05.08.2011

News Releases, Policy Points

CHAPEL HILL (August 5, 2011) – In July, the American economy added 117,000 more payroll jobs than it lost. While the private sector netted 154,000 positions, the public sector shed 37,000 jobs, due overwhelmingly to reductions by state and local governments. Also in July, 9.1 percent of the labor force was unemployed, while the underemployment rate equaled 16.1 percent. These findings come from today’s national employment report.

“Only in an economy as sickly as the current one could today’s employment report be called a ‘good’ one,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Job growth was anemic and joblessness remains at a shockingly high level. While the unemployment rate dropped slightly, the fall was attributable to people leaving the labor force rather than finding jobs.”

In July, the nation’s employers added 117,000 more payroll positions than they cut. Gains occurred entirely within the private sector (+154,000), while government payrolls fell by 37,000 position. The public sector decline was driven by reductions among state (-23,000) and local (-16,000) governments. In recent months, public-sector reductions have weighed down job growth; in July, public cuts offset 24 percent of the private gains.

Furthermore, the payroll employment estimates for May and June underwent upward revisions. With the revisions, the economy netted 99,000 jobs over those two months rather than the 43,000 positions previously reported.

Several private industries recorded job growth in July. Education and health services added the most positions, (+38,000), followed by professional and business services (+34,000), and trade, transportation and utilities (+28,000). The manufacturing sector netted 24,000 positions due almost entirely to increases in durable goods manufacturing. Financial activities shed the most positions on net (-4,000), followed by information (-1,000).

“Although better than the June report, the July employment report is yet more proof that the American jobs machine is badly broken,” noted Quinterno. “Over the past three months, net job growth has averaged just 72,000 positions. This is not what a recovery looks like.”

The inability of the current pace of job growth to alter employment conditions was reflected in the July household survey. Last month, 13.9 million Americans (9.1 percent of the labor force) were jobless and seeking work. While the unemployment rate and number of unemployed individuals dropped over the past year, so did the share of the population participating in the labor force. In July, the share of the population participating in the labor force (63.9 percent) remained at a level last seen in the early 1980s.

Another cause for concern is the fact that long-term unemployment remains elevated. Last month, 44.4 percent of all unemployed workers had been out of work for at least 27 weeks. A year ago, the comparable figure was 44.7 percent.

In July, proportionally more adult male workers were unemployed than female ones (9 percent vs. 7.9 percent). Similarly, unemployment rates were higher among Black (15.9 percent) and Hispanic workers (11.3 percent) than among White ones (8.1 percent). The unemployment rate among teenagers was 25 percent. Between June and July, unemployment rates for most every major demographic group varied little.

Additionally, 8.4 percent of all veterans were unemployed in July. The unemployment rate among recent veterans (served after September 2001) was 11.8 percent.

“Jobs remained scarce in July,” added Quinterno. “This led many individuals simply to abandon their job searches. All of the improvements in unemployment seen in July were due to people leaving the labor force rather than finding jobs. In fact, the number of employed Americans actually fell in July.”

A more extensive measure of labor underutilization is the underemployment rate, which equaled 16.1 percent in July. Further evidence of the difficulty in finding a job is that, among unemployed workers, the average time out of work rose in July to 40.4 weeks. A year ago, the comparable figure was 33.9 weeks.

“While not as bad as the June report, the July employment report shows that the American labor market is not healing itself. Conditions clearly are not improving, yet policymakers still have not acknowledged the magnitude of the problem,” observed Quinterno. “Absent aggressive action, joblessness will continue to blight American society.”

05.08.2011

Policy Points

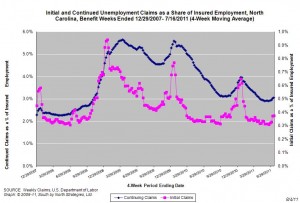

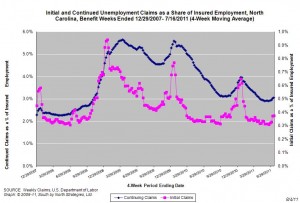

For the benefit week ending on July 16th, 11,400 North Carolinians filed initial claims for state unemployment insurance benefits, and 111,055 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 13,931 initial claims were filed over the previous four weeks, along with an average of 113,296 continuing claims. Compared to the previous four-week period, the averages of initial and continuing claims were higher.

One year ago, the four-week average for initial claims stood at 13,876 and the four-week average of continuing claims equaled 145,090.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.71 million, down from 3.78 million a year ago.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

04.08.2011

Policy Points

TaxVox explains that the reason why many American households have no federal income tax liability is because they have such low incomes.

Of the households that pay no federal income taxes due to tax deductions and credits (graph, below), ‘three-fourths of those households pay no income tax because of provisions that benefit senior citizens and low-income working families with children.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed