08.07.2011

Policy Points

In a video interview with the Institute for New Economic Thinking, Andrew Sheng, a noted Chinese economist and regulator, explains why the standard economic models taught at universities has become “an intellectual dead-end” and how those models helped produce the current crisis.

07.07.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

07.07.2011

Policy Points

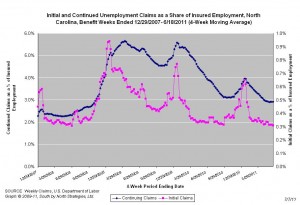

For the benefit week ending on June 18th, 11,204 North Carolinians filed initial claims for state unemployment insurance benefits, and 107,881 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 11,480 initial claims were filed over the previous four weeks, along with an average of 108,019 continuing claims. Compared to the previous four-week period, the averages of initial and continuing claims were slightly lower.

One year ago, the four-week average for initial claims stood at 12,600 and the four-week average of continuing claims equaled 154,539.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.8 million a year ago.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

07.07.2011

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

The latest survey by the Federal Reserve Bank of Richmond showed a slowdown in service sector activity. Retail sales dipped overall and big-ticket sales suffered another drop, despite an uptick in shopper traffic. Inventories declined in June, according to retail merchants. Non-retail services providers’ revenues also decelerated. Looking ahead six months, retailers expected the weakness would persist, while contacts at services firms remained optimistic.

…

Turning to labor, retail hiring flattened and average retail wages fell in June. Hiring at services firms was also nearly flat. Average wages at non-retail establishments rose only slightly compared to a month ago.

…

Price changes in the broad service sector almost matched May’s pace. Within the sector, prices climbed more rapidly at retail businesses, but the pace slowed somewhat at services firms. For the six months ahead, survey respondents at retail and non-retail services firms anticipated prices would advance more quickly than they had expected in May.

06.07.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed