Policy Points

27.02.2014

Policy Points

For the benefit week ending on February 8, 2014, North Carolinians filed some 4,394 initial claims for state unemployment insurance benefits and 70,772 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 5,803 initial claims were filed over the previous four weeks, along with an average of 73,116 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 13,137, and the four-week average of continuing claims equaled 110,778.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.87 million versus 3.80 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were six years ago.

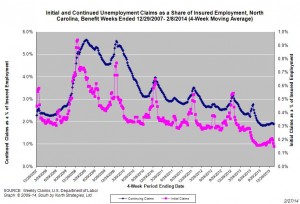

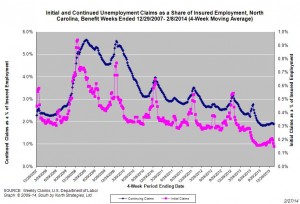

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably, though the numbers have been fluctuating in recent weeks. That said, the four-week average of initial claims, when measured as a share of covered employment, is at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen toward the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (5,803) was 55.8 percent lower than the figure recorded one year ago (13,137), while the average number of continuing claims was 34 percent lower (73,116 versus 110,778). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

18.02.2014

Policy Points

Over the President Day’s weekend, John Quinterno of South by North Strategies, Ltd. discussed the state of North Carolina’s labor market on the syndicated radio show “News and Views” hosted by Chris Fitzsimon of NC Policy Watch.

Click here to listen to the full 9.5-minute interview over the internet.

18.02.2014

Policy Points

From an op-ed written by John Quinterno of South by North Strategies, Ltd. and Dean Baker of the Center for Economic and Social Policy that recently appeared in the pages of The (Raleigh, NC) News & Observer…

Some supporters of the [unemployment insurance] insurance cuts have pointed to a separate survey of establishments conducted by the U.S. Bureau of Labor Statistics that shows some uptick in the pace of job growth in the months following the changes. In this survey, the state netted 51,400 payroll jobs between June and December. And North Carolina ended 2013 with 64,500 more jobs (1.6 percent) than it had a year earlier.

—

On closer examination, these numbers really don’t provide much evidence that the cuts to the insurance system spurred job growth. During 2013, North Carolina gained jobs at an average monthly rate of 0.1 percent, compared with a rate of 0.2 percent during 2012 and no different from the 0.1 percent average monthly rate recorded in both 2010 and 2011. Between June and December 2013, the state netted an average of 5,400 jobs per month, compared with 7,500 jobs per month in 2012. North Carolina’s problem therefore remains the same as it has been for several years: an anemic recovery.

—

If the point of cutting unemployment insurance compensation was to get people back to work and spark job growth, North Carolina’s policy choice appears, at first glance, to be a failure. If the point was to push people out of the labor force, it appears to be working.

Click here to read the full op-ed on the original web site.

13.02.2014

Policy Points

For the benefit week ending on January 25, 2014, North Carolinians filed some 5,691 initial claims for state unemployment insurance benefits and 72,974 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 7,633 initial claims were filed over the previous four weeks, along with an average of 74,573 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 16,812, and the four-week average of continuing claims equaled 115,520.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.86 million versus 3.80 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were six years ago.

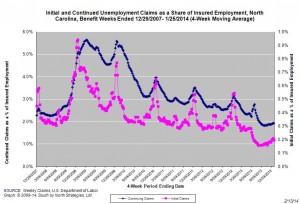

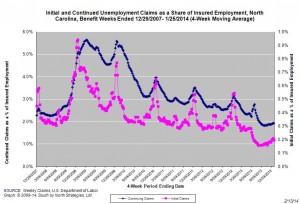

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably, though the numbers have been fluctuating in recent weeks. That said, the four-week average of initial claims, when measured as a share of covered employment, is close to the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen toward the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (7,633) was 54.6 percent lower than the figure recorded one year ago (16,812), while the average number of continuing claims was 35.4 percent lower (74,573 versus 115,520). Given the modest rate of job growth that has occurred in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

07.02.2014

News Releases, Policy Points

CHAPEL HILL, NC (February 7, 2014) – The national labor market added in January 113,000 more jobs (+0.1 percent) than it lost. After accounting for annual statistical updates, the unemployment rate and the number of unemployed persons in January were essentially unchanged from the prior month.

In January, 10.2 million Americans were unemployed (6.6 percent), while 7.3 million individuals worked part time despite preferring full-time positions. Another 837,000 individuals (not seasonally adjusted) were so discouraged about their job prospects that they had stopped searching for work altogether. Those persons were part of a larger population of 2.6 million Americans who were marginally attached to the labor force.

“January was the 40th-straight month of job growth recorded in the United States,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “In 2013, the national economy netted an average of 194,000 jobs per month. Yet the country is still some eight million jobs short of the number needed to replace the jobs lost since 2007 and to accommodate subsequent population growth.”

In January, the nation’s employers added 113,000 more payroll positions than they cut (+0.1 percent). Gains occurred entirely in the private sector (+142,000), while government employers eliminated 29,000 more positions than they added.

Moreover, the payroll employment numbers for November and December underwent revisions; with the updates, the economy netted 349,000 jobs over those two months, not the 315,000 positions previously reported. Additionally, annual methodological updates revealed that the national economy netted 136,000 more jobs in 2013 than first estimated; the bulk of the gain was due to a definitional change that resulted in the inclusion of a new industry—services for the elderly and persons with disabilities—in the official statistics.

Within the private sector, payroll levels rose the most over the month in the construction industry (+48,000), followed by the professional and business services sector (+36,000, with 56.7 percent of the gain occurring in the professional and technical services subsector) and the leisure and hospitality services sector (+24,000, with 70 percent of gain occurring in the accommodation and food services subsector).

“During 2013, the American economy gained 2.3 million more payroll positions that it lost,” noted Quinterno. “Nevertheless, the average monthly rate of job growth in 2013—some 194,000 positions per month—will not close the nation’s jobs gap anytime soon.”

After accounting for annual statistical updates, labor market conditions as measured by the household survey were relatively unchanged from December. Last month, 10.2 million Americans (6.6 percent of the labor force) were jobless and seeking work. In January, the share of the population participating in the labor force equaled 63 percent.

Compared to a year ago, 1.8 million more Americans were working in January, and 2.1 million fewer persons were unemployed. At the same time, the share of the working-age population with a job (58.8 percent) remained at a low level.

Last month, the unemployment rate was higher among adult male workers than female ones (6.2 percent versus 5.9 percent). Unemployment rates were higher among Black (12.1 percent) and Hispanic workers (8.4 percent) than among white ones (5.7 percent). The unemployment rate among teenagers was 20.7 percent.

Additionally, 5.6 percent of all veterans were unemployed in January, and the rate among recent veterans (served after September 2001) was 7.9 percent. At the same time, 13.3 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained comparatively hard to find in January. Last month, the underemployment rate equaled 12.7 percent, down from the 14.4 percent rate logged a year ago. Not only were 10.2 million Americans unemployed, but 7.3 million individuals worked part-time jobs despite preferring full-time work. Another 837,000 individuals (not seasonally adjusted) were so discouraged about the labor market that they had stopped searching for work.

Among unemployed workers, 35.8 percent had been jobless for at least six months (compared to 37.9 percent a year earlier), and the average spell of unemployment equaled 35.4 weeks, which was unchanged from a year earlier.

In January, the leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 52.3 percent of unemployed persons. Another 28.4 percent of unemployed persons were re-entrants to the labor market, while 11.4 percent were new entrants. Voluntary job leavers accounted for the remaining 7.9 percent of the total.

“The January employment report offers yet more evidence of an underperforming labor market,” observed Quinterno. “The bottom line is that the American economy is not generating enough jobs for all those who want and need work. Despite the passage of six years since the onset of the ‘Great Recession,’ the United States’ jobs crisis remains far from over.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed