26.08.2011

News Releases, Policy Points

CHAPEL HILL (August 26, 2011) – Between July 2010 and July 2011, unemployment rates rose in 54 of North Carolina’s 100 counties and in 6 of the state’s 14 metropolitan areas. At the same time, 49 counties and 8 metros had labor forces in July that were smaller compared to a year ago. These findings come from new estimates from the Employment Security Commission.

“Sizable reductions in local government payrolls in July led to a further deterioration in employment conditions across North Carolina,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “In many communities, there were no meaningful improvements in the local job market.”

Since the economy fell into recession in December 2007, North Carolina has lost, on net, 7.3 percent of its payroll employment base (-303,700 positions) and has seen its unadjusted unemployment rate climb from 4.7 percent to the current level of 10.3 percent. In July, the state lost 4,100 more payroll jobs than it gained. Over the past year, employers cumulatively added 4,400 more payroll jobs than they cut, but that level of growth—an average of just 367 jobs per month—simply was insufficient to bring down joblessness.”

Compared to the prior month, unemployment rates rose in 39 counties in July, held steady in 13 counties, and fell in 48 counties. Unemployment rates were at or above 10 percent in 66 counties. Individual county rates ranged from 5.2 percent in Currituck County to 17.7 percent in Scotland County. Compared to a year ago, unemployment rates were higher in 54 counties, unchanged in 2 counties, and lower in 44 counties.

“Non-metropolitan labor markets remained especially pressured in July,” added Quinterno. “Last month, 11.3 percent of the non-metro labor force was unemployed, as opposed to 9.9 percent of the metro labor force. While conditions in non-metro communities improved marginally over the year, unemployment remained widespread. When compared to December 2007, the non-metro labor force now is 2.1 percent smaller. Similarly, the number of unemployed individuals has doubled, while the number of employed persons has dropped by 8 percent.”

Last month, unemployment rates fell in 11 of the state’s metropolitan areas. Rocky Mount had the highest rate (13.8 percent), followed by Hickory-Morganton-Lenoir (12.4 percent). Durham-Chapel Hill had the lowest rate (7.9 percent), followed by Asheville (8.1 percent).

Compared to July 2010, unemployment rates were higher in 54 counties and 6 metros. Moreover, 49 counties and 8 metros had smaller labor forces. Among metros, Hickory-Morganton-Lenoir (-2.7 percent) recorded the largest decline in the size of its labor force, followed by Jacksonville (-2.1 percent). Rocky Mount posted the largest increase (+2.6 percent), followed by Fayetteville (+2.3 percent) and Raleigh-Cary and Wilmington (both +0.7 percent).

In the long term, any meaningful recovery will hinge on growth in the state’s three major regions: Charlotte, the Research Triangle, and the Piedmont Triad. Yet growth remains sluggish. Collectively, employment in these three metro regions has fallen by 3.6 percent since December 2007, and the combined July unemployment rate in the three metros equaled 9.8 percent. Of the three, the Research Triangle had the lowest unemployment rate (8.5 percent), followed by the Piedmont Triad (10.6 percent) and Charlotte (11.5 percent). While improvements occurred in all three areas over the year, particularly in the Research Triangle and Piedmont Triad, the improvements did not fundamentally alter the employment situation.

“In recent months North Carolina has witnessed a steady worsening of labor market conditions,” said Quinterno. “Private-sector job growth remains sluggish, and the gains that are occurring are being erased by public-sector cuts. Most indicators now are trending in the wrong direction, and 2011 is on its way to becoming the third consecutive lost year for working North Carolinians.”

26.08.2011

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity retreated in August, according to the latest survey by the Federal Reserve Bank of Richmond. Retail sales fell, as shopper traffic declined and big-ticket sales dropped. Retail inventories inched up. Revenues at non-retail services firms also edged higher, compared to July. Retailers had a bleak outlook for sales in the six months ahead, while survey participants at non-retail firms were mildly optimistic about demand for their services.

…

The number of employees in the service sector dipped as retailers and non-retail services providers trimmed their payrolls. Average wage growth was little changed at retail establishments; wage growth slowed at services providers.

…

Price increases picked up somewhat in August, and survey respondents anticipated a slightly faster pace in the six months ahead, with most of the escalation coming from retailers

25.08.2011

Policy Points

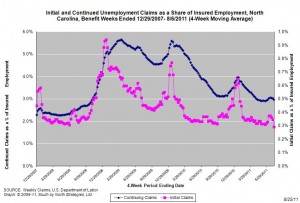

For the benefit week ending on August 6, 2011, 10,893 North Carolinians filed initial claims for state unemployment insurance benefits, and 108,849 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and more continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,863 initial claims were filed over the previous four weeks, along with an average of 109,981 continuing claims. Compared to the previous four-week period, the averages of initial and continuing claims were lower.

One year ago, the four-week average for initial claims stood at 12,541 and the four-week average of continuing claims equaled 135,928.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.8 million a year ago.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed