01.07.2010

Policy Points

The Center for Economic and Policy Research (CEPR) has published an interactive calculator that allows users to see how various policy measures would increase or decrease the total national debt, measured as a share of gross domestic product (GDP), outstanding in 2020.

Unlike similar calculators, which often present cutting Medicare benefits or raising the Social Security retirement age as the only options, CEPR’s calculator offers a broader menu of spending and revenue policies. The calculator also contains explanations of policy proposals and provides context for judging various ratios of debt to GDP.

This calculator is an excellent, fun tool for better understanding the policy arguments about the national debt.

30.06.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

30.06.2010

Biannual Jobs Review, Policy Points, Publications

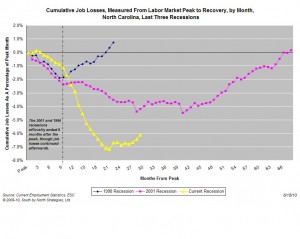

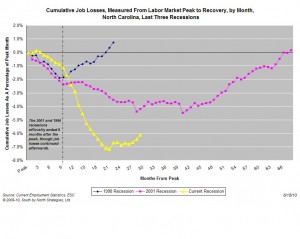

During the first half of 2010, North Carolina’s job market essentially ran in place. Although jobs were not lost at the frantic pace of 2008-09, little progress was made. Conditions remained weak, and growth did not occur at the level needed to re-absorb displaced workers or accommodate new entrants to the labor force. And considerable evidence suggests that more difficulties are in store for the the second half of 2010.

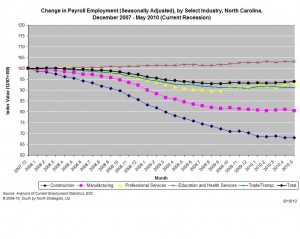

The figure (right) shows the job losses that occurred in North Carolina between December 2007 and May 2010, the most recent month with data. Over that period, North Carolina lost, on net, 254,000 positions or 6.1 percent of its payroll job base. Between September 2008 and April 2009, the state lost an average of 23,450 jobs per month. Losses slowed during the summer of 2009 before bottoming in September. Since then, the state has gained an average of 5,000 jobs per month.

The figure (right) shows the job losses that occurred in North Carolina between December 2007 and May 2010, the most recent month with data. Over that period, North Carolina lost, on net, 254,000 positions or 6.1 percent of its payroll job base. Between September 2008 and April 2009, the state lost an average of 23,450 jobs per month. Losses slowed during the summer of 2009 before bottoming in September. Since then, the state has gained an average of 5,000 jobs per month.

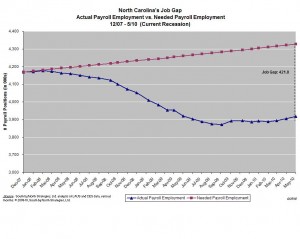

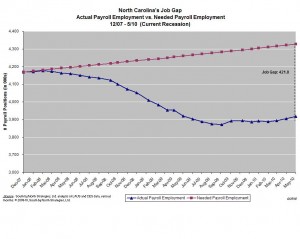

Unfortunately, North Carolina needs to add some 5,500 positions per month to keep  pace with workforce growth. If one considers the jobs that should have been created during the recession but were not, the actual gap facing the state is 422,000 positions (Figure, left).

pace with workforce growth. If one considers the jobs that should have been created during the recession but were not, the actual gap facing the state is 422,000 positions (Figure, left).

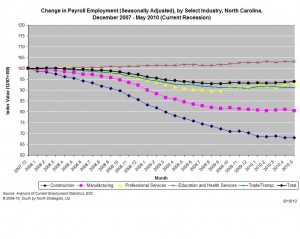

While the job growth posted in 2010 is welcome, it is insufficient. The state has netted 31,300 jobs, but only 14,100 of those jobs are private-sector ones. As the figure ( below) shows, selected private industries have posted little growth.

below) shows, selected private industries have posted little growth.

Meanwhile, many of the public-sector jobs that the state gained were temporary ones, primarily positions related to the 2010 Census. These jobs now are ending. In fact, the Census Bureau’s Charlotte region (NC, KY, TN, and VA) eliminated 27,748 jobs between the weeks of May 12th and June 12th.

read more

29.06.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

29.06.2010

Policy Points

Congress’ inability to extend the various emergency unemployment insurance provisions contained in the recovery act is harmful to North Carolina’s unemployed workers and its overall economy. For, as the N.C. Budget & Tax Center has reported, unemployment insurance replaces part of the income lost by jobless workers and helps stabilize the larger economy.

In response to the current recession, the federal recovery act contained numerous provisions related to unemployment insurance. For individuals, the program created an Emergency Unemployment Compensation (EUC) program that allows individuals to receive up to 99 weeks of benefits. Additionally, the Federal Additional Compensation (FAC) program adds $25 to each weekly unemployment insurance check. And individuals may shield a portion of their benefits from federal income taxes.

State systems, meanwhile, received access to interest-free loans from the federal government, and the federal government also agreed to pay temporarily the states’ share of the Extended Benefits (EB) program. A series of incentive payments also provided states with supplemental funds provided they enacted certain reforms.

The expiration of certain recovery act provisions — primarily the EUC and FAC programs — will harm unemployed North Carolinians and slow the state’s recovery. Consider the following:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed