18.08.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

18.08.2010

Policy Points

Simon Johnson and James Kwak offer four steps for improving the nation’s fiscal health. The most important step: controlling the cost of health care.

There are two ways to reduce the government’s health-care outlays: reduce the amount of health care the government buys, or reduce the cost of health care. The simplest solution is to mandate that the government buy less health care – by raising the eligibility age for Medicare, capping benefits for high-income beneficiaries, and so on.

…

The problem with this approach is that Medicare is not particularly generous to begin with. If the eligibility age were to increase, responsibility for health care for many people would simply be dumped back onto their employers, resulting in higher health-care costs for all working people. A better solution is to figure out how to reduce health-care costs.

…

This year’s health-care reform legislation, the Affordable Care Act (ACA), is a starting point. According to CBO data, the ACA will reduce the long-term fiscal deficit by two percentage points of GDP per year. A top priority should be to preserve and expand its cost-cutting provisions. Another obvious step to consider is to phase out the tax exclusion for employer-sponsored health plans, which would not only increase revenue, but also end the distorting effects of employer subsidization of health care.

18.08.2010

Policy Points

Felix Salmon doesn’t buy the argument that it was impossible for economists to identify the housing bubble. Writes Salmon:

So my conclusion, after reading the arguments of the housing bulls, is that they were mostly bunk. And there’s even a hint of that in one of the footnotes to the paper, which says that “economists at policy institutions may have shied away from making pessimistic predictions for fear of spooking the markets”. It seems to me that if there wasn’t a bubble, no one was likely to be worried about spooking healthy rising markets.

—

The bigger conclusion, of course, is that it’s silly to look to economists to forecast anything at all. Not because they don’t have the tools, but just because it’s always possible to find an economist who’ll believe just about anything. Housing bubbles are normally pretty obvious at the time: there’s one right now in Vancouver, for instance. You can see them in the rise of dozens of huge new glass-clad condo buildings; you can see them in massive price increases; you can see them when mortgage payments are significantly larger than the amount of money you could get renting out the place; and you can see them whenever people start making more money from selling their homes than they do from actually working. The only people who can’t see them, it seems, are economists, realtors, and bankers on Wall Street.

17.08.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

17.08.2010

Policy Points

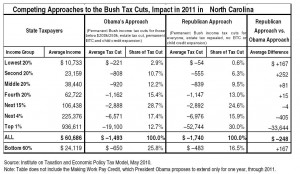

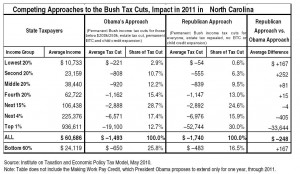

A new research brief prepared by Americans for Responsible Taxes and Citizens for Tax Justice looks at how North Carolina’s personal taxpayers would fare under the expiration of the Bush-era tax changes and under each of the two major congressional proposals.

The table (below) summarizes the changes by income group.

Key findings include the following:

Key findings include the following:

- Under the Republican approach, the bottom 60 percent of North Carolina taxpayers would pay $167 more in 2011, on average, than they would under President Obama’s approach.

- Under the Republican approach, the richest one percent of North Carolina taxpayers would pay $33,644 less in 2011, on average, than they would under President Obama’s approach.

- Under the Republican approach, the richest one percent of North Carolina taxpayers would receive 30.0 percent of the total tax cuts going to the state in 2011.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed