27.10.2010

Policy Points

In a new research paper, the Center for Economic and Policy Research explains why fiscal austerity measures are unlikely to expand the American economy. From the report …

In short, there is little reason to believe that a fiscal adjustment will lead to a substantial improvement in the United States’ trade position any time in the near future. This channel for offsetting the contractionary impact of deficit reduction is not very promising.

…

The investment channel does not appear much more promising. With interest rates already at historic lows, it seems implausible that whatever further decline may occur as a result of adjustment could have very much impact. In most sectors output remains far below capacity, so firms have little incentive to expand capacity far in advance of demand. This is especially true because the bubble in non-residential real estate led to enormous excess supply in most areas.

…

Businesses can invest in modernizing equipment, but the impact of further declines in interest rates is likely to be limited. There is a large body of research that finds that investment is not very responsive to interest rates.8 Furthermore, the rate of growth of equipment and software investment is already quite rapid, with growth averaging 19.9 percent from third quarter of 2009 to the second quarter of 2010. It does not seem likely that lower interest rates will increase this rate substantially, especially in a context where demand is contracting due to budget cuts.

26.10.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

26.10.2010

Policy Points

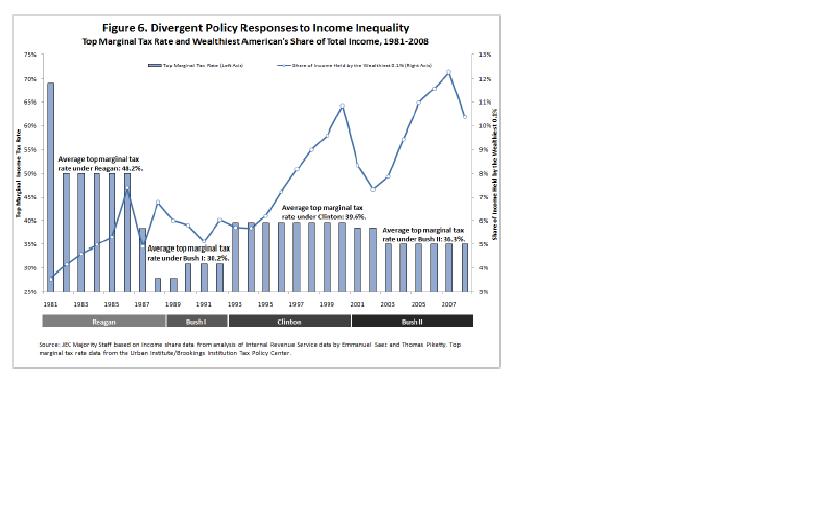

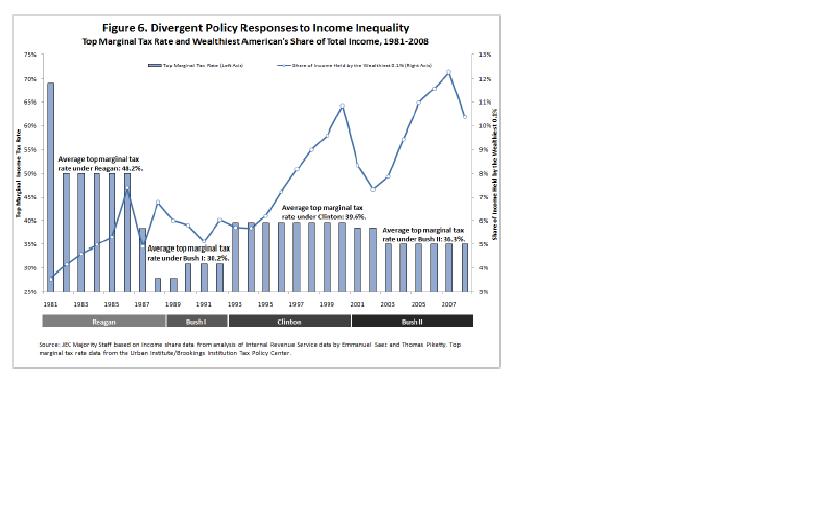

The following graph, taken from an analysis prepared by the majority staff of Congress’ Joint Economic Committee, compares changes in the top marginal federal income tax rate to the the share of the nation’s income held by the top 1 percent of households.

Not only are current rates low by historical standards, but they also appear to have little impact on the share of income held by the richest households; rather, their fortunes are influenced much more by economic conditions and market returns.

26.10.2010

Policy Points

The National Employment Law Project reports that a congressional failure to reauthorize emergency unemployment benefits will cause 1.2 million Americans to lose unemployment insurance payments in December. Benefit losses will continue over subsequent months. From the report …

Of these 1.2 million workers, more than 828,000 will lose out on weeks of a federal extension that would otherwise be available to them …. These are workers who are currently receiving one of the Emergency Unemployment Compensation (EUC) “tiers” and who would not be able to move on to the next tier available in their states after they finish their current set of weeks. In many states, these also include recipients who are finishing out their EUC benefits, but will be unable to receive additional weeks under Extended Benefits due the loss of federal funding for the program.

…

Another 387,000 recipients will lose all access to any form of an extension.These are unemployment recipients enrolled in their states’ regular benefit program, which only allows up to 26 weeks of benefits. This group of unemployed workers, after finishing their state’s program, will have no other benefits available to them after the extensions expire. This means that in most states, recently laid-off workers will receive only six months of benefits or less, even though unemployment is as high or higher than it was when the current federal programs were first enacted and much higher than it was during earlier federal programs. Given the dearth of jobs available for those in need of work and sustained record levels of long-term unemployment, cutting off the benefits jobless workers expected from the federal extensions will result in significant hardship for hundreds of thousands of the recently unemployed.

25.10.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed