19.04.2011

Policy Points

David Cay Johnston points out “9 things the rich don’t want you to know about taxes.” From the article…

This year the first $9,350 of income is exempt from [federal income] taxes for singles and $18,700 for married couples, just slightly more than in 2008. That means millions of the poor do not make enough to owe income taxes.

—

But they still pay plenty of other taxes, including federal payroll taxes. Between gas taxes, sales taxes, utility taxes and other taxes, no one lives tax-free in America.

—

When it comes to state and local taxes, the poor bear a heavier burden than the rich in every state except Vermont, the Institute on Taxation and Economic Policy calculated from official data. In Alabama, for example, the burden on the poor is more than twice that of the top 1 percent. The one-fifth of Alabama families making less than $13,000 pay almost 11 percent of their income in state and local taxes, compared with less than 4 percent for those who make $229,000 or more.

18.04.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

18.04.2011

Policy Points

The N.C. Budget and Tax Center recently released a blueprint for modernizing the state revenue system in a way that adequately funds the services demanded by North Carolina citizens in a manner that is more efficient and more fair than the status quo.

From the report:

… modernizing and adjusting the tax system as proposed would mean an overall decrease in state income and sales taxes for households with taxable incomes below $29,000. For everyone else the increase would range from barely a tenth of 1 percent to just over a half percent.

—

If these proposals were adopted, North Carolina would have a 21st century tax structure that reflects the nature of today’s economy and produces the revenue required to meet the growing needs of a growing state, allowing continued investment on necessities that help promote prosperity and job creation. By changing the relative emphasis of various forms of taxation, the overall structure would better keep up with growth in the state’s economy and the needs of state residents, while also withstanding economic downturns.

18.04.2011

Policy Points

Below are a few graphs from the Center on Budget and Policy Priorities that put federal income taxes in perspective.

The first shows how federal income taxes paid by average families is at a historic low.

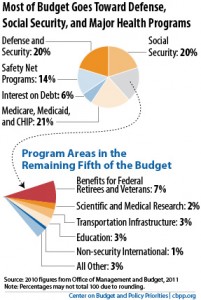

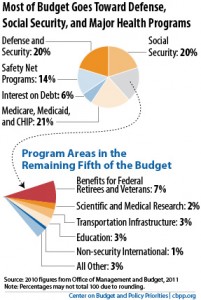

The second shows how tax collections are spent.

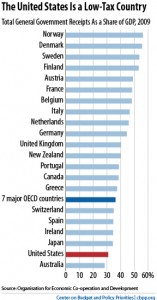

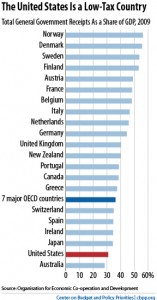

The final chart places federal taxes in an international context.

15.04.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed