03.06.2011

News Releases, Policy Points

CHAPEL HILL (June 3, 2011) – In May, the American economy added just 54,000 more payroll jobs than it lost—a pace of growth inconsistent with an economic recovery. Net job creation ground to a halt in most major industries, and consequently, 15.8 percent of the labor force was effectively jobless. These findings come from today’s national employment report.

“The national labor market gave up much ground in May,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Job growth fell well below the level needed to accommodate the natural growth of the labor force, and the share of the working-age population with a job remained near a level last seen in the early 1980s.”

In May, the nation’s employers added 54,000 more payroll positions than they cut; this marked the eighth consecutive month of job growth in the United States. Gains occurred entirely within the private sector (+83,000), while government payrolls fell by 29,000 positions due overwhelmingly to cuts by local governments. In recent months, public-sector reductions have weighed down job growth; in May, for instance, government reductions offset 34.9 percent of the total private-sector gain.

Moreover, the payroll employment estimates for March and April were lowered. With the revisions, the economy netted 426,000 jobs over those two months rather than the 465,000 positions previously reported.

Private-sector job gains in May occurred primarily in professional and business services (+44,000), education and health services (+34,000), and mining and logging (+6,000). Job levels in all other private-sector industries held fairly steady in May.

“The May employment report suggests that job growth is slowing and that the national labor market is giving back some of the modest gains logged earlier in the year,” noted Quinterno. “Over the past three months, net job growth has averaged 160,000 positions, but that pace is insufficient to reverse the recession’s damage anytime soon.”

The inability of the current pace of job growth to change employment conditions was reflected in the May household survey. Last month, 13.9 million Americans (9.1 percent of the labor force) were jobless and seeking work. While the unemployment rate and number of unemployed individuals dropped over the past year, so did the share of the population participating in the labor market. In May, the share of the population participating in the labor force (64.2 percent) remained at a level last seen in the early 1980s.

Another cause for concern is the fact the number of newly unemployed individuals has been trending upward throughout 2011. Last month, 19.4 percent of all unemployed individuals had been jobless for less than 5 weeks. At the other end of the spectrum, the share of workers unemployed for more than six months also has been trending upward. Last month, 45.1 percent of all unemployed workers had been out of work for at least 27 weeks.”

In May, proportionally more adult male workers were unemployed than female ones (8.9 percent vs. 8 percent). Similarly, unemployment rates were higher among Black (16.2 percent) and Hispanic workers (11.9 percent) than among White ones (8 percent). The unemployment rate among teenagers was 24.2 percent. Between April and May, unemployment rates for most every major demographic group were little changed.

Additionally, 8.3 percent of all veterans were unemployed in May. The unemployment rate among recent veterans (served after September 2001) was 12.1 percent.

“Despite the growth in payroll employment, jobs remained difficult to find in May,” added Quinterno. “Last month, the underemployment rate equaled 15.8 percent. Among unemployed workers in May, the average time out of work was 39.7 weeks.”

“The May employment report suggests that job growth in the private sector has slowed with much of the growth that is occurring being canceled out by job losses in the public sector,” observed Quinterno. “The labor market clearly is not healing itself, and today’s report should catapult job issues to the forefront of the nation’s policy and political debates.”

03.06.2011

Policy Points

Rortybomb summarizes two competing views of the state of the American economy.

The [Obama administration’s] story goes like this: the real lifting is done, and we must remember that following a financial crisis there’s a limited amount that the government can do. There’s a minor program of stuff left to do that conceptually involves clean-up. What’s left is to get workers skills, because the long-term unemployed will be left behind as new jobs come. We need to make some small targeted nudges to businesses to get them to hire through various R&D style credit rebates. And we need to start to get very serious about cutting the deficit because the medium-term deficit is going to be a check on any real recovery.

…

Regular readers know I don’t see the economy that way. I don’t think Reinhart/Rogoff justifies inaction. The idea that job openings justifies moving to skills training and other “structural” concerns isn’t justified in the data. I haven’t seen good evidence that the long-term unemployed are a particularly weak form of labor against historical trends and I’m not particularly convinced that R&D style tax credits aren’t just collected as rents by incumbents. And I think the administration moved to deficit reduction too early, as I don’t see why medium-term debt/GDP ratios impact a recovery. I see that we should be concerned about a jobs problem, while the administration sees that we should be concerned about a confidence problem.

02.06.2011

Policy Points

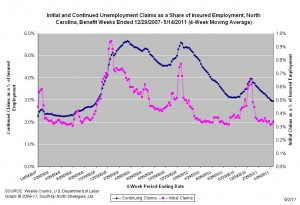

For the benefit week ending on May 14th, 12,342 North Carolinians filed initial claims for state unemployment insurance benefits, and 108,510 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,493 initial claims were filed over the previous four weeks, along with an average of 109,622 continuing claims. Compared to the previous four-week period, there were more initial and fewer continuing claims.

One year ago, the four-week average for initial claims stood at 12,804 and the four-week average of continuing claims equaled 168,830.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.8 million a year ago.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed