20.05.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

20.05.2010

Policy Points

For the benefit week ending on May 1st, 12,698 North Carolinians filed initial claims for state unemployment insurance benefits, and 168,979 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,905 initial claims were filed over the last four weeks, along with an average of 176,639 claims. Compared to the previous four-week period, both initial and continuing claims were lower.

One year ago, the four-week average for initial claims stood at 24,041 and the four-week average of continuing claims equaled 220,824.

One year ago, the four-week average for initial claims stood at 24,041 and the four-week average of continuing claims equaled 220,824.

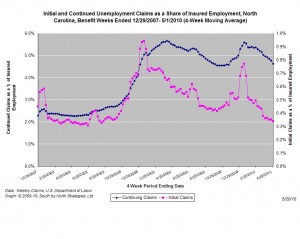

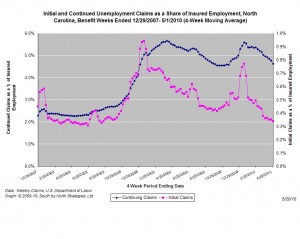

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this business cycle, and the four-week average of new claims has fallen to a level last seen in the Summer of 2008. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

20.05.2010

Policy Points

A recent report by Shawn Fremstad of the Center for Economic and Policy Research lays out “a modern framework for measuring poverty and basic economic security.”

From the report’s executive summary:

The dominant framework for understanding and measuring poverty in the United States has become an ideologically conservative one. It conceptualizes poverty only in terms of having an extremely low level of annual income, and utilizes poverty thresholds that are adjusted only for inflation rather than for changes in overall living standards. As a result, the official poverty measure has effectively defined deprivation down over the last four decades, moving it further and further away from mainstream living standards over time, as well as from majority public opinion of the minimum amount needed to “get along” at a basic level. While the Supplemental Income Poverty Measure (SIPM) proposed by the Obama administration makes some important improvements to the current poverty measure, it appears likely to lock in this defining down of the poverty standard in a measure that would remain the focal measure of basic economic security. As a result, the SIPM would do little to re-center poverty measurement from its current marginal and conservative framework to a more modern and mainstream one.

—

Despite these limitations, the SIPM could be, with several crucial modifications, part of a modern approach to measuring poverty and basic economic security, and certain of the SIPM’s technical improvements should be incorporated into such an approach. However, given the narrow and conservative nature of the SIPM, the federal government should not adopt it by itself without also adopting more accurate measures of low income (and not just “extremely” low income) and basic economic security.

19.05.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

19.05.2010

Policy Points

From a new GAO study of state financing of unemployment insurance systems:

Long-standing UI tax policies and practices in many states over 3 decades have eroded trust fund reserves, leaving states in a weak position prior to the recent recession. While benefits over this period have remained largely flat relative to wages, employer tax rates have declined. Specifically, most state taxable wage bases have not kept up with increases in wages, and many employers pay very low tax rates on these wage bases.

…

Options to improve state UI trust fund financial conditions include raising and indexing the taxable wage base under the Federal Unemployment Tax Act (FUTA), which could induce many states to raise and index their own bases, and reducing the number of both employers paying very low rates and those that pay less in UI taxes than benefits paid to their former workers. Other options include adjusting state tax rates more frequently; raising solvency targets before lowering rates; setting additional conditions to receive interest-free federal loans; and raising interest credits for well funded trust funds. Now is the time to consider changes to policies to improve the long-term financial structure of UI trust funds.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed