Just Asking

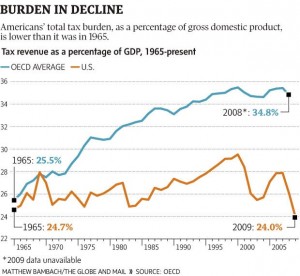

Felix Salmon looks at this chart…

And then asks several questions …

And then asks several questions …

This raises two questions. The first is why America’s taxes are so much lower than anybody else’s. Its system of government, after all, is a pretty standard democracy, so it’s not exactly baked in to the Constitution. The second question is why Americans don’t actually appreciate how low taxes are here. It’s a standard talking point in US politics that taxes are too high, and must be lowered; Republicans are adamant that even modest tax hikes, to levels still well below the rest of the developed world, would be economically devastating.

…

Right now a deal seems to be getting done in Washington which reduces the deficit by means solely of spending cuts, with no tax hikes at all. That makes no sense: just as it’s right that people should pay a higher tax rate as they get richer, the same is true of countries as well. Instead, the US seems to think that it can work as an advanced democracy while maintaining a tax rate more commonly associated with tinpot basketcases. Up until now, it’s managed to do that by borrowing the difference. But if it wants to try to cut spending to a level commensurate with its tiny tax base, it’ll soon learn how economically disastrous that can be.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed