20.07.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

20.07.2011

Policy Points

Mark Thoma wonders how rising income inequality has shaped American attitudes towards social spending.

… As most everyone is aware at this point, inequality has been growing steadily since the 1970s. There have been substantial gains at the top of the income distribution charts, but incomes for those in the middle and bottom have been flat. As households have come under increasing stress because of their stagnant incomes, many people have started to wonder why they should share with others when nobody is sharing with them. Let those who received the gains – those at the top who don’t have to worry about making it to the next paycheck – bear the burden.

…

In order to overcome the increasing resistance to social spending, we must do a better job of educating people about how their tax dollars are used and who those tax dollars actually support. But that alone won’t be enough. We must also find a way to solve the growing inequality problem, or support for important social programs will continue to fall.

20.07.2011

Policy Points

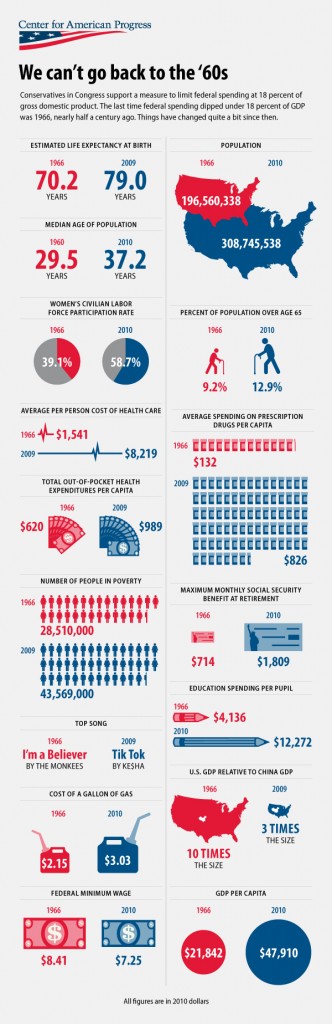

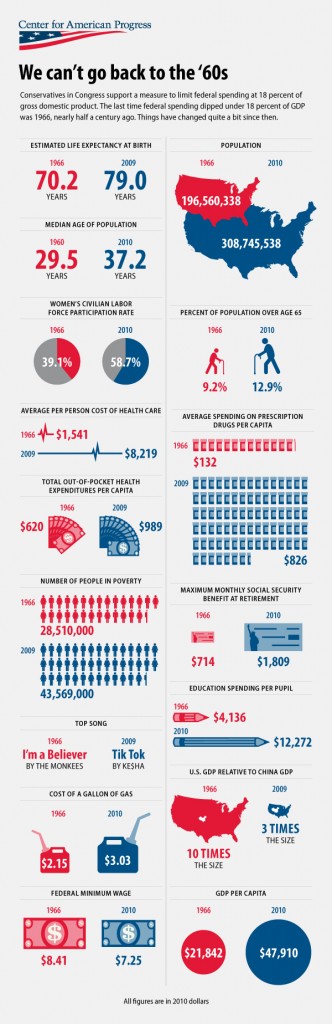

The Center for American Progress doesn’t think adopting a 1960s budget is a good idea for contemporary America.

19.07.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

19.07.2011

Policy Points

Simon Johnson points out the a failure to raise the debt ceiling actually would make the size of the federal government larger relative to the overall economy.

The reason is simple: a government default would destroy the credit system as we know it. The fundamental benchmark interest rates in modern financial markets are the so-called “risk-free” rates on government bonds. Removing this pillar of the system – or creating a high degree of risk around US Treasuries – would disrupt many private contracts and all kinds of transactions.

…

In addition, many people and firms hold their “rainy day money” in the form of US Treasuries. The money-market funds that are perceived to be the safest, for example, are those that hold only US government debt. If the US government defaults, however, all of them will “break the buck,” meaning that they will be unable to maintain the principal value of the money that has been placed with them.

…

The result would be capital flight – but to where? Many banks would have a similar problem: a collapse in US Treasury prices (the counterpart of higher interest rates, as bond prices and interest rates move in opposite directions) would destroy their balance sheets.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed