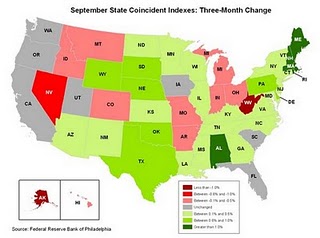

State Coincident Indicators: Oct.

Economic conditions across much of the nation improved slightly in September, according to the newest State Coincident Indexes Report prepared by the Federal Reserve Bank of Philadelphia.

In September coincident indexes moved in a positive direction in 24 states and in a negative direction in 14 states. No changes occurred in 12 states.

The map to the right, which is taken from the Reserve Bank’s survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

The map to the right, which is taken from the Reserve Bank’s survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

Over the last three months, coincident indexes increased in 31 states, decreased in 12 states and held steady in seven states.

During the same three-month period, North Carolina’s coincident index moved in a positive direction, which suggests improvements in local economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed