20.10.2011

Policy Points

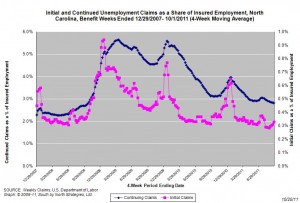

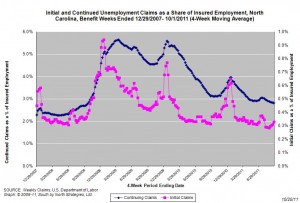

For the benefit week ending on October 1, 2011, some 12,846 North Carolinians filed initial claims for state unemployment insurance benefits, and 102,807 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,282 initial claims were filed over the previous four weeks, along with an average of 104,159 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, while the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 13,787 and the four-week average of continuing claims equaled 117,870.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.8 million a year ago.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

20.10.2011

Policy Points

Rortybomb thinks about how the Occupy Wall Street movement talks about economic inequality and how those arguments differ from traditional ones about economic fairness.

What about the 99%? I’ve previously looked through the We Are the 99% Tumblr and found that the biggest emphasis was on debt, ranging from student loans to medical debt, and a lack of enough employment to get by month-to-month. Here inequality is less a problem related to the more traditional liberal concerns of fairness or the idea that a few are left behind, and more a problem in which inequality is making indentured peasants of a huge part of the population. Risks are shifted to individuals who are already struggling, opportunities and possibilities are ruthlessly revoked, employment is nonexistent, and month-to-month survival is a battle for more than the just the very bottom….

…

This ties into traditional liberal concerns. Liberals want institutions that allow people to develop their talents and also ones that insure them against the bad luck of health and unemployment. These institutions have been unraveled, and their public nature has been replaced with debt. And when people involved in Occupy Wall Street talk about this phenomenon, they connect how debt functions as a new safety net with the experience of servitude and suffering. Not in a relative sense of inferiority and shame (although that’s there too), but in actual deprivation and the feeling of powerlessness against creditors, bosses, and the top of the elite.

19.10.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

19.10.2011

Policy Points

Economist’s View despairs about the lack of political and policy interest in addressing unemployment:

I wish I could find a way to adequately express the frustration I feel over the way Congress has all but turned its back on the unemployed. Even now, the only reason we’re hearing anything from Democrats about job creation is because there’s an election ahead. The legislation is timed for the politicians — it needs to maximize reelection chances — minimizing the struggles of the unemployed is a secondary consideration (if that). If the election were further away it’s unlikely we’d be hearing about this much at all. And Republicans are worse, they have no plans at all except to use unemployment as an excuse to further ideological goals (balanced budget amendments, tax cuts for the wealthy, etc.). How can politicians be so indifferent to the struggles that the unemployed face daily? Are they really so disconnected from the lives of ordinary people that they don’t understand how devastating this is to those who lost jobs due to the recession, people who can’t find a way to get hired again no matter how hard they try?

…

Anyway, I can’t seem to find a way to say this with the shrillness it deserves, and I apologize for that, but I just don’t understand why the unemployment crisis isn’t a national emergency.

19.10.2011

Policy Points

A new study from the Congressional Budget Office looks at how people save for retirement. While the agency doesn’t offer any opinions in the report, the data point to a retirement system that is not working, especially for people with modest incomes.

Just over half (52 percent) of all workers who filed tax returns in 2006 participated in some form of tax-favored retirement plan, CBO reports—in a study released today. The highest rates of participation were among workers between the ages of 45 and 59; those whose income was $40,000 or more; and those who were the primary (that is, the higher) earner in a two-earner household. The lowest rates were among workers under the age of 30; those whose income was under $20,000; and those who were unmarried.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed