02.05.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

02.05.2011

Policy Points

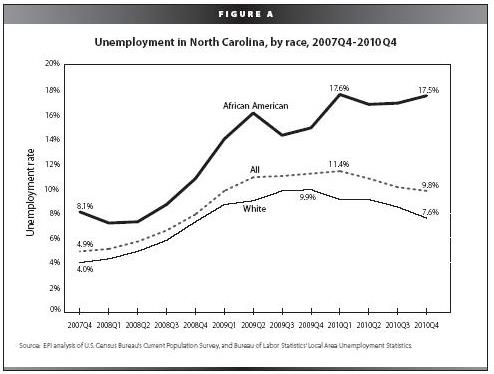

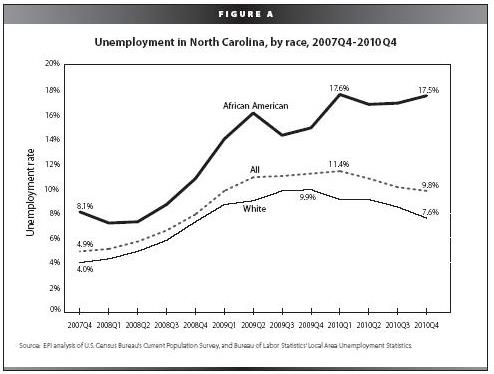

A new paper by the Economic Policy Institute points out that the unemployment rate among African-American workers in North Carolina was 17.5 percent at the end of 2010.

29.04.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

29.04.2011

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region expanded in April for the seventh straight month but at a more temperate pace than a month ago, according to the Richmond Fed’s latest survey. All broad indicators — including shipments, new orders and employment — continued to grow but at a rate below March’s pace. Other indicators were mixed. Fifth District contacts reported that capacity utilization continued to grow more slowly, while backlogs turned slightly negative. Vendor delivery times edged higher and raw materials inventories grew at a somewhat higher rate.

…

In spite of the recent moderation in activity, assessments for business activity remained generally positive since our last report. Survey contacts at an increasing number of firms looked for solid growth in shipments, new orders, capacity utilization and capital expenditures over the next six months.

29.04.2011

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity picked up in April, according to the latest survey by the Federal Reserve Bank of Richmond. Retail sales rebounded and shopper traffic increased compared to a month earlier, although big-ticket sales remained down. Revenues also strengthened at non-retail services firms. In addition, survey respondents at retail and non-retail service sector businesses were upbeat in their outlook for business in the six months ahead.

…

On the labor front, the number of employees grew more rapidly at services-providing firms in April, while retail merchants made more payroll cuts. Average retail wages were nearly flat; at services firms, average wages picked up this month.

…

Price change was moderate, with the overall rate of increase slightly quicker in April than in March. Separately, retailers’ prices slowed, while services providers indicated prices rose more rapidly. Survey participants looked for a small uptick in the pace of price increases during the next six months.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed