10.03.2011

Policy Points

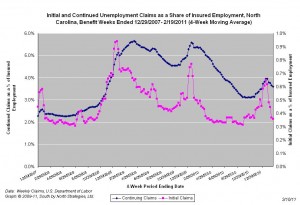

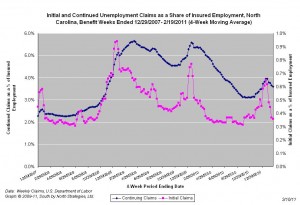

For the benefit week ending on February 19th, 11,877 North Carolinians filed initial claims for state unemployment insurance benefits, and 128,733 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 13,266 initial claims were filed over the previous four weeks, along with an average of 133,634 continuing claims. Compared to the previous four-week period, there were fewer initial and continuing claims.

One year ago, the four-week average for initial claims stood at 18,399 and the four-week average of continuing claims equaled 207,453.

While the number of claims has dropped over the past year so has covered employment. Last week, covered employment totaled 3.7 million, down from 3.9 million a year ago.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

10.03.2011

Policy Points

Writing in The New Republic, Harold Pollock explains why state governors shouldn’t bash Medicaid.

Consider what would happen if Texas governor Rick Perry, who has mused about dropping Medicaid entirely, could do what he wanted. Talking about dropping Medicaid might attract attention for Perry’s new book. Actually doing so would be ludicrous, both as policy and politics. Most Texas Medicaid dollars go to the elderly and the disabled. Millions of middle-class Americans—in Texas and everyplace else—rely on Medicaid to protect them if they or a loved one requires costly medical services or long-term care. Few politicians would risk damaging services to these groups.

…

Medicaid’s rules and procedures are also encoded in the DNA of every state’s medical and social service systems. Withdrawing from the program would be an administrative nightmare that would likely deeply anger patients, not to mention the well-organized network of providers who provide Medicaid-funded services.

…

Moreover, the federal government picks up more than 60 percent of Texas’s Medicaid tab. I doubt Texas would turn down more than $15 billion annually from the federal government, just as I doubt it will forego additional federal funds which finance virtually the entire cost of expanded Medicaid under ACA. (Recent analysis indicates that Texas will also receive billions of dollars in new subsidies for individuals and for state services under the new health reform law.)

09.03.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

09.03.2011

Policy Points

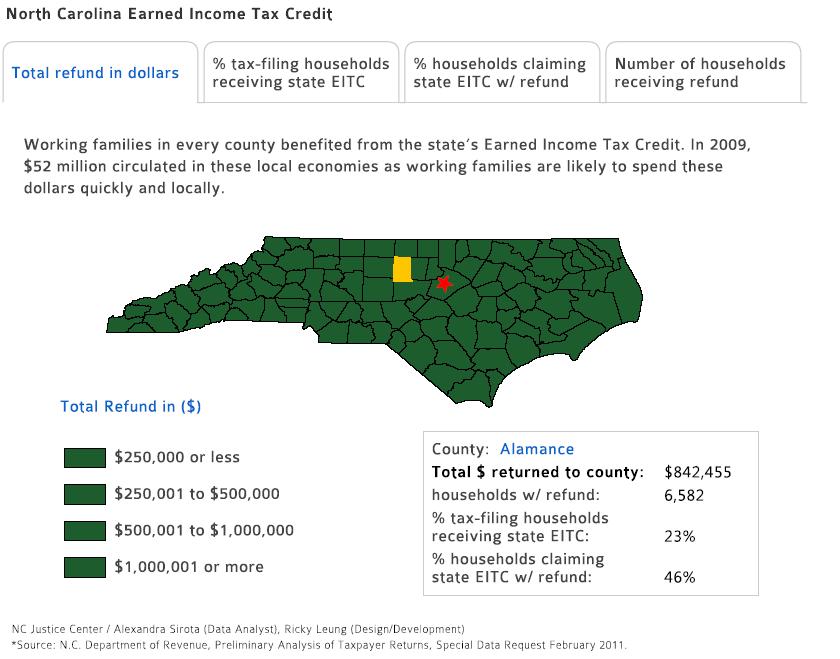

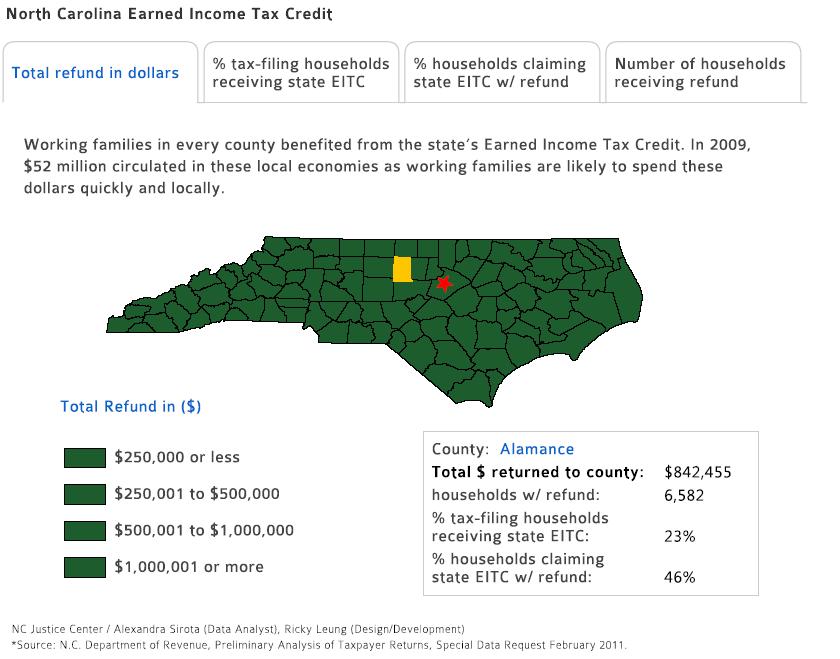

NC Policy Watch and the North Carolina Budget and Tax Center recently released an interactive calculator showing the county-by-county impacts of the state’s Earned Income Tax Credit, a refundable tax credit targeted at working families with relatively low incomes. Click on the image below to access the calculator.

09.03.2011

Policy Points

The 2011 edition of the Institute for Taxation and Economic Policy’s Guide To Fair State and Local Taxes provides a straightforward introduction to the workings of state and local tax systems. Moreover, it explains why tax fairness is a goal to which state and local systems should aspire.

Fair taxes also help government in its relations with its citizens. The public accepts taxes because it values the services that government provides. When a tax system is unfair, however, there is a limit to the taxes the public will tolerate. It’s one thing to ask people to pay taxes. It is another to ask them to pay more because others aren’t paying their fair share. When states choose to balance their budgets by hiking taxes on the low- and middle-income families who are hit hardest by the current tax system, while giving the best-off families a free pass, this obvious unfairness undermines public support for revenue-raising tax reforms even when they are most desperately needed.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed