25.06.2010

Policy Points

North Carolina’s local labor markets underwent few real changes in May, according to preliminary data released today by the Employment Security Commission. In May, 53 counties posted double-digit unemployment rates, and 21 counties recorded unemployment rates of at least 12 percent.

Last month, unemployment rates fell in 10 of the state’s metropolitan areas, and 11 metros gained more jobs than they lost. Nevertheless, five metros posted double-digit unemployment rates. The Hickory-Morganton-Lenoir area had the highest unemployment rate (13 percent) followed by Rocky Mount (12.9 percent). The lowest metro unemployment rate was 7.3 percent in Durham-Chapel Hill.

In the long term, any meaningful recovery will be driven by growth in the state’s three major metro regions: Charlotte, the Research Triangle, and the Piedmont Triad. Yet job growth in 2010 has been sluggish. Collectively, employment in these three major metro regions has fallen by 3.8 percent since the start of the recession. The overall May unemployment rate in the major metros equaled 9.5 percent. Of the three areas, the Research Triangle had the lowest May unemployment rate (8 percent), followed by the Piedmont Triad (10.4 percent) and Charlotte (11.4 percent).

Click here for South by North Strategies’ full analysis of the May report.

25.06.2010

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity softened in the Fifth District service sector in June, according to the latest survey by the Federal Reserve Bank of Richmond. Revenue expansion at non-retail businesses slowed and retail sales were nearly flat, hampered in part by a continued slump in big-ticket sales. In addition, shopper traffic waned and inventory reductions slowed.

…

On the labor front, employment in the service sector leveled off in June as retailers cut more jobs and the pace of hiring cooled at non-retail services firms. Average wages continued to advance at a stable pace, however.

…

Price growth slowed slightly this month and survey respondents’ outlook for the next six months was for only a mild pick-up in the pace. Expectations for sales during the next six months remained a bright spot in June.

24.06.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

24.06.2010

Policy Points

For the (holiday shortened) benefit week ending on June 5th, 13,949 North Carolinians filed initial claims for state unemployment insurance benefits, and 157,171 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and fewer continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,975 initial claims were filed over the previous four weeks, along with an average of 161,632 continuing claims. Compared to the previous four-week period, there were more initial and fewer continuing claims.

One year ago, the four-week average for initial claims stood at 22,033 and the four-week average of continuing claims equaled 213,923.

One year ago, the four-week average for initial claims stood at 22,033 and the four-week average of continuing claims equaled 213,923.

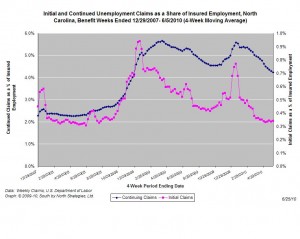

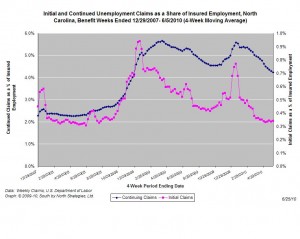

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this business cycle, and the four-week average of new claims has fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

24.06.2010

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region expanded for the fifth consecutive month, according to the Richmond Fed’s latest survey. Looking at the main components of activity, shipments were virtually unchanged, while employment grew at a modest pace, and new orders grew more slowly. Other indicators varied. Growth in backlogs moderated considerably this month and capacity utilization fell below its all-time high readings seen in April and May. Vendor lead-time continued to grow at a solid pace, while inventories grew at a somewhat slower rate.

…

Looking ahead, manufacturers’ optimism remained in place in June, though it was less rosy than last month. Firms anticipated that their shipments, new orders, capacity utilization, employment and the average workweek would grow in coming months, albeit less robustly. In contrast, they expected backlogs of orders and capital expenditures to grow more quickly.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed