03.05.2010

Policy Points

An article in The Washington Post explains the hidden cost of tax expenditures:

Congress last cleaned up the tax code in 1986. Since then, special breaks have proliferated with bipartisan support and now permeate almost every corner of American life. The tax-free treatment of employer-paid health insurance will cost the government $160 billion this year, according to the Treasury Department. The tax break for mortgage interest will cost $92 billion. And deductions for state and local taxes will take $34 billion from federal coffers.

…

Republicans see tax breaks as a way to spur business investment and rein in the growth of government. Democrats use them to channel money toward social programs — low-income housing, assistance for low-income workers, college tuition and green energy. But analysts say many of the biggest tax breaks have a built-in tendency toward cost escalation, similar to the automatic, formula-driven growth of old-age entitlement programs.

…

“Budget wonks rail about limiting entitlement programs like Medicare and Social Security, but a large and growing share of federal spending is off the radar screen,” said Leonard E. Burman, a tax policy expert at Syracuse University. “Tax expenditures are on autopilot.”

03.05.2010

Policy Points

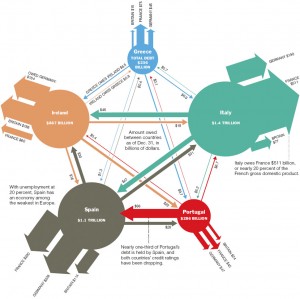

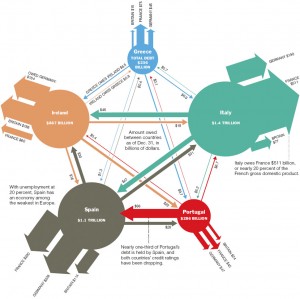

Perhaps the biggest economic story of the weekend was the Eurozone’s decision to provide up to $146 billion in assistance to Greece. Given the complex web of financial ties connecting Greece to other Eurozone and EU countries, the assistance is less altruistic than it appears, as it will be used to prevent bank and investment losses in donor countries. A graphic from yesterday’s New York Times shows the complicated financial ties linking just a few European countries.

30.04.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

30.04.2010

Policy Points

Advance estimates from the U.S. Bureau of Economic analysis show that real gross domestic product (GDP) grew at a 3.2 percent annual rate between October and December 2009. This is the third consecutive quarter of GDP growth.

Real GDP is driven by four broad factors: personal consumption expenditures (PCE), gross private domestic investment, net exports, and government spending and investment.

Last quarter, personal consumer expenditures were the main driver to GDP, adding 2.6 percentage points to the quarterly change. The other major contributor was gross private domestic private investment (primarily changes to private inventories), which added 1.7 percentage points to growth. Increases in net exports and declines in government spending subtracted from quarterly growth.

Many observers will look at the positive top-line figure — which is subject to two further revisions — as proof that the economy is improving. While positive GDP growth is welcome news, the top-level figure masks a great deal of weakness. Residential real estate is still a drain on the economy while the positive contributions from inventory adjustments are transitory at best. Also, the overall growth rate slowed sharply compared to the prior quarter and are is not at a level capable of lowering the national unemployment rate.

30.04.2010

Policy Points

A new report from the Health Care Access Project of the North Carolina Justice Center summarizes the small business provisions of the federal health care reform law. From the report …

Beginning this year small businesses with fewer than 25 full-time employees are eligible for tax credits of up to 35 percent of the employer’s insurance premium contributions. To be eligible the employer must contribute at least 50 percent of the total premium for employee health coverage and have average wages of less than $50,000 per year.

…

As an example, let’s take an employer with 9 full-time equivalent employees that pays average annual wages of $23,000. If the employer pays $72,000 in health care premiums then the business would qualify for a 2010 tax credit of $25,200. In 2014 the tax credit will increase to 50 percent of the employer’s insurance premium contributions. In our example that’s $36,000 in credits.

…

The tax credit offsets an employer’s actual income tax liability or alternative minimum tax liability for the year, which means that businesses with no taxable income generally can’t claim the credit. Businesses can carry the credit forward for 20 years to help cover future tax liabilities. Businesses will claim the credit on their annual income tax return.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed