initial claims were filed over the previous four weeks, along with an average of 52,515 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,870, and the four-week average of continuing claims equaled 91,443.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.9 million versus 3.8 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than six years ago.

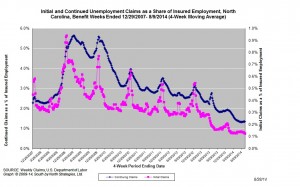

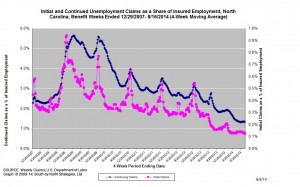

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008, while the four-week average of continuing claims is near the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (4,902) was 28.6 percent lower than the figure recorded one year ago (6,870), while the average number of continuing claims was 42.6 percent lower (52,515 versus 91,443). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

21.08.2014

Policy Points

For the benefit week ending on August 2, 2014, North Carolinians filed some 5,130 initial claims for state unemployment insurance benefits and 52,751 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 5,134 initial claims were filed over the previous four weeks, along with an average of 52,593 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 7,081, and the four-week average of continuing claims equaled 96,874.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.9 million versus 3.8 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than six years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008, while the four-week average of continuing claims is near the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (5,134) was 27.5 percent lower than the figure recorded one year ago (7,081), while the average number of continuing claims was 45.7 percent lower (52,593 versus 96,874). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed