08.02.2011

Policy Points

The NC Budget & Tax Center explains how the state’s inadequate revenue system has contributed to the current budget shortfall. From the center’s recent research brief …

During the twenty years preceding the Great Recession, state tax revenues averaged 5.8 percent of all North Carolina residents’ incomes put together. Once the2009 tax package expires at the end of June, state tax collections will likely amount to only 4.8 percent of residents’ incomes next year—almost one-sixth less than the average of the past two decades …. If next year were instead an “average”year for tax collections as a share of residents’ incomes, the $3.7 billion shortfall would drop to less than $400 million.

08.02.2011

Policy Points

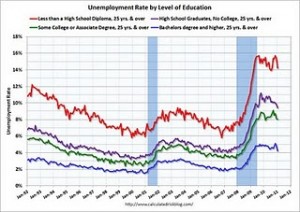

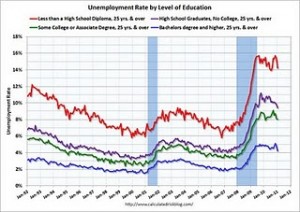

Calculated Risk graphs changes in unemployment rates by level of education between 1992 (the first year with available data) to the present. While unemployment rates generally fall as educational attainment rises, the unemployment rates for every group have doubled during the “Great Recession.”

07.02.2011

Policy Points

Economic policy reports, blog postings, and media stories of interest:

07.02.2011

Policy Points

Derek Thompson of The Atlantic asks if attending college is worth the cost.

Each year, a college education becomes more valuable for U.S. workers. The college premium — the “bonus” a typical college-educated worker receives over a high-school grad — has doubled in the last 30 years in real terms.

…

But each year, a college degree moves further out of reach for middle class families. A four-year public college education cost 18% of a middle-class family’s income in 2000. Today, it’s 25%. And that percentage will grow exponentially, since middle class wages are stagnating and higher education costs are growing four times the rate of inflation, according to Louis E. Lataif in Forbes.

…

Education is an appreciating asset. By that, I mean it helps young workers leapfrog low-skill jobs, so its value increases over time. But today, the price is prohibitive. Since the mid-1990s, average student debt has doubled. Today, two of three college graduates from public and private universities have loan obligations that average more than $20,000.

07.02.2011

Policy Points

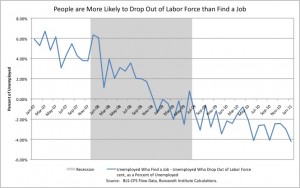

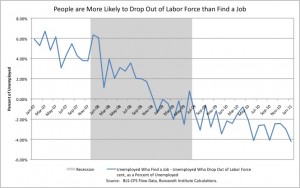

Rortybomb graphs an alarming trend in the labor market: the fact that unemployed workers now are more apt to drop out of the labor market than find a new job.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed