10.06.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

10.06.2011

Policy Points

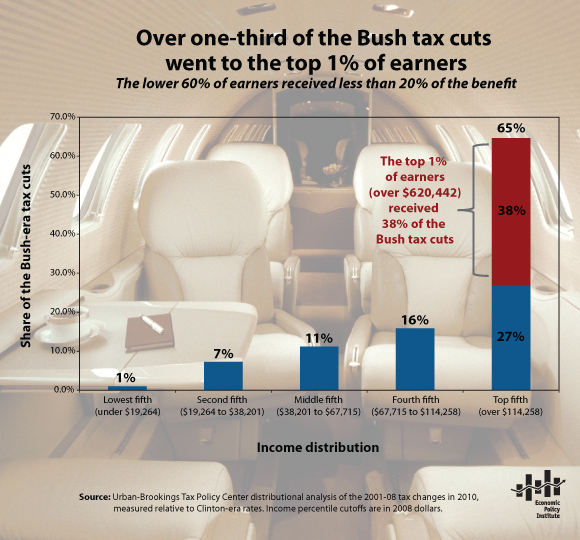

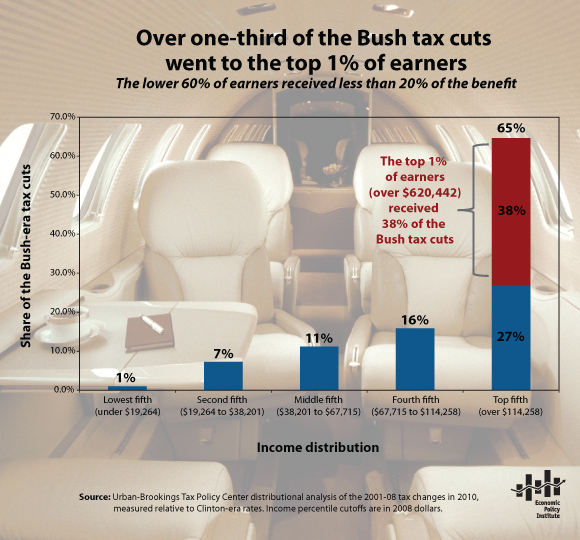

The Economic Policy Institute graphs the distribution of the Bush-era tax cuts.

10.06.2011

Policy Points

The American Prospect explains the new federal regulation pertaining to the use of federally-backed student loans at for-profit colleges and universities.

The rules, which apply to career and vocational programs at for-profit and non-profit colleges, are intended as a quality-control measure for the growing for-profit industry that draws billions from the federal government each year, yet has little accountability. While only about 12 percent of college students attend for-profit institutions, they receive 26 percent of Title IV funds …. and account for a staggering 47 percent of student-loan defaults. In the last decade, for-profit schemes have exploded — and largely on the government’s dime: Between 2000 and 2009, the amount of federal aid going to the for-profits quintupled, to $26.5 billion.

…

But starting in 2012, schools will have to pass one of three quality-control measures to qualify for federal aid. Career colleges can either show that in a given year, at least 35 percent of their students are repaying some amount (even so much as a dollar) off their loans. Alternatively, they can satisfy federal requirements by showing their graduates’ debt-to-income ratio falls below a threshold or that their debt-to-discretionary-income — their total debt relative to their income spent on non-essentials — levels fall below a different threshold. If a college fails to meet at least one of the three metrics three times in four years, it will lose eligibility….

09.06.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

09.06.2011

Policy Points

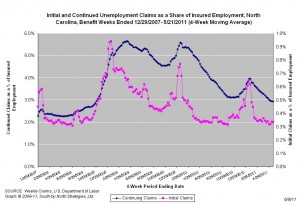

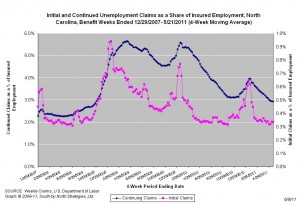

For the benefit week ending on May 21st, 11,799 North Carolinians filed initial claims for state unemployment insurance benefits, and 108,345 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer more initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,353 initial claims were filed over the previous four weeks, along with an average of 108,828 continuing claims. Compared to the previous four-week period, there were fewer initial and continuing claims.

One year ago, the four-week average for initial claims stood at 13,090 and the four-week average of continuing claims equaled 166,421.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.8 million a year ago.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed