26.10.2011

Policy Points

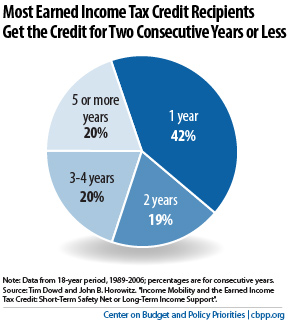

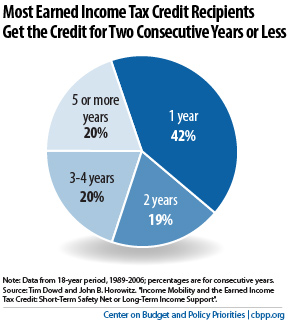

Off the Charts highlights new research that shows that more working families take advantage of the federal Earned Income Tax Credit (EITC) than is commonly thought. And, most of those workers take advantage of the credit for no more than two consecutive years, which suggests that the EITC is helping households cope with temporary economic setbacks.

25.10.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

25.10.2011

Policy Points

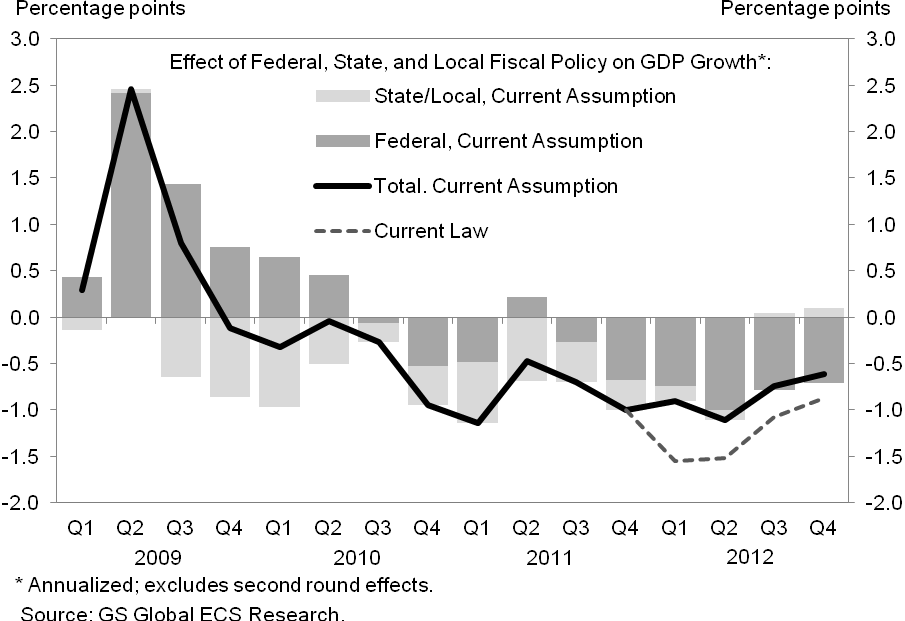

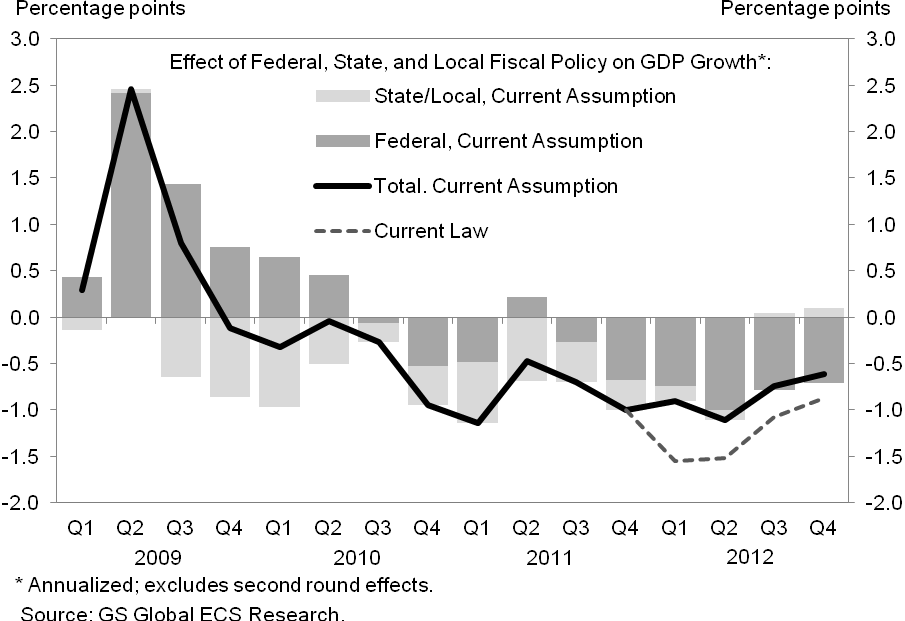

Working Economics explains how cutbacks and tax increases on the part of state and local governments have offset much of the fiscal expansion pursued by the federal government. The result has been a significant “anti-stimulus,” as the graph below illustrates.

25.10.2011

Policy Points

When it comes to businesses, James Surowiecki of The New Yorker thinks that “big is beautiful.”

…[S]mall businesses are, on the whole, less productive than big businesses, and though they do create most jobs, they also destroy most jobs, since, while starting a business is easy, keeping it going is hard. This is true around the world. A recent study by the World Bank that looked at ninety-nine developing countries found that large firms had significantly higher productivity growth. And in the U.S. the connection between size and productivity is, as a 2009 study showed, especially close. In part, this is because big businesses are able to enjoy economies of scale and scope. Big businesses are also better able to make investments in productivity-enhancing technologies and systems; in the U.S., for instance, big companies account for the vast majority of R. & D. spending.

24.10.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed