NC Job Market Goes Nowhere

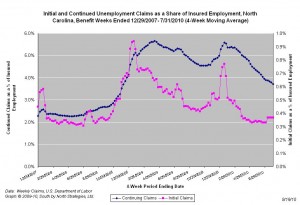

CHAPEL HILL (August 20, 2010) – The latest employment report for North Carolina is the worst one recorded so far in 2010. In July, the state shed 29,800 more payroll positions than it added. This drop erased 77 percent of the payroll employment gains made during the year’s first half. Moreover, a fall in the size of the labor force suggests that joblessness is more widespread than reflected in the unemployment rate.

“North Carolina’s fragile job market took a turn for the worse in July,” says John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “The job report was the worst one of the year and points to a labor market that is deteriorating rather than improving.”

In July, employers cut 29,800 more positions than they added. The public sector shed 27,300 positions with local governments responsible for most of the losses (-26,500). Total private-sector payroll employment fell by 2,500 positions. Among private industries, construction lost the most positions (-2,800), followed by leisure and hospitality services (-1,700) and professional and business services (-1,300). The losses were offset by gains in trade, transportation, and utilities (+2,800), manufacturing (+600), and finance (+600).

Additionally, a revision to the June data eliminated the slight net gain first reported for the month. Rather than gaining 5,100 positions, North Carolina actually lost 3,700 jobs. After accounting for that revision, North Carolina has shed, on net, 276,700 positions or 6.6 percent of its payroll employment base since December 2007.

“Last month’s payroll losses erased 77 percent of the gains recorded during the first half of 2010,” notes Quinterno. “North Carolina has netted just 9,000 payroll jobs since December. The pace of growth – 1,300 positions per month – is insufficient to keep pace with population growth, let alone replace the jobs lost during the recession.”

Labor market conditions have been flat over the past year. Compared to July 2009, the state had 6,000 (+0.2 percent) more jobs. In terms of individual industries, professional and business services grew the most in absolute and relative terms (+19,700, +4.3 percent). Government added 14,000 positions (+2 percent). Construction (-18,300) and manufacturing (-7,900) lost the greatest number of positions over the past year with construction declining the most in relative terms (-9.7 percent).

July’s household data also were troubling. Last month, the labor force contracted by 0.8 percent as 35,612 individuals stopped working or seeking work. The number of employed individuals fell, as did the number of unemployed individuals. Owing mainly to the contraction of the labor force, the unemployment rate fell from 10 percent to 9.8 percent. The reduction in the size of the labor force is disturbing and suggests that joblessness is much more widespread than reflected in official measures.

“Some 59,900 North Carolinians have left the labor force since May,” observes Quinterno. “The contraction is responsible for much of the recent decline in the unemployment rate. Unfortunately, this trend is consistent with a labor market that is declining rather than recovering.”

“The July jobs report exposed just how weak the economy really is,” explains Quinterno. “The economy is proving unable to generate jobs absent the crutch provided by public policy supports, and individuals across the state simply are abandoning the labor market.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed