Policy Points

04.06.2010

Policy Points

The national employment report for May is an unimpressive one. Last month, employers added 431,000 more payroll positions than they eliminated. Almost all of the gain, however, was attributable to the hiring of temporary workers by the U.S. Census Bureau.

In May, the nation’s employers added 431,000 more payroll positions than they cut. Gains occurred primarily in the public sector due to the hiring of 411,000 temporary census workers by the federal government. The rest of the economy netted just 20,000 positions. The largest private-sector gains occurred in manufacturing (+29,000) and in professional and business services (+22,000), primarily in the temporary help services sub-industry. Construction payrolls fell by 35,000 positions, which erased many of the industry’s recent gains. All other major industry groups recorded little or no change.

Jobs remained hard to find in May. Last month, 46 percent of all unemployed workers had been jobless for at least six months. Many other individuals simply stopped looking, and counting those individuals and those working part-time on an involuntary basis brings the underemployment rate to 16.6 percent.

Click here to read South by North Strategies’ full analysis of the May report.

04.06.2010

Policy Points

In a memorandum prepared for the Center for American Progress, Harry Holzer of Georgetown University unpacks the arguments over whether or not the United States is developing a polarized labor market. Writes Holzer of the evidence:

In sum, the notion that we are developing an “hourglass economy” with large top and bottom layers but a vastly shrinking middle, while not without basis, has been overblown. Accordingly, there remains a strong need for more workers with better cognitive and analytical skills and with four-year college degrees, as Autor emphasizes. But the kinds of postsecondary education and training below the level of a four-year bachelor’s degree that still provide satisfactory preparation for many well-paying middle-skill jobs should be supported as well. And other policies to encourage higher job quality, as well as opportunities for workers to develop skills and progress on the job within a range of sectors, can be helpful too.

03.06.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

03.06.2010

Policy Points

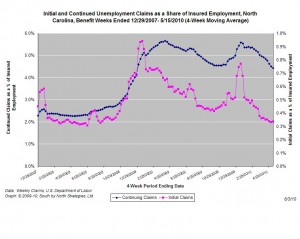

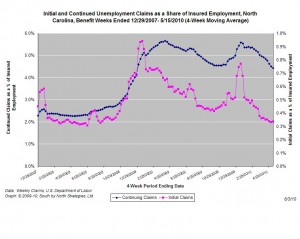

For the benefit week ending on May 15th, 12,900 North Carolinians filed initial claims for state unemployment insurance benefits, and 165,281 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,804 initial claims were filed over the previous four weeks, along with an average of 168,830 continuing claims. Compared to the previous four-week period, initial claims were higher and continuing claims were lower.

One year ago, the four-week average for initial claims stood at 22,430 and the four-week average of continuing claims equaled 216,556.

One year ago, the four-week average for initial claims stood at 22,430 and the four-week average of continuing claims equaled 216,556.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this business cycle, and the four-week average of new claims has fallen to a level last seen in June 2008. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

03.06.2010

Policy Points

From a commentary by Shawn Fremstad of the Center for Economic and Policy Research …

The extent to which the current poverty measure has defined deprivation down can be seen by comparing the poverty line’s movement over time with public opinion on the minimum income families need to make ends meet. For several decades, Gallup has asked adults: “What is the smallest amount of money a family of four (husband, wife, and two children) needs each week to get along in this community?” When it was initially developed, the official poverty line was equal to about 72 percent of the average response to this “minimum get-along” question. By 2007, the poverty line had fallen to 41 percent of the average response to the get-along question (the 2007 poverty line was $21,500; the minimum get-along average was $52,087). If the poverty line had kept pace with public opinion on the minimum get-along amount over time (that is, remained equal to 72 percent of that amount), the poverty line would have been $37,500 in 2007 rather than $21,500.

Adds Fremstad about the development of the current measure …

In essence, the current federal poverty measure started out as a measure of very low income and ended up as a measure of extremely low income. The reasons for this are far from politically neutral. The beginnings of the shift toward an ideologically conservative approach to measuring poverty date to the late 1960s. As Gordon Fisher notes, in 1968, the Johnson administration prohibited the Social Security Administration from “tak[ing] a very modest step toward raising the poverty thresholds to reflect increases in the general standard of living,” a decision that would have increased the poverty threshold by 8 percent in real terms. This decision appears to have been an ad hoc one, driven by the administration’s short-term political need to avoid reporting an increase in poverty five years after declaring “war” on it. However, when the Nixon administration adopted the poverty measure as an official statistic in 1969, it formalized the disconnection between poverty and living standards by tying the official measure to the Consumer Price Index, without making any allowance for real increases in living standards. The disconnection was further solidified when the administration failed to act on recommendations made by a federal interagency task force in 1973 to update the measure for changes in living standards.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed