Metro Unemployment By Race

A report by the Economic Policy Institute analyzes racial differences in unemployment rates in each of the nation’s 50 largest metropolitan areas.

A report by the Economic Policy Institute analyzes racial differences in unemployment rates in each of the nation’s 50 largest metropolitan areas.

A report by the Employee Benefit Research Institute analyzes the income of the elderly population. The report finds that older Americans derive 40 percent of their incomes from Social Security. And as the chart below shows, Social Security is especially important to the well-being of elderly Americans with lower incomes.

Economic policy reports, blog postings, and media stories of interest:

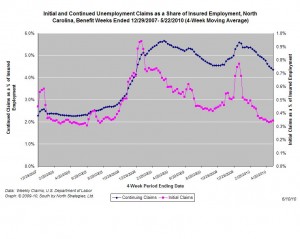

For the benefit week ending on May 22nd, 13,284 North Carolinians filed initial claims for state unemployment insurance benefits, and 164,304 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and fewer continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 13,090 initial claims were filed over the previous four weeks, along with an average of 166,421 continuing claims. Compared to the previous four-week period, initial claims were higher and continuing claims were lower.

One year ago, the four-week average for initial claims stood at 22,825 and the four-week average of continuing claims equaled 216,339.

One year ago, the four-week average for initial claims stood at 22,825 and the four-week average of continuing claims equaled 216,339.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this business cycle, and the four-week average of new claims has fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

A new analysis from the Center for Economic and Policy Research explains why the increase in life expectancies is not as significant for the well-being of Social Security as it may first appear. From the report:

Since the introduction of Social Security, life expectancy has grown, but much of the gains have taken the form of increased time spent working. For women in particular, the increase in working years means that they will see a length of retirement virtually the same as their parents. For those who labor in more physically demanding areas of the economy, working to an even later age is not a serious option. Fortunately, future generations will be far more productive than today – hence able to afford the lengthy retirements that increased life expectancy offers. While paying for these longer retirements does require additional savings on the part of workers, this is no less true in retirement planning generally than it is for Social Security. Thus, there is a need to increase national savings; but this requires addressing America’s persistent trade deficits – not denying seniors retirement income.