Policy Points

19.04.2013

News Releases, Policy Points

CHAPEL HILL, NC (April 19, 2013) – The total number of payroll jobs in North Carolina essentially was unchanged in March (-300, +/- 0 percent). While the statewide unemployment rate (seasonally adjusted) fell by 0.2 percentage points, the decline was intertwined with a 0.5 percent contraction in the size of the labor force. In fact, fewer people held jobs in March than in February. These findings come from new data released by the Labor and Economic Analysis Division of the NC Department of Commerce.

“Calling the March employment report ‘lackluster’ would be an overly charitable description,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Overall employment levels in both the private and public sectors were unchanged, while a number of major labor force indicators moved in the wrong direction. The share of the working-age population participating in the labor force, for one, fell to a level last seen in late 2011.”

In March, North Carolina employers cut 300 more jobs than they added (+/- 0 percent). Private-sector payrolls netted 600 positions (+/- 0 percent), while public-sector payrolls shed 900 jobs (+/- 0 percent). Within the private sector, the professional and business services sector netted the most jobs (+4,200, +0.8 percent), with 71.4 percent of the gain originating in the administrative and waste management services subsector. The information industry added, on net, 1,300 positions (+1.8 percent), followed by the education and health services sector (+1,100, +0.2 percent). Meanwhile, the manufacturing sector shed the most positions (-3,700, -0.8 percent), with 72.9 percent of the losses related to the manufacture of non-durable goods. The trade, transportation, and utilities sector lost 2,200 positions (-0.3 percent), with all of the losses occurring in the retail trade subsector. The construction sector also shed -1,800 jobs (-1.1 percent).

A revision to the February payroll data found that the state gained fewer jobs than first estimated (+2,500 versus +3,300). With that revision, North Carolina now has, on net, 119,400 fewer payroll positions (-2.9 percent) than it did in December 2007. Since bottoming out in February 2010, the state has netted an average of 5,632 payroll jobs per month, resulting in a cumulative gain of 208,400 positions (+5.4 percent).

“North Carolina has experienced little net payroll growth so far in 2013,” noted Quinterno. “During the first quarter of 2013, the state netted 16,300 payroll jobs, for a total increase of 0.4 percent. In comparison, state payrolls grew, on net, by 30,900 positions, or 0.8 percent, during the first quarter of 2012.”

The household data for March also pointed to the existence of an under-performing labor market. Last month, the number of unemployed North Carolinians fell (-11,619, -2.6 percent), but so did the number of employed persons (-10,954, -0.3 percent). The drop in the unemployment rate to 9.2 percent from 9.4 percent in February therefore was intertwined with a contraction in the size of the labor force (-22,573, -0.5 percent). In March, the share of the working-age population participating in the labor force (62.8 percent) fell for the second consecutive month and reached a level last seen in late 2011.

Compared to a year ago, 42,669 more North Carolinians held jobs in March (+1 percent), while 7,127 fewer persons were unemployed (-1.6 percent). Viewed in light of the increase in the size of the labor force that also occurred (+35,542, +0.8 percent), the drop in the unemployment rate that took place over the year was a positive improvement. Meanwhile, the labor force participation rate fell by 0.2 percentage points over the year, while the employment to population ration held constant at 57.1 percent; both measures, however, remain at depressed levels.

Such improvements in the labor market are unimpressive when viewed in relation to the severity of the employment problems facing the state. North Carolina’s unemployment rate has equaled or exceeded 9 percent in every month since January 2009 and has ranged as high as 11.4 percent. Over the past 15 months, the rate has fluctuated between 9.2 percent and 9.6 percent. Moreover, compared to December 2007, which was when the “Great Recession” began, the statewide unemployment rate is 4.2 percentage points higher, and the number of unemployed North Carolinians is 90.3 percent larger.

“The March employment report is consistent with a labor market that is stable but going nowhere fast,” observed Quinterno. “When combined with reports from earlier in the year, it is clear that 2013 is not so far shaping up to be the year in which the state’s labor market turns a corner.”

18.04.2013

Policy Points

For the benefit week ending on March 30, 2013, some 12,791 North Carolinians filed initial claims for state unemployment insurance benefits and 95,595 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,415 initial claims were filed over the previous four weeks, along with an average of 96,294 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 10,371, and the four-week average of continuing claims equaled 106,648.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were over five years ago.

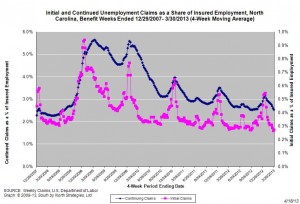

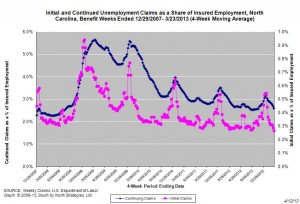

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

11.04.2013

Policy Points

For the benefit week ending on March 23, 2013, some 8,388 North Carolinians filed initial claims for state unemployment insurance benefits and 93,107 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,175 initial claims were filed over the previous four weeks, along with an average of 98,430 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 10,879, and the four-week average of continuing claims equaled 111,480.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were approximately five years ago.

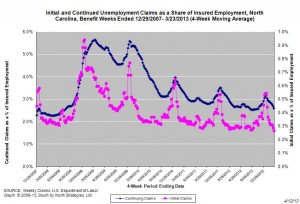

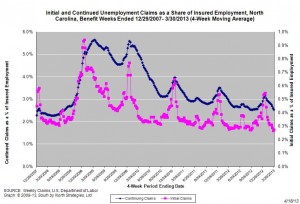

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

10.04.2013

News Releases, Policy Points

CHAPEL HILL, NC (April 10, 2013) – Between February 2012 and February 2013, unemployment rates fell in 76 of North Carolina’s 100 countries and in 12 of the state’s 14 metropolitan areas. Over the period, the size of the labor force grew in 46 counties and in 10 metro areas. These findings come from new estimates prepared by the Labor and Economic Analysis Division of the North Carolina Department of Commerce.

“Over the year, local unemployment rates dropped across most of North Carolina,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Unemployment nevertheless remained widespread. Last month, local unemployment rates equaled or exceeded 10 percent in 60 counties and 4 metro areas. In February 2008, in contrast, five counties and no metro areas logged unemployment rates of 10 percent or greater.”

Compared to December 2007, which is when the national economy fell into recession, North Carolina now has 2.9 percent fewer jobs (-118,300) and has seen its unadjusted unemployment rate climb to 9.5 percent from 4.7 percent. In February, the state added 3,300 more jobs than it lost (+0.1 percent). Since bottoming out in February 2010, the state’s labor market has netted some 5,819 jobs per month, resulting in a cumulative gain of 209,500 positions (+5.5 percent).

Between January 2012 and February 2013, local unemployment rates declined in 99 of the state’s 100 counties. Individual county rates ranged from 5.9 percent in Orange County to 20.2 percent in Graham County. Overall, 60 counties posted unemployment rates greater than or equal to 10 percent, and 39 counties posted rates between 6.8 and 9.9 percent.

“Non-metropolitan labor markets continue to struggle relative to metropolitan ones,” noted Quinterno. “In February, 10.9 percent of the non-metro labor force was unemployed, compared to 9 percent of the metro labor force. Compared to December 2007, the non-metro labor force now has 6.7 percent fewer employed persons, while the number of unemployed individuals is 94.1 percent larger.”

Over the month, unemployment rates fell in all 14 metro areas. Rocky Mount had the highest unemployment rate (13.2 percent), followed by Hickory-Morganton-Lenoir (10.8 percent) and Wilmington (10.2 percent). Durham-Chapel Hill had the lowest unemployment rate (7 percent), followed by Raleigh-Cary (7.5 percent) and Asheville (7.8 percent).

Compared to February 2012, unemployment rates in February 2013 were lower in 76 counties and 12 metro areas. Over the year, labor force sizes increased in 46 counties and in 10 metros. Among metros, Asheville’s labor force expanded at the fastest rate (+2.6 percent), followed by that of Greenville (+2.4 percent). With those changes, metro areas now are home to 71.8 percent of the state’s labor force, with 50.4 percent of the labor force residing in the Triangle, Triad, and Charlotte metros.

In the long term, improvements in overall labor market conditions will hinge on growth in the Charlotte, Research Triangle, and Piedmont Triad regions. Yet growth in these metros remains subdued. Collectively, employment in those three metro regions has risen by 2.5 percent since December 2007, and the combined February unemployment rate in the three regions equaled 8.5 percent. That was down from the 9.1 percent rate recorded one year ago yet was well above the 4.9 percent rate recorded in February 2008. Of the three broad regions, the Research Triangle had the lowest February unemployment rate (7.5 percent), followed by Charlotte and the Piedmont Triad (both 9.6 percent).

“Three years into a statewide labor market recovery, unemployment remains widespread across much of North Carolina,” said Quinterno. “The state simply lack enough jobs for all those who need and want work, and little evidence suggests that the pattern is about to change anytime soon.”

05.04.2013

News Releases, Policy Points

The national labor market added in March just 88,000 more jobs than it lost in March. The unemployment rate, meanwhile, dipped to 7.6 percent, due in part to a contraction in the size of the labor force. Despite some improvements in certain key indicators in recent months, unemployment and underemployment remain elevated.

“March was the 30th-straight month of job growth recorded in the United States,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Over the past three months, the national economy has netted an average of 168,000 jobs, a pace that, while positive, is insufficient to drive unemployment down to pre-recessionary levels. More than 3.5 years into a recovery, the unemployment rate remains well above the December 2007 level of 5 percent.”

In March, the nation’s employers added 88,000 more payroll positions than they cut. Gains occurred entirely in the private sector (+95,000), while government employers eliminated 7,000 more positions than they added, owing chiefly to reductions by the US Postal Service. Moreover, the payroll employment numbers for January and February underwent revisions; with the updates, the economy gained 416,000 jobs over those two months, not the 355,000 positions previously reported.

Within the private sector, payroll levels rose the most in the professional and business services sector (+51,000, with half of the gain attributable to the administrative and waste services subsector), followed by education and health services sector (+44,000, with 53.2 percent of the gain attributable to the health care subsector), the construction sector (+18,000), and the leisure and hospitality sector (+17,000, with 71.6 percent of the gain occurring in the accommodation and food services subsector). Payroll levels fell the most in the trade, transportation, and utilities sector (-27,000, with 89.3 percent of the losses originating in the retail trade subsector).

“Over the last year, the American economy has gained 1.9 million more payroll positions that it has lost,” noted Quinterno. “The current average monthly rate of job growth—some 159,000 positions per month—nevertheless is insufficient to fill the sizable jobs gap caused by the most recent recession.”

Slack labor market conditions were evident in the March household survey. Last month, 11.7 million Americans (7.6 percent of the labor force) were jobless and seeking work. While the unemployment rate dropped between February and March, that was due in part to a large contraction in the size of the labor force (-496,000 persons). Also in March, the share of the population participating in the labor force fell to 63.3 percent, a rate lower than the one recorded a year ago. On a somewhat positive note, more Americans were working in March compared to a year ago, while fewer persons were unemployed. At the same time, the share of the working age population with a job fell in March to a level close to the lowest one recorded during the current business cycle.

Last month, the unemployment rate was higher among adult female workers than male ones (7 percent versus 6.9 percent). Unemployment rates were higher among Black (13.3 percent) and Hispanic workers (9.2 percent) than among White ones (6.7 percent). The unemployment rate among teenagers was 24.2 percent. Moreover, 7.1 percent of all veterans were unemployed; the rate among recent veterans (served after September 2001) was 9.2 percent. At the same time, 13 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained scarce in March. Last month, the underemployment rate equaled 13.8 percent. Among unemployed workers, 39.6 percent had been jobless for at least six months, and the average spell of unemployment was 37.1 weeks. The leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 53.6 percent of unemployed persons in March. Another 26.9 percent of unemployed persons were reentrants to the labor market, while 11.1 percent were new entrants. Voluntary job leavers accounted for the remaining 8.4 percent of the total.

“In March, the air very much leaked out of the American job market,” observed Quinterno. “The monthly job gain was the smallest recorded since last June, and the economy still is not adding jobs fast enough to accommodate all the Americans who need work. And while the unemployment rate fell, that drop was due to people leaving the job market altogether.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed