25.08.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

25.08.2010

Policy Points

A new report from the Institute on Taxation and Economic Policy argues that states should reform the ways in which they use itemized tax deductions. Notes the report:

Each of the itemized deductions allowed by states are frequently defended as an important means of offsetting large household expenses that reduce a family’s ability to pay taxes. But because low-income families rarely have potentially deductible expenses that exceed the basic standard deduction amount, the ability to itemize offers little or no tax cuts to fixed-income families. And, because itemized deductions are structured as deductions from taxable income, they typically provide much larger tax breaks to the best-off families than to middle-income taxpayers. This is because the tax cut you get from an itemized deduction depends on your federal income tax rate: imagine two New York families, each of which has $10,000 in mortgage interest payments that they include in their itemized deductions. If the first family is a middle income family paying at the 15 percent federal tax rate, the most they can expect is a $1,500 federal tax cut from this deduction ($10,000 times 15 percent). But if the second family is much wealthier and pays at the 35 percent top rate, they could expect a tax cut of up to $3,500 from this deduction, even though they spent exactly the same amount on mortgage interest as the first family. It is unlikely that a lawmaker would ever propose a direct spending program designed to make home-ownership more affordable that excluded low income families entirely and gave the biggest subsidies to the richest families—yet that is the inexorable impact of itemized deductions.

24.08.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

24.08.2010

Policy Points

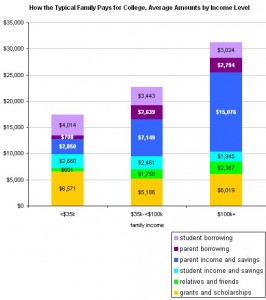

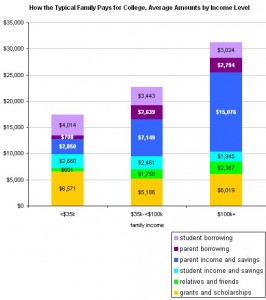

A post at Economix compares how families in different income groups pay for college costs.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed