04.02.2013

Policy Points

Dean Baker of the Center for Economic and Policy Research analyzes the national employment report for January 2013.

The unemployment rate edged up slightly to 7.9 percent in January as the economy added 157,000 jobs in the month. The unemployment rate has essentially been unchanged the last five months. The January job growth was pretty much in line with expectations, but growth for the prior two months was revised up by 127,000. This brings the average rate of job growth over the last three months to 200,000, considerably better than the average of 168,000 over the last year.

…

There were few noteworthy changes in the household data. There was a 0.4 percentage point rise in the unemployment rate for white men to 6.6 percent due to an influx of people looking for work. This could be a sign of the unemployed being more optimistic about their job prospects, but it may also just be an erratic fluctuation in the data. The participation rate for white men had fallen by 0.2 percentage points from October to December. The employment-population ratio for workers with just a high school degree fell by 0.3 percentage points to 54.0 percent, a new low for the downturn.

31.01.2013

Policy Points

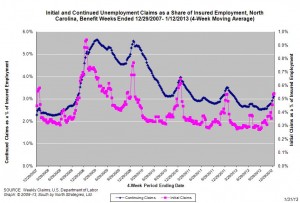

For the benefit week ending on January 12, 2013, some 14,145 North Carolinians filed initial claims for state unemployment insurance benefits and 111,752 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 20,479 initial claims were filed over the previous four weeks, along with an average of 118,156 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 20,020, and the four-week average of continuing claims equaled 131,553.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were five years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

31.01.2013

Policy Points

Economist Mark Thoma explains why “there is a need for social insurance under capitalism.”

It is important that the economy be allowed to change with new technology and changing preferences, but the consequences for innocent workers affected by such changes is a social responsibility that needs to be addressed. In addition, as extended family relationships are hindered by geography and the social contract between parents and children breaks down, the elderly need a way to avoid poverty. Programs such as Unemployment Compensation, Medicare, and Social Security arose as a means to mitigate these economic risks under capitalism using the least amount of society’s valuable resources.

…

Drawing a rough analogy, socialism is like investing in T-Bills. Low risk, but low return. Capitalism is like the stock market. There is a higher average return accompanied by higher risk. Financial theory tells how to insure against such risks and there is no reason why this cannot be applied in the social insurance arena to smooth variations in income.

30.01.2013

Policy Points

John Cassidy of The New Yorker thinks about what the Obama administration can do to support the American labor movement.

By issuing some more rulings favorable to the unions over the next four years, the N.L.R.B. will help tilt the balance of power in the workplace back towards labor. But after many years in which employers were allowed to flout the law and intimidate union organizers with impunity, nobody in the labor movement is under any illusion that these administrative changes will be sufficient to reverse the unions’ historic decline. Indeed, even some economists who are sympathetic to unions believe that their decline is irreversible. In large parts of the country, particularly in the private sector, unions are no longer a major player in the economy. Changing that is going to take much more than two terms of Obama in the White House. But if he is serious about pursuing a liberal agenda, he can’t avoid getting involved.

29.01.2013

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the service sector improved, according to the latest survey by the Federal Reserve Bank of Richmond. The decline in retail activity slowed in January and business expanded at non-retail services establishments. In addition, both retail and non-retail firms had a better business outlook for the next six months than they held last month.

…

Service sector labor markets were mixed, with retail employment and wages remaining weak, though improved from a month ago, while employment and average wages picked up at services firms.

…

Price growth in the broad service sector picked up slightly in January, while remaining well-contained. Looking ahead six months, survey respondents expected overall price growth to remain moderate.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed