27.05.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

27.05.2010

Policy Points

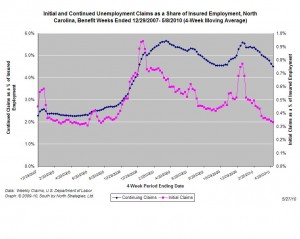

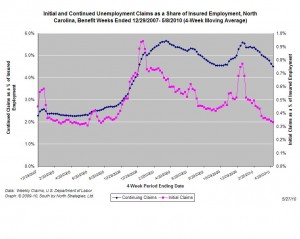

For the benefit week ending on May 8th, 13,476 North Carolinians filed initial claims for state unemployment insurance benefits, and 167,121 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and fewer continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,595 initial claims were filed over the last four weeks, along with an average of 171,981 claims. Compared to the previous four-week period, both initial and continuing claims were lower.

One year ago, the four-week average for initial claims stood at 24,050 and the four-week average of continuing claims equaled 219,164.

One year ago, the four-week average for initial claims stood at 24,050 and the four-week average of continuing claims equaled 219,164.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this business cycle, and the four-week average of new claims has fallen to a level last seen in June 2008. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

27.05.2010

Policy Points

Washington Post columnist Harold Meyerson wonders why jobs issues have disappeared from the public debate. Writes Meyerson:

Of all the gaps between elite and mass opinion in America today, perhaps the greatest is this: The elites don’t really believe we’re still in recession. Or maybe, they just don’t care.

…

How else to explain the continual harping on the deficit by editorialists, centrist think tanks and the like when the nation is still enmeshed in the most serious economic downturn since the 1930s? How else to understand the growing opposition to the jobs bills Congress is set to vote on this week, particularly when nobody has identified any future engine of American economic growth save countercyclical public investment?

26.05.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

26.05.2010

Policy Points

A long cover story in the current issue of New York offers armchair psychoanalysis of “one of Americans most dysfunctional relationships,” meaning the one between the Obama administration and Wall Street.

Speaking of Wall Street …

Today, it’s hard to find anyone on Wall Street who doesn’t speak of Obama as if he were an unholy hybrid of Bernie Sanders and Eldridge Cleaver. One night not long ago, over dinner with ten executives in the finance industry, I heard the president described as “hostile to business,” “anti-wealth,” and “anti-capitalism”; as a “redistributionist,” a “vilifier,” and a “thug.” A few days later, I recounted this experience to the same Wall Street CEO who’d called the Volcker Rule a testicular blow, and mentioned I’d been told that one of the most prominent megabank chiefs, who once boasted to friends of voting for Obama, now refers to him privately as a “Chicago mob guy.” Do all your brethren feel this way? I asked. “Oh, not everybody—just most of them,” he replied. “Jamie [Dimon]? Lloyd [Blankfein]? They might not say Obama’s a socialist, but they come pretty close.”

Meanwhile, the President has his own point of view …

For Obama, Wall Street’s cluelessness is a source of intense frustration—“He’s like, ‘What the f[—], you guys?’ ” says a White House official—and its ire toward him one of the cruelest paradoxes of his presidency. Rather than bowing to bailout rage or indulging the yearning for what Geithner calls “Old Testament justice,” Obama believes, justifiably, that he has taken a moderate approach to dealing with the financial system. On arriving in office, he chose to shore up the banks, not nationalize them. The regulations he has advocated aren’t punitive or radical. Despite the occasional burst of opprobrium, his stance has been one he summed up pithily at a meeting with the heads of the largest banks: “My administration is the only thing between you and the pitchforks.”

…

Yet now Obama stands accused by Wall Street of leading the pitchfork brigade, even as the soldiers in that battalion assail him for being in Wall Street’s pocket. Having labored to strike a delicate balance, he has managed to incur the wrath of both hoi polloi and the lords of finance. The political perils of this dynamic are obvious enough. And though the passage of regulatory reform may help assuage the anger of the masses, his relationship with Wall Street will be harder to mend—if mendable it proves to be.

And in an ironic conclusion …

Whatever the effects of the [financial reform] bill, among them will be neither an end to the too-big-too-fail doctrine nor any curb on what the sharpest Wall Streeters see as the central threat to the system’s stability: excessive financial leverage. Geithner, Summers, and Obama had little interest in tackling those matters, not because they are indentured servants to Wall Street but because at heart they are all technocrats who believe the system doesn’t need to be rebooted or downsized, merely better supervised.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed