An All-Too-Familiar Jobs Report

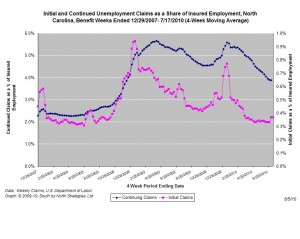

CHAPEL HILL (August 6, 2010) – The national employment report for July showed little deviation from recent trends. Last month, employers eliminated 131,000 more payroll positions than they added. An expected fall in temporary census employment drove that decline; after accounting for it, the economy netted 12,000 positions, a level grossly insufficient to either keep pace with workforce growth or re-absorb jobless individuals.

“Fundamental employment dynamics were little changed in July,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Payroll employment fell due to the ending of temporary census positions. When those jobs are excluded, the nation netted just 12,000 payroll positions, all of which were in the private sector.”

In July, the nation’s employers shed 131,000 more payroll positions than they added. Losses occurred primarily in the public sector due to the elimination of 143,000 temporary census jobs coupled with the loss of another 59,000 federal, state, and local positions. When census reductions are excluded, the economy netted just 12,000 positions. And payroll employment levels for June were revised sharply downward: after adjusting for cuts in census employment, the economy added just 27,000 payroll positions in June.

The largest private-sector gains in July occurred in manufacturing (+36,000) and education and health services (+27,800). Finance payrolls fell by 17,000 positions. All other major industry groups posted little or no change. Meanwhile, the public sector slashed 59,000 positions in addition to temporary census ones; local government accounted for the bulk of that decline.

“The July employment report illustrates just how weak the economy is without policy supports,” noted Quinterno. “The private-sector is proving unable to offset the drop in temporary census employment. So far in 2010, the private sector has added an average of just 90,000 jobs per month. That is an insufficient level of job creation.”

Weak job prospects are reflected in the July household survey. Last month, 14.6 million Americans – 9.5 percent of the labor force – were jobless and actively seeking work. Proportionally more adult male workers were unemployed than female ones (9.7 percent vs. 7.9 percent). Similarly, unemployment rates were higher among Black (15.6 percent) and Hispanic workers (12.1 percent) than among White ones (8.6 percent). The unemployment rate among teenagers was 26.1 percent.

Furthermore, newly available data show that 8.4 percent of all veterans were unemployed in July; the rate among veterans who had served since September 2001 was 11.8 percent.

“In developments inconsistent with a recovery, 181,000 individuals left the labor force in July, and the share of the adult population engaged in economically productive activities fell,” added Quinterno. “Compared to a year ago, the labor force is smaller, fewer people are employed, and the unemployment rate essentially is unchanged.”

Job remained hard to find in July. Last month, 44.9 percent of unemployed workers had been jobless for at least six months with the average spell of unemployment lasting for 34.2 weeks. Many other individuals stopped looking, and counting those individuals and those working part-time on an involuntary basis brings the underemployment rate to 16.5 percent.

“The reduction in temporary census hiring in July exposed just how weak the labor market really is,” observed Quinterno. “The job market appears unable to stand without the crutch provided by policy actions, and jobless individuals across the country simply are abandoning the labor market.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed