04.10.2011

Policy Points

TaxVox summarizes new research into small businesses and taxes.

Small businesses take on an outsized importance in the tax policy debate for two reasons: These firms play into the great American entrepreneurial narrative and, in the current political debate, they are the “job creators.” Raise their taxes, goes the argument, and you further wreck an already-weak economy by discouraging these firms from hiring and investing.

…

Well, it turns out most of the firms those pols define as small businesses don’t hire or invest very much at all. There is no question that other companies whose income is reported on individual tax returns do hire and invest (quite a lot in some cases), but they are not small businesses, at least not according to this new definition.

…

So what is a small business? The Treasury team, led by Matthew Knittel at the Office of Tax Analysis, defined one as a firm that has combined income or deductions of at least $10,000 but no more than $10 million and one that operates in a businesslike manner. In other words, it has expenses such as wages, office supplies, rent, and the like.

The post then contrasts the Treasury Department definition to that of the Small Business Administration.

This is very different than the Small Business Administration, which uses multiple definitions but can include firms with sales of as much as $35.5 million with as many as 1,500 employees. It also is an effort to distinguish between those who report business income on their individual returns and actual small businesses. Treasury finds that many partnerships, S corporations, and others who file on an individual return don’t meet the small business test—either because they make too much money to be “small” or too little to be a real business.

…

Those distinctions are extremely important since many politicians love nothing more than to happily label all firms whose owners report income on their individual returns as iconic small businesses. If nothing else, the Treasury staff analysis shows how bogus that exercise is.

…

For example, using tax year 2007 data, Treasury found that of the 23.2 million people who reported income on Schedule C, fewer than half met its small business test—nearly all because they were too small. On average, the excluded firms reported just $7,000 of total income and $4,600 of net income.

04.10.2011

Policy Points

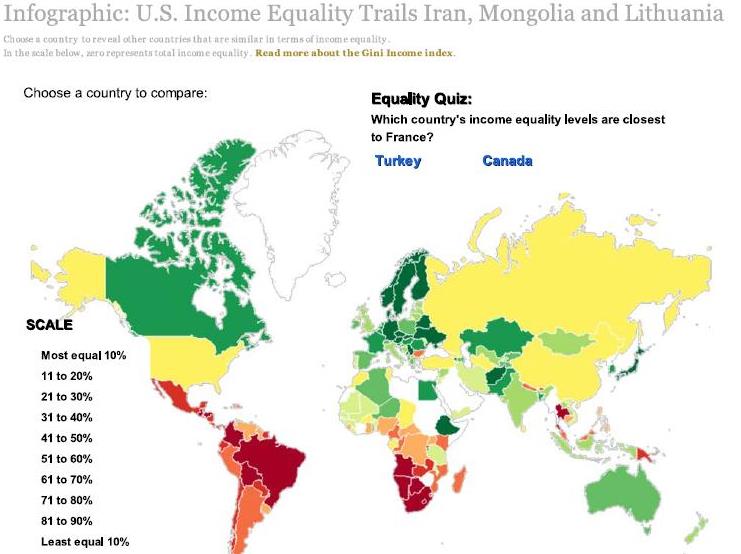

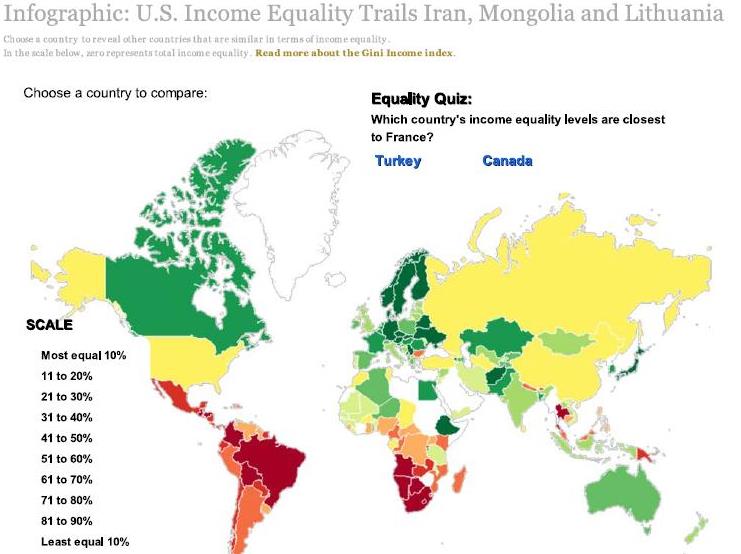

A nifty online calculator prepared by The PBS NewsHour allows users to compare levels of income inequality across the world. Countries are compared based on their Gini coefficient, a statistical measure of the dispersion of income within a country.

03.10.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

03.10.2011

Policy Points

A new report from the Education and Law Project of the North Carolina Justice Center documents how the proceeds of the North Carolina Education Lottery are not being used to supplement public education budgets. From the report …

During the debate around the creation of the North Carolina Education Lottery in 2005, critics from across the political spectrum predicted that the state would eventually back off of its promises that lottery funds would be used to enhance rather than replace existing education funds.The reality of what has happened in the years since is worse than what critics predicted: North Carolina spent less on K‐12 education in the 2010‐11 school year than it did in the last school year before the lottery came into existence, even without accounting for inflation or increases in the student population….

…

The lottery supports vital education programs,including reduced class size in early grades, academic prekindergarten programs, school construction, and scholarships for needy college and university students. But, rather than using lottery proceeds to supplement the state’s funding for these programs and the larger public school system, North Carolina’s legislative leaders have increasingly relied on the lottery to cover up cuts to education.

…

The lottery did give a bump to spending on education in the early years of its existence during the 2007‐2008 and 2008‐2009 school years. However, that increase has disappeared completely, and spending on K‐12 educaion is now below what it was when the lottery began.

03.10.2011

Policy Points

In a guest post at Felix Salmon’s blog, Barbara Kiviat explains that work-based social welfare programs don’t work well when jobs are scarce.

…The point is to illustrate that we can’t really have a conversation about whether or not linking cash assistance to market-based employment is problematic in a time of high unemployment, because program structure itself is distorting the behavior of would-be cash assistance recipients.

—

Although, in a way, maybe that is an answer to the question. As sociologist Kathryn Edin and social anthropologist Laura Lein illustrated in their 1997 book Making Ends Meet …, the problem never really was that cash assistance recipients didn’t want to work. Indeed, interviews with hundreds of women showed that, depending on the city, between a third and half were working, just not in the formal economy….

—

So maybe what we’re learning—should we be able to put aside the overly simplified view of the “deserving” and “undeserving” poor—is that it’s time for another round of welfare reform. But this time what needs to be reformed is how the system goes about understanding the needs and limitations of single working mothers. As Edin and Lein documented, barriers to formal employment include not just balancing work schedules with lone parenting and the added costs of having a job outside of the home (such as day care), but also the realities of low-wage work…..

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed