01.12.2010

Policy Points

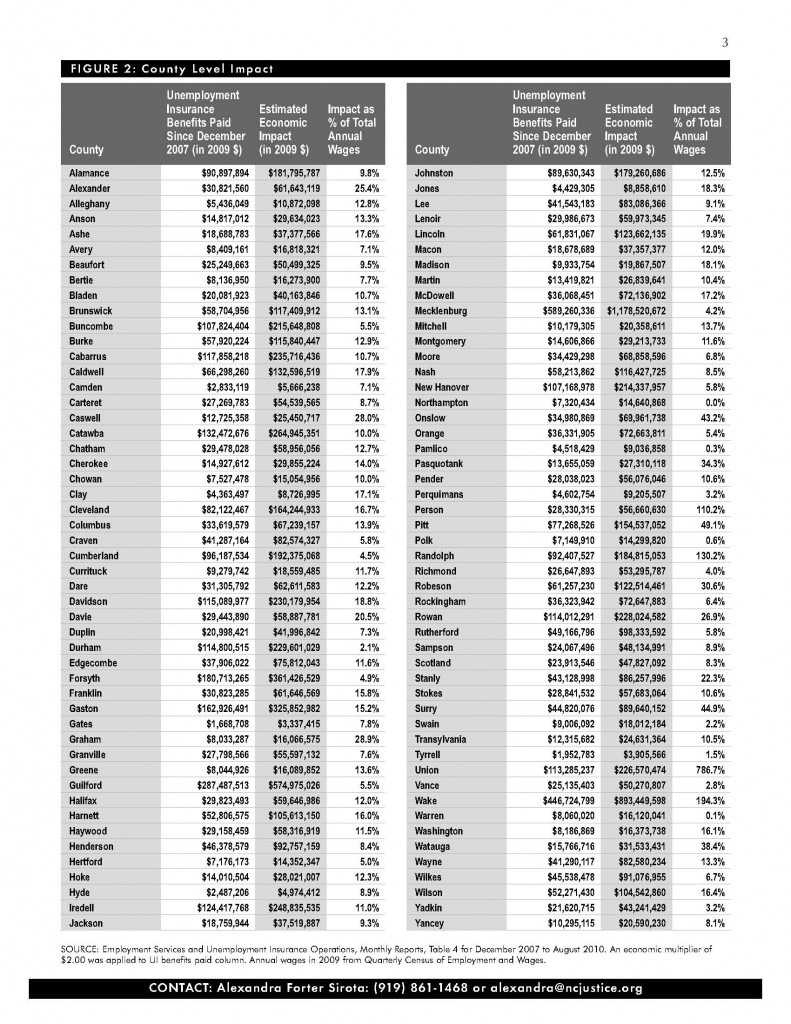

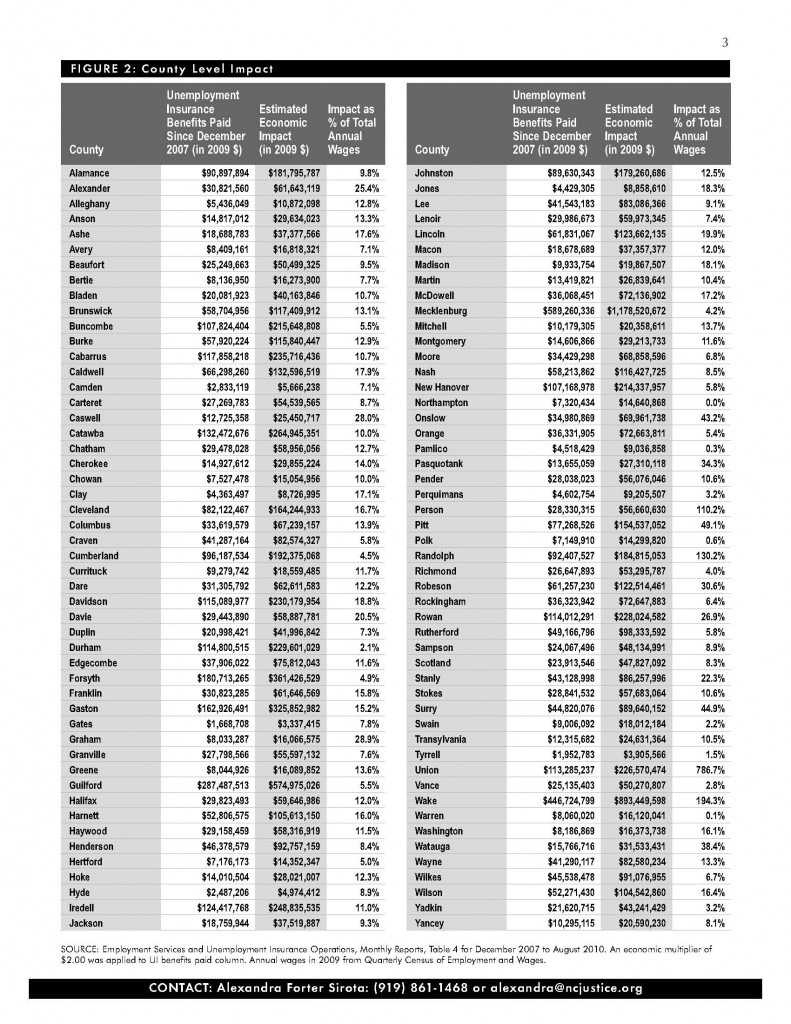

A new policy brief from the North Carolina Budget and Tax Center finds that unemployment insurance payments to eligible Tar Heels has generated $20.2 billion in economic activity since December 2007. The table below estimates the county-by-county economic impacts of unemployment insurance payments.

01.12.2010

Policy Points

From a recent Center on Economic and Policy Research report on the future of Social Security …

The current cohort of near retirees (people between the ages of 50 and 65 in 2010) has been the victim of a uniquely bad period in American economic history. Most of the members of this age cohort saw little by way of wage gains during their working lifetime as a hugely disproportionate share of the benefits of productivity growth went to those at the top of the income scale.

…

In addition, the limited wealth that they were able to accumulate during their working years was largely destroyed by the collapse of the housing bubble. As a result, the vast majority of these workers are approaching retirement with little other than their Social Security to support them. The median net worth (including home equity) of older baby boomers (between the ages of 55 and 64) is just $170,000.3 This would leave the median household with roughly enough money to pay off the mortgage on the median house and then be entirely dependent on Social Security for all their expenses. The median late baby boomer has roughly $80,000 in net worth including their home equity, roughly enough to pay off half the mortgage on the median house.

30.11.2010

News Releases, Policy Points

CHAPEL HILL (November 30, 2010) – Local labor markets across North Carolina recorded few meaningful improvements in October, according to preliminary data released today by the Employment Security Commission. Last month, 37 counties posted double-digit unemployment rates. And compared to a year ago, 78 counties had smaller labor forces.

“North Carolina’s local labor markets made little progress in October,” says John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Although unemployment rates across the state continued to fall, the declines were due to an exodus of workers from the job market. The trend is a troubling one.”

Since the onset of the recession in December 2007, North Carolina has shed 6.4 percent of its payroll employment base (-267,800 positions) and has watched its unadjusted unemployment rate climb from 4.7 percent to 9.1 percent. The state recorded no net job growth in October.

Every broad region of the state experienced weak labor markets in October. Unemployment rates exceeded 10 percent in 37 counties; over the past year, however, there has been a notable reduction in the number of counties with double-digit unemployment rates. Individual county rates ranged from 4.9 percent in Currituck County to 14.7 percent in Scotland County.

“Labor markets in non-metropolitan communities remain weak,” adds Quinterno. “Last month, 9.9 percent of the non-metro labor force was unemployed, compared to 8.8 percent of the metro labor force. More alarmingly, the non-metropolitan labor force continued to shrink. Between October 2009 and October 2010, the non-metropolitan labor force contracted by 1.7 percent or 22,520 individuals. Many of those missing persons are effectively jobless.”

Last month, unemployment rates fell in 13 of the state’s metropolitan areas. Rocky Mount had the highest unemployment rate (12.1 percent), followed by the Hickory-Morganton-Lenoir area (11.7 percent). Durham-Chapel Hill had the lowest rate at 6.6 percent.

Because of the lack of seasonal adjustments, monthly fluctuations in local unemployment rates must be interpreted cautiously. A better comparison is an annual one.

Compared to October 2009, unemployment rates were the same or lower in 98 counties and every metro area. Yet compared to a year ago, 78 counties and 11 metro areas had smaller labor forces. Among metros, Hickory-Morganton-Lenoir posted the largest decline in the size of its labor force (-5.5 percent), followed by Rocky Mount (-3.5 percent). Jacksonville posted the largest gain (+5.7 percent).

“Many recent drops in local unemployment rates have been driven by workers abandoning the job market, not by job growth or improvements in underlying conditions” cautions Quinterno. “Labor force contraction is a sign of an unhealthy economy and shows just how weak the current recovery is, By the same point in time following the last two recessions, the labor force was growing.”

In the long term, any meaningful recovery will be driven by growth in the state’s three major metro regions: Charlotte, the Research Triangle, and the Piedmont Triad. Yet growth has been sluggish. Collectively, employment in these three metro regions has fallen by 4.3 percent since the start of the recession. The overall October unemployment rate in the major metros equaled 8.7 percent. Of the three areas, the Research Triangle had the lowest unemployment rate (7.4 percent), followed by the Piedmont Triad (9.5 percent) and Charlotte (10.5 percent).

“In the 13 months since the state’s labor market hit bottom, local job markets have recorded few improvements, apart from some temporary gains caused by public policy actions,” explains Quinterno. “The removal of policy supports – such as the imminent expiration of emergency unemployment insurance – has revealed a private sector unable to generate jobs at a pace needed to accommodate all those who wish to work. Thousands of North Carolinians have responded by leaving the job market entirely.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed