Policy Points

04.12.2009

Policy Points

A recent analysis commissioned by the N.C. Department of Cultural Resources found that the state’s creative industries ( arts, information/ entertainment/new media, and design) contribute some $19.5 billion to state’s economy — an amount equal to five percent of North Carolina’s gross domestic product.

Additionally, the study, which was prepared by the policy research division of the N.C. Department of Commerce, discovered that some 100 creative industries accounted for some 293,000 jobs and was responsible for over $10 billion in compensation (4.9 percent of the state’s total).

03.12.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

03.12.2009

Policy Points

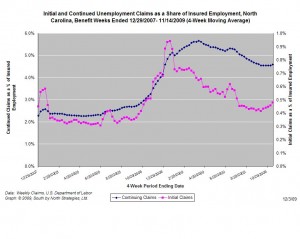

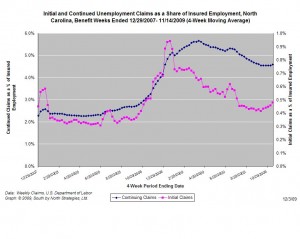

For the benefit week ending on November 14th, 22,741 North Carolinians filed initial claims for unemployment insurance, and 187,322 individuals applied for continuing insurance benefits. Compared to the prior week, there were many more initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 18,973 initial claims were filed over the last four weeks, along with an average of 181,445 continuing claims. Compared to the previous four-week period, both initial and continuing claims were much higher.

One year ago, the four-week average for initial claims stood at 20,448 and the four-week average of continuing claims equaled 127,062.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this cycle, the claims levels remain elevated and point to a labor market that remains extremely weak.

03.12.2009

Policy Points

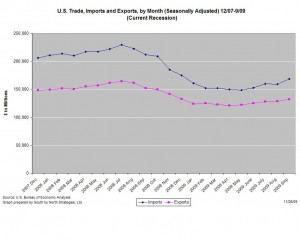

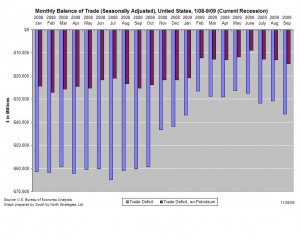

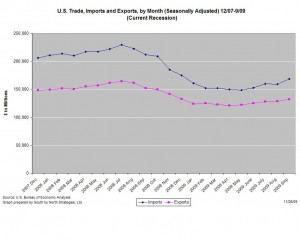

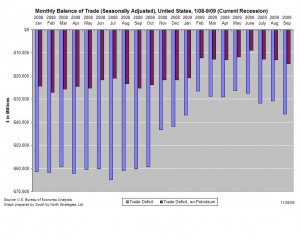

The recession continued to affect America’s international trade in September. Once again, the U.S. imported more goods and services than it exported, according to the most recent report from the Bureau of Economic Analysis. Compared to the revised August data, the September trade deficit was higher, as were the levels of of both imports and exports

The graph (left) shows the changes in American imports and exports that have occurred since the start of the recession in December 2007.

The graph (left) shows the changes in American imports and exports that have occurred since the start of the recession in December 2007.

The recession has reduced American demand for foreign goods and services and foreign demand for American goods and services (though the fall in the dollar’s value likely is boosting American exports).

Compared to a year ago (seasonally adjusted), U.S. imports were 20.6 percent lower while exports were 13.2 percent lower.

The rapid decline in imports has helped to reduce the trade gap. In September, the U.S. imported $36.5 billion more than it exported . When imports of petroleum products are excluded, the trade gaps stood at a lower $14.8 billion.

. When imports of petroleum products are excluded, the trade gaps stood at a lower $14.8 billion.

Compared to one year ago (seasonally adjusted), the non-petroleum trade deficit is 45 percent lower and the overall trade deficit is 39.4 percent lower.

02.12.2009

Policy Points

On the eve of the Obama administration’s Jobs Summit, former Secretary of Labor Robert Reich poses an impertinent question:

But here’s the real worry. The basic assumption that jobs will eventually return when the economy recovers is probably wrong. Some jobs will come back, of course. But the reality that no one wants to talk about is a structural change in the economy that’s been going on for years but which the Great Recession has dramatically accelerated.

…

Under the pressure of this awful recession, many companies have found ways to cut their payrolls for good. They’ve discovered that new software and computer technologies have made workers in Asia and Latin America just about as productive as Americans, and that the Internet allows far more work to be efficiently outsourced abroad.

…

This means many Americans won’t be rehired unless they’re willing to settle for much lower wages and benefits. Today’s official unemployment numbers hide the extent to which Americans are already on this path. Among those with jobs, a large and growing number have had to accept lower pay as a condition for keeping them. Or they’ve lost higher-paying jobs and are now in a new ones that pays less.

…

Yet reducing unemployment by cutting wages merely exchanges one problem for another. We’ll get jobs back but have more people working for pay they consider inadequate, more working families at or near poverty, and widening inequality. The nation will also have a harder time restarting the economy because so many more Americans lack the money they need to buy all the goods and services the economy can produce.

…

So let’s be clear: The goal isn’t just more jobs. It’s more jobs with good wages. Which means the fix isn’t just temporary measures to accelerate a jobs recovery, but permanent new investments in the productivity of Americans.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed